COVID-19 Impact on Crude Oil Demand

Feb. 28, 2020

We have been talking extensively about the subdued global economic outlook going into 2020, supported by data from global organizations such as the IMF and OECD, which have been revising their predictions for growth downwards throughout 2019. Despite that, numbers for 2020 were generally more positive than 2019 until the emergence of COVID-19 or Coronavirus, that has already disrupted markets, with the near-term future remaining unknown.

Towards the end of last week, markets were showing positive signs after news that new infections were generally slowing down. However, information regarding a significant spread of the virus to South Korea and Italy over the weekend reignited fears that the threat is far from over, something that had a significant impact on stock markets and oil prices alike. In a recent announcement, the IMF mentioned that the impact of the virus in the global economy could result in a 0.1% reduction of global GDP growth for 2020. For China specifically, the organization suggested that it will revise growth projections to 5.6% from its previous number of 5.8% in January. Given that economic fundamentals go hand-in-hand with oil demand, downward revisions will almost certainly mean lower demand, which in turn will put further pressure on oil producers worldwide. OPEC and its allies have already discussed either maintaining or further extending oil production cuts -something that will be decided during the organization’s upcoming meeting in early March.

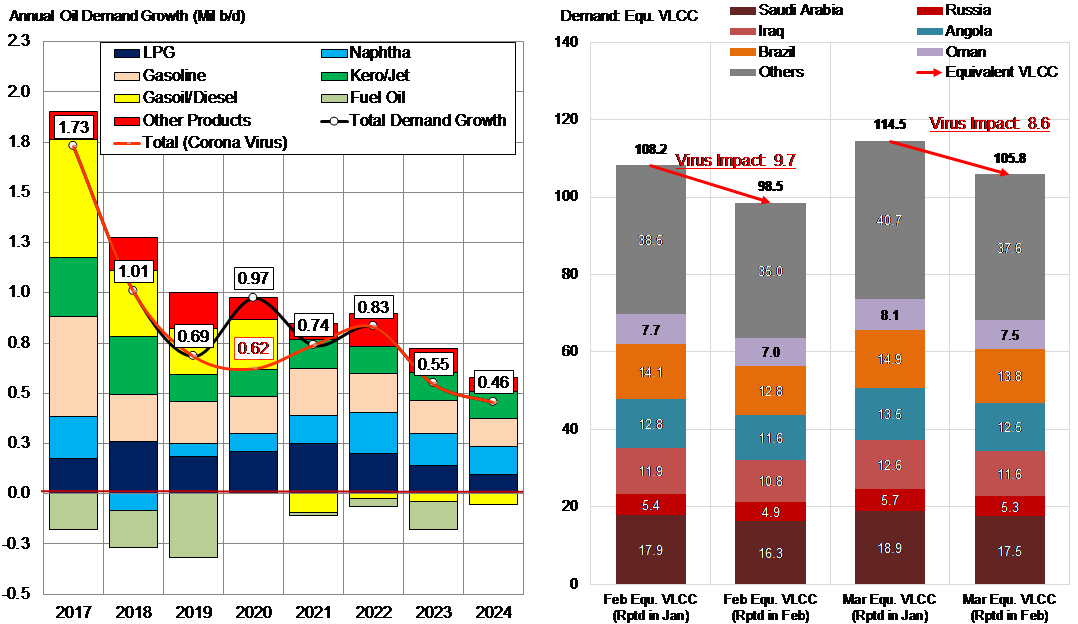

Pending the official IMF data expected in April and any announcements by the World Health Organization regarding the spread and evolution of COVID-19, we have already assessed an approximate 350,000 b/d reduction in oil demand growth, a number that will likely grow if the spread of the virus and its economic impact is not curbed soon. On the freight side, latest data suggest that the virus spread will reduce Chinese crude oil demand by a total of 18 VLCC equivalent loadings in the February – April fixing window. It remains to be seen if there will be a sharp recovery after the infection comes under control, although that would likely not come earlier than halfway through the second quarter.

Figure 1 - COVID-19 Impact on Oil Demand (left) and Chinese Crude Import (right)

Source: McQuilling Services