A Positive Export Picture for Brazil Crude

Dec. 18, 2020

Brazil, and generally the East Coast of South America has been a permanent segment of any discussion regarding crude oil supply and demand throughout the year. The reason is the relatively steady output and export volumes that have been coming out of the country, even during the peak of lockdowns amid the coronavirus spread. In this weekly highlight, we attempt to take a quick look at what the future of crude oil production and exports may look like for the region, focusing on Brazil, by far the largest producer in it.

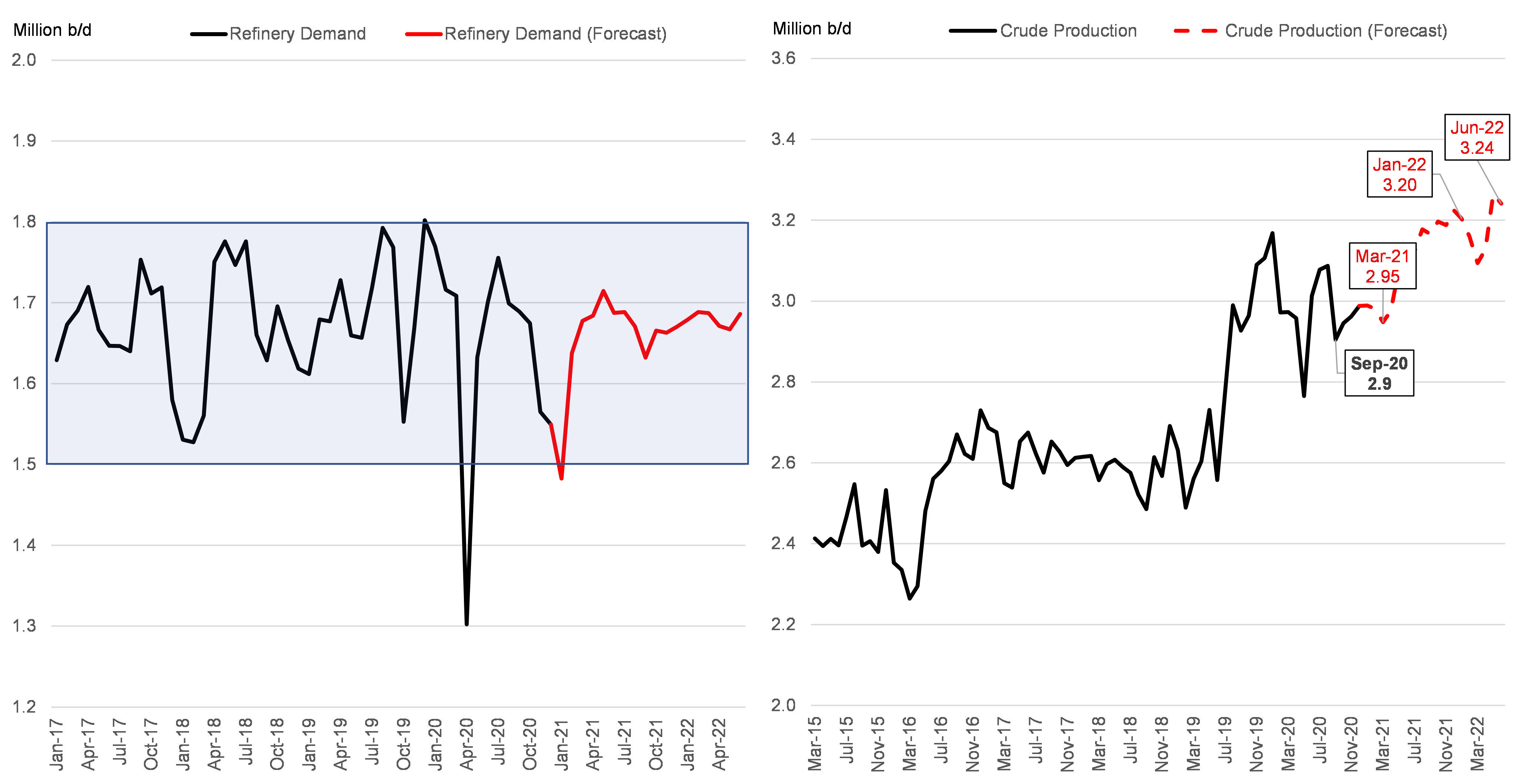

Beginning with some fundamentals, Brazil’s economy has underperformed in 2020. According to the IMF, the country’s GDP is set to contract about 5.8%, which is lower than the global average of -4.4%. Because of that contraction that was set forth by the covid-19 pandemic, domestic demand for oil products did not expand as expected, leading to refinery underutilization. As a result, the country’s state producer and refiner Petrobras has been active in divesting from the refining sector and our projections show an overall demand picture that remains flat at least through 1H 2022 (Figure 1).

Despite that, crude oil production has generally continued its upward trend, seemingly unphased by the developments with the economy and lack of domestic demand. Looking at the numbers, we see that crude production has gradually increased from about 2.4 million b/d in March 2015 to 2.9 million b/d in September 2020, with the expectation that the upward trend will continue all the way up to 3.24 million b/d by summer of 2022 (Figure 1).

Putting it all together, it is clear how relatively low domestic product demand combined with increasing oil production are poised to increase the crude balance number for the country and the region in general. As we have pointed out in the past, increased balances lead to an increase of exports. In fact, according to our projections, 2021 could see an increase of 100,000 b/d exported from Brazil, to reach a total of 1.6 million b/d for the year that will likely find its way to the East mainly on VLCC and Suezmax tonnage.

Figure 1 – Brazil Refinery Demand and Crude Oil Production with Forecast

Source: JBC Energy, McQuilling Services