An Updated Look on Crude Balance

June 19, 2020

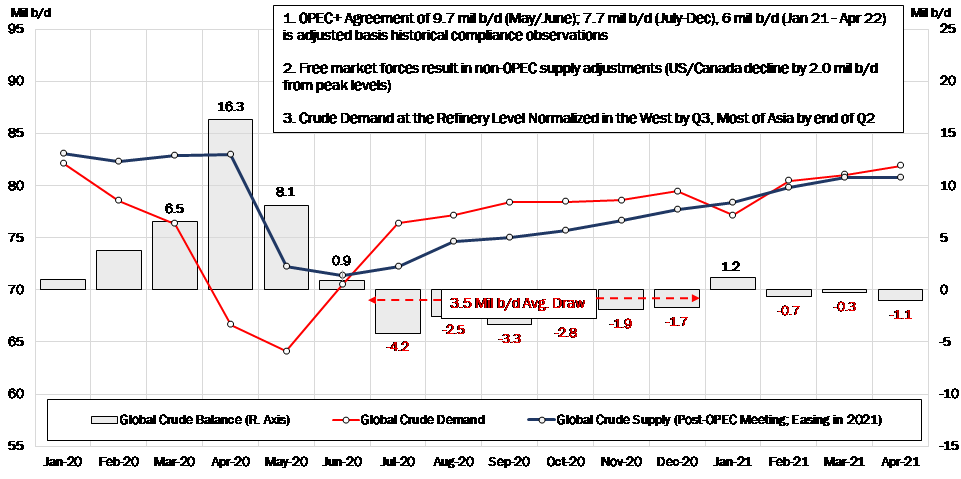

We are almost at the end of the second quarter of 2020 and the effects of OPEC+ implementing the biggest production cuts in history are becoming clearer. The structure of the cuts is now common knowledge, except for a change that was decided in a recent virtual meeting among OPEC and Russia. The organization and it allies agreed to extend the 9.7 million b/d cuts for one additional month until the end of July. The decision was made to better mitigate the oversupply issues caused by persistent low global oil demand and to allow for Nigeria, Iraq to meet their commitments.

Despite the overall gloomy demand environment so far in 2020, we have started to see some signs of recovery, in line with our initial projections. As economies worldwide begin to re-open, early signs of inventory drawdowns have emerged, although the impetus is likely to be felt in the coming quarter. In our previous assessment we pointed out the significance of demand returning at the refinery level and in Q3 we have a clearer picture on that. In general, Asia had started to rebound early on, with utilization rates stabilizing and, in some cases, increasing by May. Followed by North America and Europe normalizing in June, we have observed a slow and steady recovery that has been instrumental in decreasing inventories and balances. Contrary to earlier outlooks, we expect the transition to be less acute, but steady throughout our short-term forecast.

According to the latest available data, we believe that the crude surplus is being reduced from approximately 16.3 million b/d in April to 8.1 million b/d in May, the result of which is a slowdown in both land and floating storage requirements. Moving on to the second half of the year, and still assuming the world recovers from the coronavirus pandemic, we expect to see the cuts to start working amid an increasing demand environment. We project that by July, demand will outpace supply at a relatively steady rate throughout the year and into 2021 (Figure 1). From July 2020 – through March 2021, we estimate an average crude deficit of 3.5 million b/d, resulting in a drawdown of inventories, both floating and land-based. Our earlier speculative position regarding the curbing of the OPEC+ production cuts once crude inventories are drawn to a deficit still holds, although if that happens it will likely be further towards the end of 2020 or beginning of 2021.

Figure 1 – Crude Balances Post-OPEC+ Meeting

January 2020 – April 2021F

Source: JBC Energy, McQuilling Services