A Growing Aframax Trade?

Nov. 20, 2020

A few days ago, we saw another crude oil cargo leaving Northern Europe with destination the US Atlantic Coast. While not that significant as a singular event, it gives us the opportunity to discuss a potential rising trade in the Aframax sector. It has been our position for a while now that it is very likely to start seeing more crude cargos from Northern Europe to the US East and Gulf coast and in order to explain that, we have to start by looking at the crude balance for both regions.

With a pandemic that doesn’t seem to slow down, we have seen US producers cut crude production significantly, potentially making less WTI barrels available for exports, while the barrel itself is likely to find upward support relative to international benchmarks. At the same time, in Northern Europe and specifically at the Johan Sverdrup field we are seeing an increase in production, set to reach 500,000 b/d by the end of the year and even up to 720,000 b/d during Phase 2 of development. As a Brent-linked barrel, the medium sour crude from the region is not only becoming more attractive in terms of pricing, but we believe has commercial viability at more complex refineries in the US.

The pricing dynamics at play between WTI and Brent are likely to spur increasing interest by US refiners to import foreign crudes, primarily medium/heavy sour grades. As it relates to Johan crude, we estimate a higher netback for a US-destined barrel due to the favorable freight economics on Aframax tankers looking for a “backhaul” cargo back to the US Gulf following discharge of US crude into Europe.

For owners, this backhaul trade can become even more attractive if we consider an expanding cargo selection that can include Urals barrels (especially if Russia and OPEC+ increase production from January 1st 2021) as well as HSFO cargoes that we have seen can be easily used by refineries in the Gulf for feedstock.

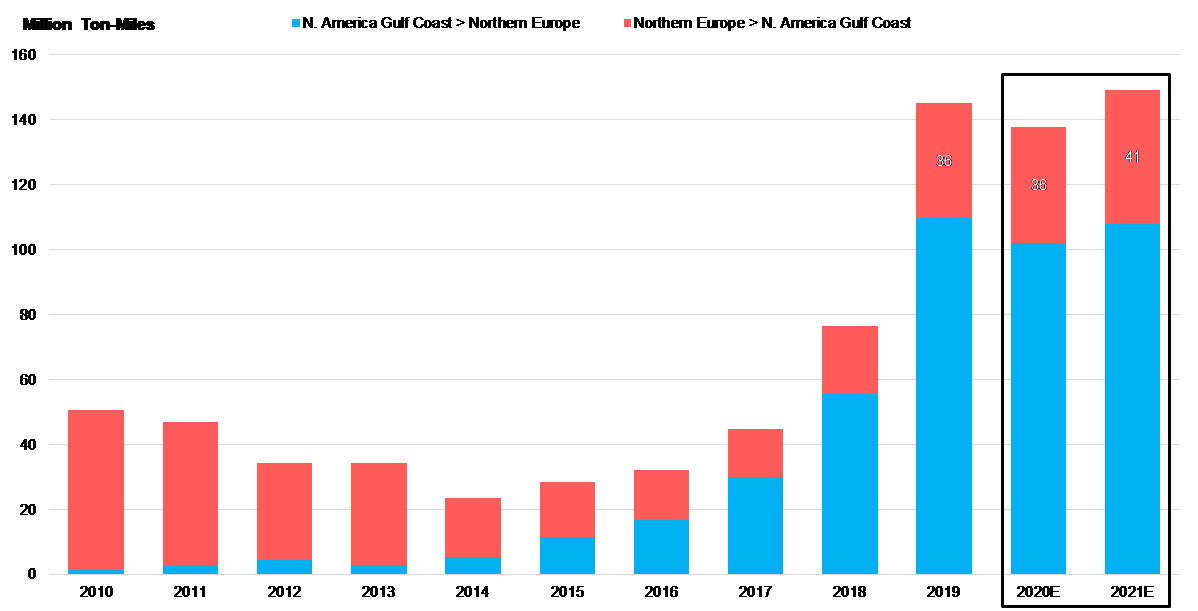

With all the above in mind, we project total ton-miles for the UKC to USG trade on Aframaxes for 2020 to remain at the same level as 2019 even amid a lower overall demand. For 2021 we expect the same trade to gain demand and rise to levels not seen since 2011 (Figure 1).

Figure 1 – USG/UKC & UKC/USG Aframax Ton-Miles | 2010 – 2021F

Source: McQuilling Services