A Look at Iran Sanctions Relief Scenarios

March 5, 2021

As the US presidency officially changed in January of this year, questions regarding the new administration’s approach on sanctioned nations (Iran, Venezuela) as well as the overall energy policy have been increasing in frequency. We have already seen efforts to promote a “greener” plan on energy production, steering away from fossil fuels and into heavier investing for renewable sources. At the same time, it makes sense to expect that the Biden administration could be more lenient towards sanctioned nations, potentially opening up additional pathways to diplomacy.

For this week, we are going to focus on the potential scenario of seeing sanctions relief for Iran and what that would mean for the country’s oil production, exports and eventually the impact on the DPP tanker sectors.

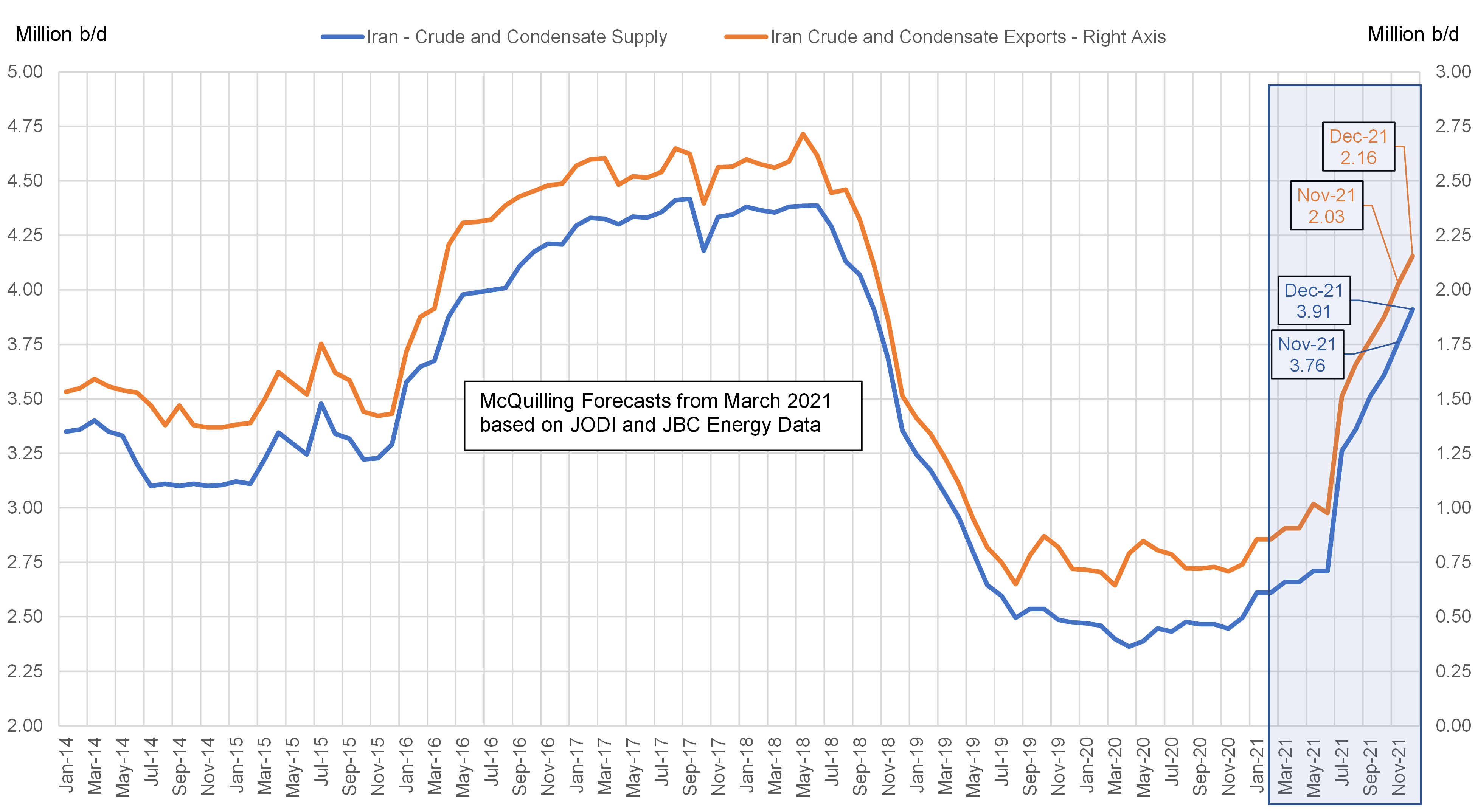

We have been monitoring news coming out of Iran that have the country increasing its efforts to update infrastructure with the goal of producing more crude oil and thus increasing its exports. According to data from JBC Energy, the current production level for Iran stands at around 2.6 million b/d, slightly increased from a year ago but a far cry from the pre-sanction levels of March 2018 that had reached 4.35 million b/d. A sanctions relief in 2H and given that the country will in fact continue with the investments needed to increase output, could see supply increasing to 3.91 million b/d by the end of the year (Figure 1).

To calculate the impact on the tanker market, we looked at historical VLCC loadings before and after sanctions. We found out that, on average, about 45% of all VLCC loadings from Iran involved third-party tanker operators, with the balance loaded on the country’s national fleet (NITC). By applying this statistic to our tanker earnings models, we discovered that the impact on VLCC earnings would mean an increase of US $3,000/day to our base case forecasts published in our 2021-2025 Tanker Market Outlook report.

Figure 1 – Iran Sanctions Relief Impact

Source: JODI, JBC Energy, McQuilling Services