Chinese Product Push

April 18, 2018

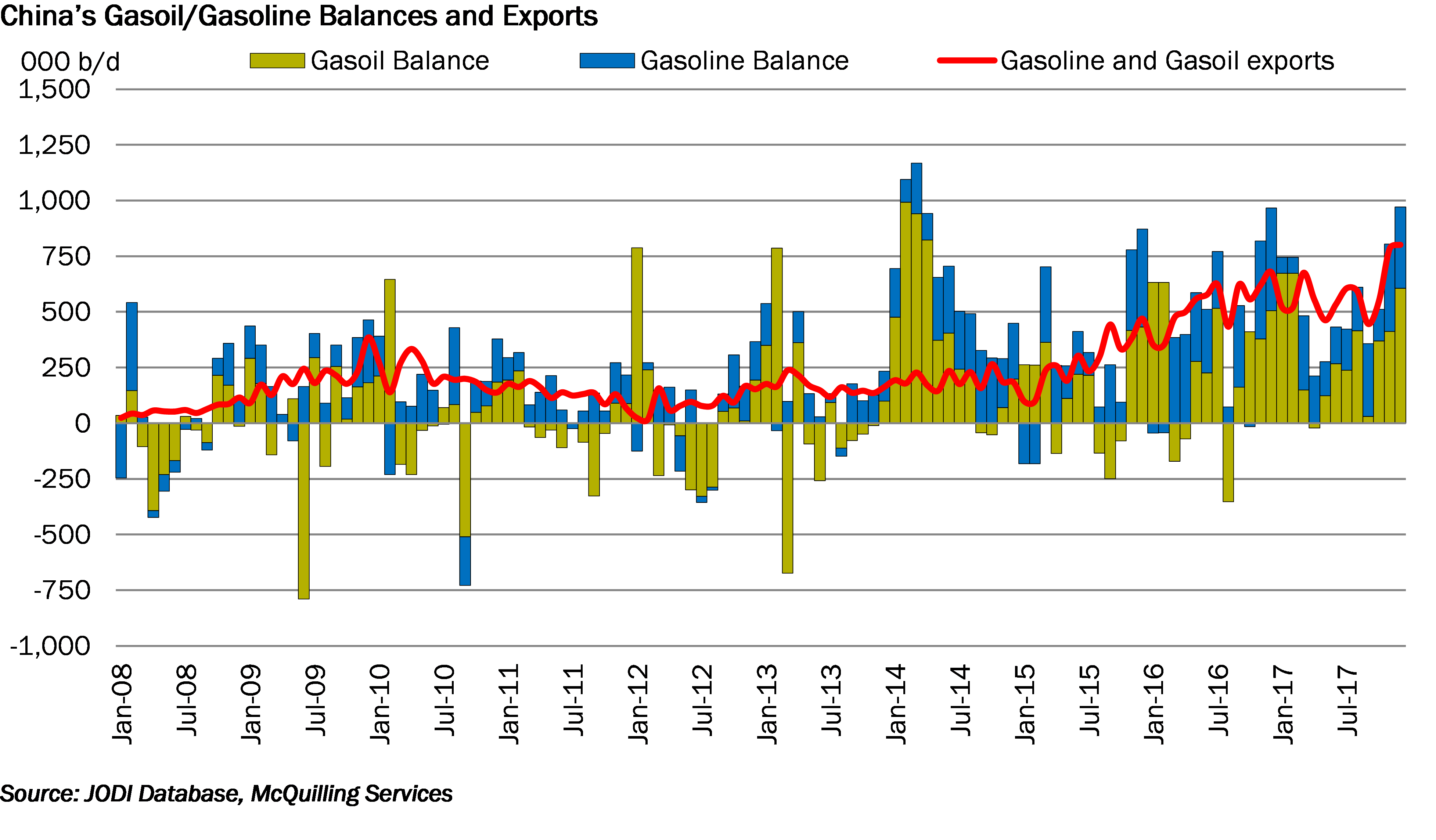

Asian refining margins remained relatively stable over the first quarter of 2018 with Singapore margins largely supported by a stronger middle distillate segment. Growth in product exports out of this region has been quite strong over 2016/2017; however, we note a weakening of this trend in the second half of 2017 and into this year, excluding China which has observed the contrary. According to official data from the Joint Organization Data Initiative for Oil and Gas, towards the end of 2017, China’s gas oil/diesel balance rose to a height of 476,000 b/d over November/December, alongside the gasoline balance which rose to 315,000 b/d in the same period (Figure). Market reports indicate that December 2017 marked a record high in refined product exports rising 6.17 million tons; however, official customs data indicates that March broke this figure with 6.69 million tons of refined products exported out of China.

This notion comes on the back of ~20% rise in clean product fixing activity out of China for the first quarter of 2018 versus last. March is a particularly strong month with the highest quantity of MR2 spot market fixtures (33) out of China in 15 months as well as higher LR volumes. We also note a rise in clean products shipped on dirty carriers with one VLCC and one Suezmax (newbuilds) were reported loaded with Chinese middle distillates in the first quarter for discharge in the West. Dirty vessels which trade clean products on their maiden voyage represent a headwind for clean tanker demand; however, the recent strength in exports outweighed this impact and clean tankers found support amid higher demand. This is likely a contributing factor to the recent strength in not only MR rates East of the Suez but also LR rates, as vessel employment rose and available supply contracted. TC4 (Singapore > Japan) and TC7 (Singapore > EC Australia) traded up to new highs over March, while we have observed structural support for TC5 since the beginning of February, remaining well above WS 100 for the majority of the quarter.

Our proprietary fixture data indicates that fixing volumes for April load have remained above levels observed in January/February and we expect that official data will indicate strong export volumes over this month. On the contrary, a heavier maintenance schedule for April (+600,000 b/d offline month-on-month) points to a potential shrinking of the product balance; however, this follows a record 12 million b/d in refinery runs over March, which will likely remain supportive of export volumes in April, according to JBC Energy. Following potential short-term pressure, we expect the balance of refined products to continue to grow through the summer months with Chinese refinery runs forecast to rise by over 500,000 b/d year-on-year in May-August amid reduced maintenance. We remain confident in a relatively firm East of the Suez MR market over this period with TC7 on track to correct slightly from recent highs to WS 205 in June, but remain above the WS 200 level through August.