Caribbean Flows and Suezmax Demand

Dec. 10, 2021

As we are preparing our long-term forecasts for our upcoming Tanker Market Outlook, we want to take a look at some key developments in regions and tanker classes of increased interest. One of those is the Caribbean, a region that is poised to see some ton-mile demand growth due, among other factors, to the developments in Guyana. In fact, Exxon’s FPSO “Liza Unity” has reached the country in late October and according to the company is going to come online sometime in early to mid-2022, adding up to 220,000 b/d of additional production.

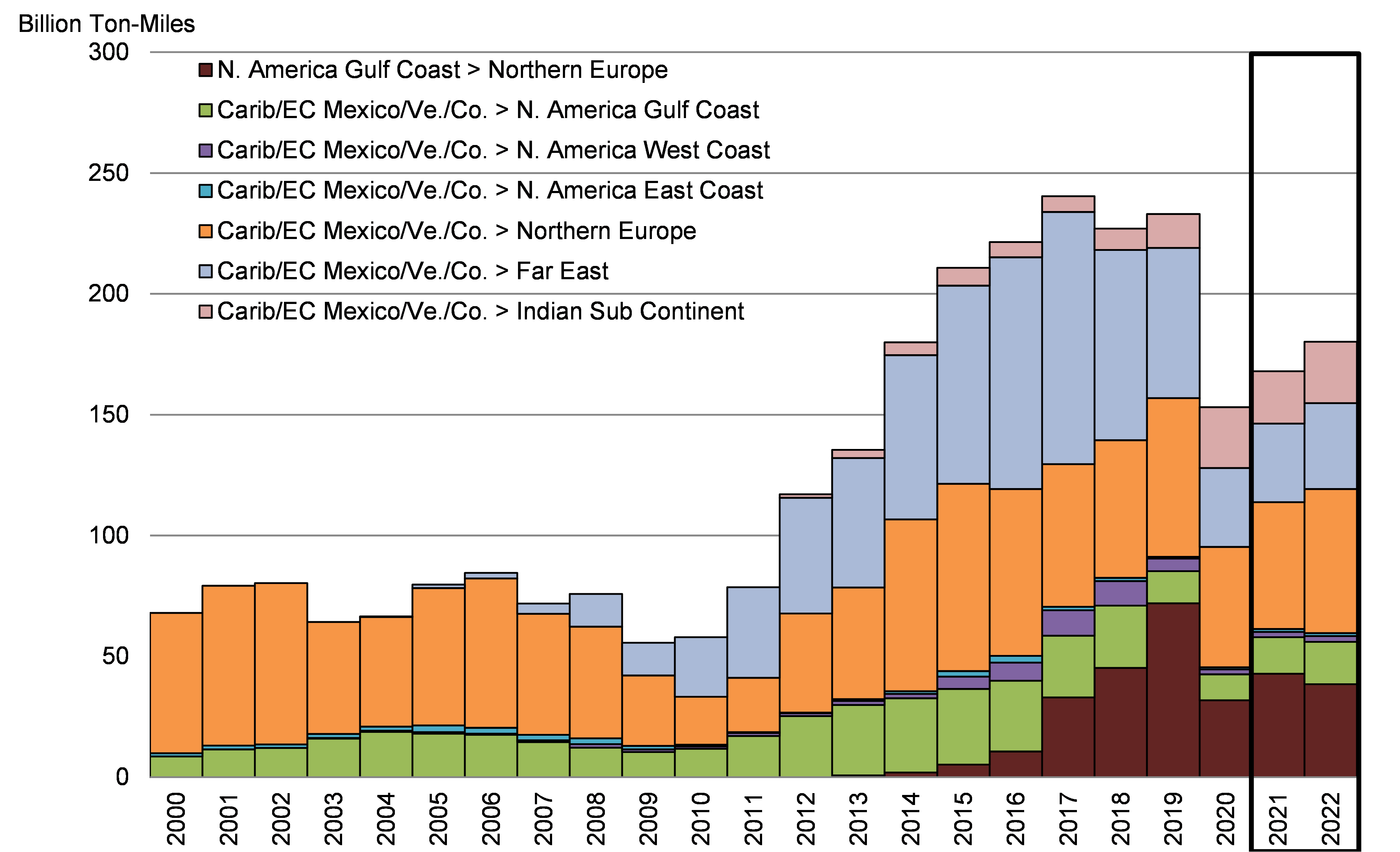

This is positive news for Suezmaxes that are expected to see an increase in ton-mile demand for the region according to our preliminary analysis. Overall, the class is projected to have an additional 3.7% increase in total ton-mile demand in 2022, outperforming Aframaxes but coming slightly lower than the VLCC sector. The dominant trade by market share is still the S. Europe to the Far East, which is expected to continue growing throughout our forecast period.

Focusing on the Caribbean region, the largest trade by ton-miles for 2021 has been to Northern Europe, which is expected to grow further by 14% in 2022. On the other hand, flows to the Far East are likely to see much less growth in 2022, with some of these cargos likely to be diverted to the Indian Sub-Continent. Ton-mile demand from the Caribbean for the latter is expected to keep growing in 2022 and forward although it is possible it will remain outside the top-ten trades in terms of total market share.

Finally, of particular interest for Guyana crude are flows to North America. As US shale oil producers remain disciplined in terms of increasing production so far, we see crude oil from the Caribbean region placing well into the US Gulf refining system at least for the short term. As a result, preliminary projections show an increase in ton-mile demand for Suezmaxes to the US Gulf Coast at a 16% year-on-year for 2022. Lastly, flows to the US West Coast could see an uptick in total ton-mile demand in 2022 although this is likely to taper off going forward due to the refinery closures and conversions in the region amid a decarbonization push.

Given these are only some preliminary findings, we invite you to stay tuned for our upcoming flagship Tanker Market Outlook report in January, which will include detailed analysis as well as our long-term forecasts.

Figure 1 – Suezmax Ton-Mile Demand with 2022 Forecast

Source: McQuilling Services