A Temporary Tumble

July 20, 2017

Suezmax fixing activity in the Black Sea has increased considerably this year largely due to higher production in Kazakhstan pushing barrels through the Caspian Pipeline Consortium (CPC) to Novorossiysk. Kazakhstan crude and condensate output has risen to over 1.7 million b/d in recent months, underpinned by a ramp up of operations at the massive Kashagan oilfield.

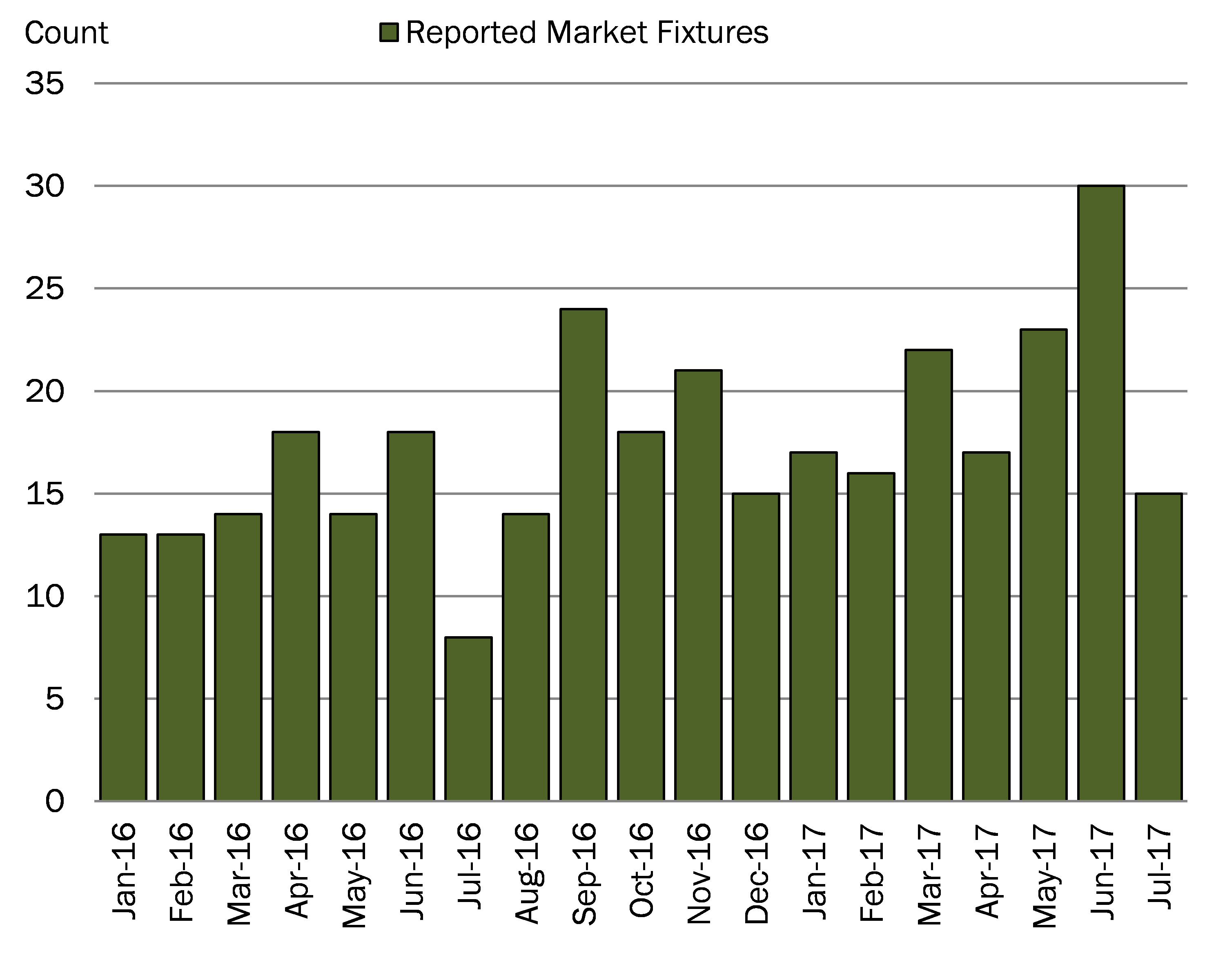

Support has also stemmed from stable output in Russia, which contributed to the pressure on pricing for CPC blend assessments. Volumes have been shipped to Asian markets in increasing quantities; however, consistent buying has recently reduced regional supply and allowed pricing to tick up once again. July fixing activity has been relatively subdued and we project a decline from June. As such, we expect August loadings to remain subdued due to reduced incentives for Asian refiners to source this blend. In our view, this dip in tanker demand will be temporary and we expect this market to remain a supportive factor for the Suezmax sector with the Black Sea > Mediterranean route averaging at WS 65 in August.