All Eyes on Libya

Sept. 25, 2020

The discussion on the status of Libyan crude oil production has been a contested topic almost since the beginning of the blockades in the country’s oil producing facilities back in January. In fact, as analysts we have been trying to project developments in the region, especially after the destruction of demand due to the pandemic followed by OPEC’s biggest production cuts in history. With such fragile balances in the global supply and demand environment for crude oil, it is understandable how the recent announcements for the return of production in Libya is making headlines.

The commander of the forces situated in Eastern Libya, general Haftar, was the one whose forces initiated the blockade and the one who announced that his forces will allow the blockade to be lifted. According to Libya’s National Oil Company (NOC), the country will be able to increase production up to 260,000 b/d by next week and perform crude loadings in “secure” ports. At the moment, these ports are the Marsa El Hariga and Brega oil terminals. Based on recent reports, at least two Suezmax tankers are on their way to these terminals to load the first crude cargos after the blockade took effect.

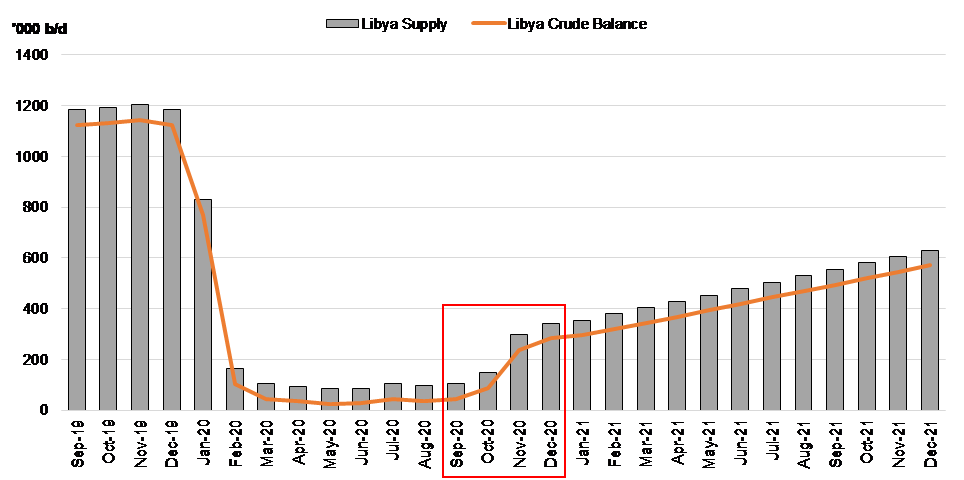

Looking at historical data and the most recent available projections, we can see that Libya has still a long way to go in order to reach the pre-blockade levels of about 1.2 million b/d. The technical difficulties of restarting production along with an unstable geopolitical situation both are expected to contribute to a slow recovery. Despite that, we expect production to come close to 400,000 b/d by the end of the year and with it increase available balances for exports as local demand in Libya is almost non-existent (Figure 1).

Regarding freight developments, in the recent Mid-Year Update of our Tanker Market Outlook, we did share our expectations that production from Libya will eventually return by the end of 2020, something that will further support a robust recovery for the Suezmax sector within 2021. The latter has so far seen slightly increased cargo flows from West Africa to make up for some of the lost volumes from Libya to Southern Europe, even amid the deep OPEC+ cuts. On the Aframax side, we have already seen how the Med/Med trade has been trending much lower in 2020, with Libya playing a significant role. A return of production could supply Southern European refiners with more regional crude, something that could potentially hamper the growth of crude flows from the US.

Figure 1 – Historical and Projected Libyan Crude Oil Production and Balance, Sep 2019 – Dec 2021

Source: JBC Energy, McQuilling Services