A Look at CPP Tanker Demand

May 29, 2020

As with the dirty product segment, our projections at the beginning of the year for tanker demand in refined products seem to belong to a distant past. Globally, the COVID-19 reality has taken its toll on product demand, especially for gasoline and jet fuels amid the lockdowns and lack of travelling. Even as the world begins to re-emerge from quarantine, it has become clear that we will not see an immediate recovery. What this means for CPP tankers is an overall slump in ton-mile demand for the year, but perhaps less than the crude side due to increasing mileages as imbalances between regions stimulate long haul opportunities.

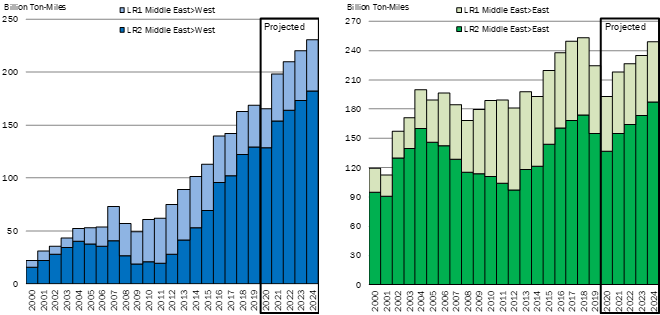

One of our prior expectation was for the LR sector to see increased demand from the Middle East, with the region adding 372,000 b/d refining capacity in 2020 and an additional 610,000 in 2021. With the massive production cuts though, it appears the region (especially Saudi Arabia) is more likely to elect to reduce utilization and refrain from feeding its refineries domestic crude, mainly to retain export market share amid tightening balances. The two main trades on LR2 tankers from the Middle East to the Far East and Northern Europe are expected to have different results with the former declining by 9.8%, while the prolonged reduction in Western refinery intake supports a more moderate decline in the AG>West LR2 trade. Trades to the West and East are both expected to rebound in 2021, with global product demand returning to normal levels and a potential shifting of focus to diversification in the Middle East (Figure 1).

In this environment however, there are trades that we have observed emerging, that have to do with the timing of the reopening of economies. Specifically, Asian refineries appear to be one to two months ahead of their Western counterparts in terms of increasing runs and production. This potentially creates a “window” of opportunity for product exports from the Fat East, but also other East of Suez centers (India) to the West, mainly gasoil and in some cases gasoline, which may help offset requirements in the region as refineries and economies slowly emerge out of quarantine. At the same time, we have observed an increase in Naphtha trades in the opposite direction, from the West to refineries in the Far East. As oil & gas production in the West diminished, so did availability of LPGs used as feedstock in many refineries, increasing the relative pricing of LPG versus naphtha for petrochemical activities. We don’t expect this trend to last long-term, but it did create certain opportunities in the market.

Figure 1 – LR Ton-Mile Demand ex-Middle East to the West and the East (2000-2024F)

Source: McQuilling Services