A Short 2021 Outlook

Dec. 30, 2020

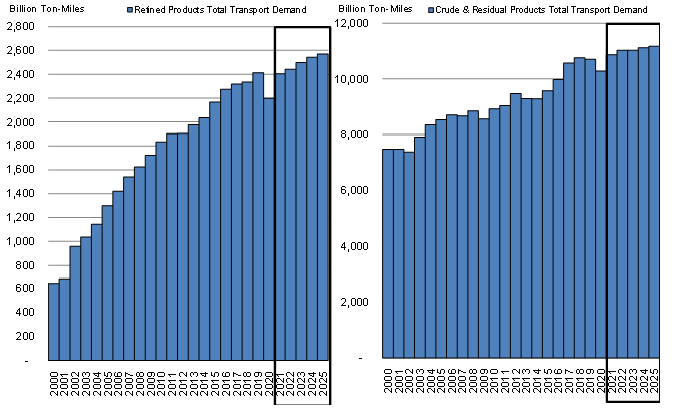

Last week we examined a few of the key events and developments for the DPP and CPP tankers markets as well as global oil supply and demand for 2020. This week we will attempt to highlight a few key trends that we see emerging in the oil and tankers markets, in anticipation for a year without pandemic-related restrictions and a return to “normal”.

Looking at the global oil supply and demand environment, we naturally expect both oil demand and supply to rebound from the negative numbers of 2020. What is key though is that according to our latest numbers, demand and supply growth are not going to surpass the losses of 2020, showing somewhat of a slower than expected recovery. OPEC and its allies (OPEC+) will ease cuts by 500,000 b/d in January and we expect this trend to continue each month for the first quarter of 2021. With OPEC+ increasing production we expect crude balances to grow longer in Russia and the Middle East. At the same time, the US is projected to keep production limited for the year resulting in a tighter crude balance. The main result of this balance development would likely be for US crude exports to fall, at least for the short and medium term.

A lower US crude production and tighter crude balance may be one of the main stories for the DPP sector as well. As less WTI will be available, it is likely that the price of the grade will converge with that of Brent. If something like that happens, it would make sense for US refiners to start bringing in heavy sour crude from the AG (and other areas like N. Europe), thus supporting higher ton-mile demand from the AG to the West -and in turn perhaps higher US crude exports. The other region with increased production for 2021 is shaping up to be Europe, mainly from the new North Sea fields. These heavy crudes could also find their way in the US refining system, thus creating an attractive “backhaul”, especially for Aframax tonnage in 2021.

Lastly, for the CPP sector, 2021 is projected to bring significant additional refining capacity in the Middle East, something that has the potential to increase CPP ton-mile demand from the region, especially for larger LR tankers into the West. At the same time, the conditions are positive (product balance length) for a West to East naphtha trade to expand in 2021, while we also favor a USG>Europe naphtha trade, supporting MR demand.

Figure 1 – CPP and DPP Total Ton-Mile Demand Projection

Source: McQuilling Services