Chart of the Week - Tanker Tonnage Supply

Oct. 28, 2014

It’s no secret the oil tanker market has been struggling with an oversupply issue over the past few years. The unbalanced supply/demand situation has led to an ongoing weak earnings environment for most owners and the industry has even seen some of the world’s most prominent tanker companies file for Chapter 11 Bankruptcy. Amid the chaos, market participants like John Fredriksen of Frontline, took to the media in 2013 to urge fellow owners to scrap vessels older than 15-years of age.

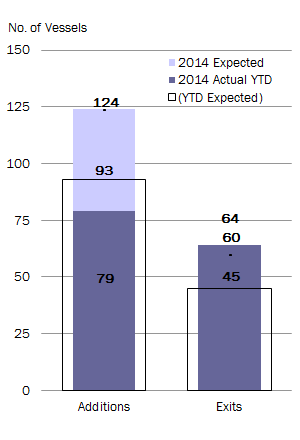

Since this call to action more than a year ago, what adjustments have been made to tanker tonnage supply? At the beginning of each year, McQuilling Services publishes a forecast for tanker additions and deletions in their annual Tanker Ma rket Outlook. As shown in the figure to the right, 124 vessels are expected to enter the trading fleet in 2014, while 60 tankers were forecast to be sold for demolition or conversion. Through 3Q 2014, based on the forecast, 93 vessels should have delivered to the fleet and 60 tankers should have exited the fleet. Actual proprietary data shows that 79 vessels have delivered – 17% below original expectations and 64 vessels have exited, which not only exceeds the group’s year-to-date forecast, but the full year-forecast as well.

rket Outlook. As shown in the figure to the right, 124 vessels are expected to enter the trading fleet in 2014, while 60 tankers were forecast to be sold for demolition or conversion. Through 3Q 2014, based on the forecast, 93 vessels should have delivered to the fleet and 60 tankers should have exited the fleet. Actual proprietary data shows that 79 vessels have delivered – 17% below original expectations and 64 vessels have exited, which not only exceeds the group’s year-to-date forecast, but the full year-forecast as well.

There has been limited net fleet growth in the larger crude tanker segments. VLCCs posted a net fleet growth of four through September, while Suezmaxes have had no fleet growth thus far. The Aframax and Panamax fleets have both seen a slim down this year as the Aframaxes have shed 14 ships and Panamaxes one. Clean product tankers, for the most part, have also seen either negative or barely any fleet growth, with the exception of the MR2 class. Through September, MR2s (IMO III) posted a net fleet growth of 28 ships.

While the tanker markets can still be considered oversupplied, the past nine months have certainly shed a positive light on fleet supply for owners and it seems they have heeded the advice of other market participants. Let’s see how the fourth quarter pans out.

Visit our products and services page for more information about McQuilling Services Tanker Market Outlook.