A Slowdown that Makes Sense

May 8, 2020

The tanker freight rates in the past couple of weeks have exhibited a peculiar behavior by reaching intense highs followed by a period of slumping until essentially today where we are starting to see the situation stabilizing and, in some cases, reversing. This week, we will take a quick look at the market lull, the reasons behind it and what may be developing in the near future.

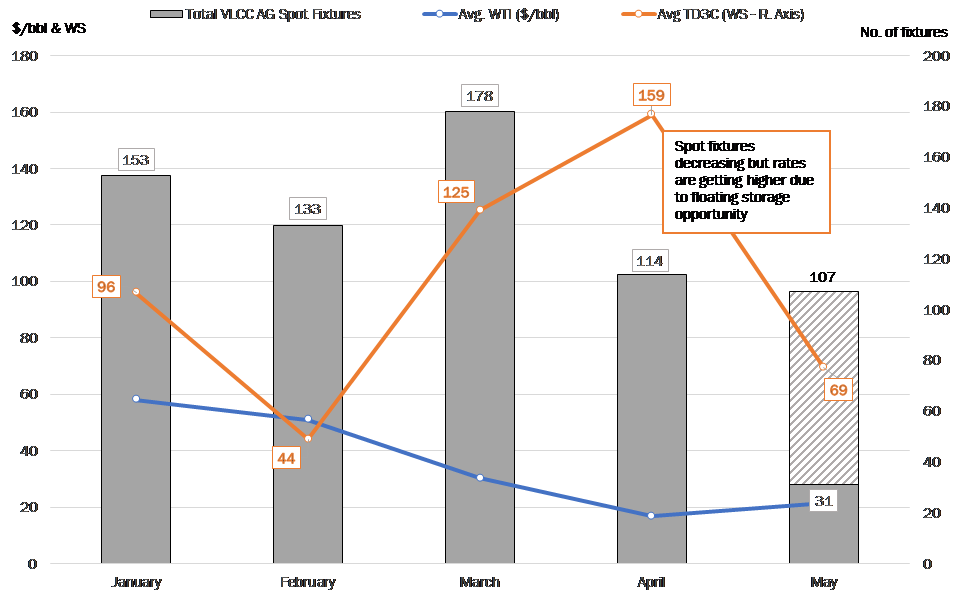

The combination of increased production and demand destruction for March and April was mainly behind the extraordinary drop in crude oil prices. The market went on to develop a steep contango structure that presented certain opportunities for floating storage. For that reason, we saw a huge pickup in TC activity for floating storage and tanker rates soaring in those months (Figure 1).

The situation changed towards the end of April and beginning of May. The new OPEC+ production cuts were set to take effect in May and along with that, we saw announcements for the gradual reopening of various economies in Europe and the US. These factors created a positive sentiment that affected crude oil prices. With prices going up, the contango spreads began narrowing, thus putting the brakes on the floating storage frenzy. With this development, the lack of spot fixtures due to the oil glut became apparent and with limited ships fixing, rates inevitably trended lower (Figure 1).

As we move towards mid-May, we expect refiners around the world to start having a better understanding of the upcoming demand environment and spot fixture activity to pick up again. Rates will likely increase given the very high number of ships conducting floating storage, thus unavailable for spot cargos. Increased rates and some additional floating storage (at decelerated pace) are likely to continue to the end of Q2. Entering Q3, we will likely see a more balanced market given the ongoing production cuts. With increased demand, we expect to start seeing stable drawdowns of inventories, including ships discharging and returning from floating storage. The insertion of this ships back into the trading fleet will likely start pushing freight rates lower throughout the end of the year and possibly into Q1 2021.

Figure 1 – Development of spot rates and number of fixtures for VLCCs in the AG (Jan. 2020 – May 2020)

Source: McQuilling Services