2018 European Product Balances Shrinking

Jan. 4, 2018

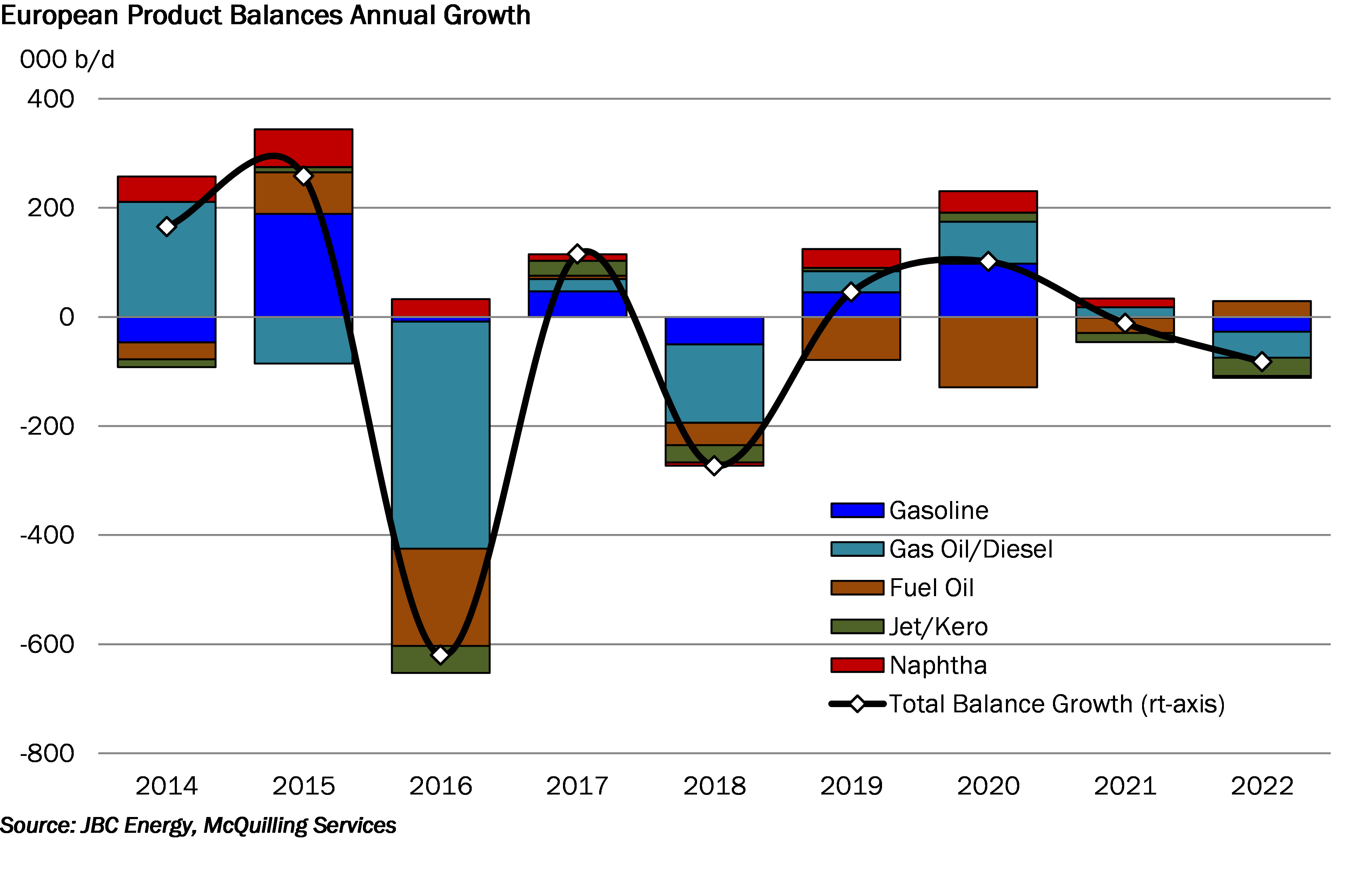

According to JBC Energy, it is estimated that the European region (Northern Europe + Mediterranean) will produce 22.9 million b/d of refined products in 2017, while demanding 20.9 million b/d, which would imply an 182,000 b/d rise in product balances year-on-year, basis 20.7 million b/d demand and 22.5 million b/d supply in 2016.

Both regions have supported clean product trading with ton-mile demand out of Northern Europe over the first nine months of 2017 averaging 2% higher than 2016’s full year average, while the Mediterranean has observed significant growth of about 10.4% over the same period. The rise of Mediterranean (Libya) and Black/Caspian Sea (Kazakhstan, Russia) crude supply coupled with strong growth in product demand, allowed for healthier margins for refiners and in turn, more product output. Ton-mile demand was also supported by higher trading activity with distant nations such as Korea. As we move into 2018, however, we see a structural shift in fundamentals pointing towards a reversal of this story.

Both Northern Europe and the Mediterranean are expected to experience lower product balances for export with the majority of declines projected to stem from the middle of the barrel, as the deficit of gas oil/diesel expands by 20% in 2018. This 140,000 b/d expansion is likely to be filled by increased import volumes, which in our view, will come from the US and the Middle East with potential for higher Canadian volumes as well. Trading activity in Northern Europe may also rise on the back of higher volumes from Russia into the continent. Over the 2019/2020 and even 2021 period, we are likely to see these volumes temper as European refining activity increases and shrinks the deficit, before 2022 brings another structural shift. We further discuss this topic in our latest Industry Note as well as the 2018-2022 Tanker Market Outlook.