CPP Fleet Utilization Spikes

April 29, 2022

Clean tanker utilization has exhibited a strong upward trend since the beginning of the war in Ukraine, predominantly for the LR2 and MR2 sectors. This jump can be attributed to two main factors. On one side, most nations are moving past the pandemic and global demand for products is picking up. On the other side, it represents an effort from traders to meet demand in Europe (mainly) from refining centers in the East of Suez but also the US Gulf, especially now that significant volumes from Russia are “lost”.

There are still numerous questions regarding the future of product supply in Europe, especially after the May 15 deadline for non-essential Russian oil product imports in the EU zone. So far, we have seen increased activity in East of Suez export centers, benefiting LR tankers on longer haul voyages to the Continent although we caution that without European exports to the East, underutilization scenarios are likely with these vessels adding vessel supply to traditional Western market activity. For now, our models calculate a high correlation between this increased utilization and earnings, suggesting that CPP tankers rates will remain elevated for the short-term; however, risks to the downside exist with the increased vessel availability looming.

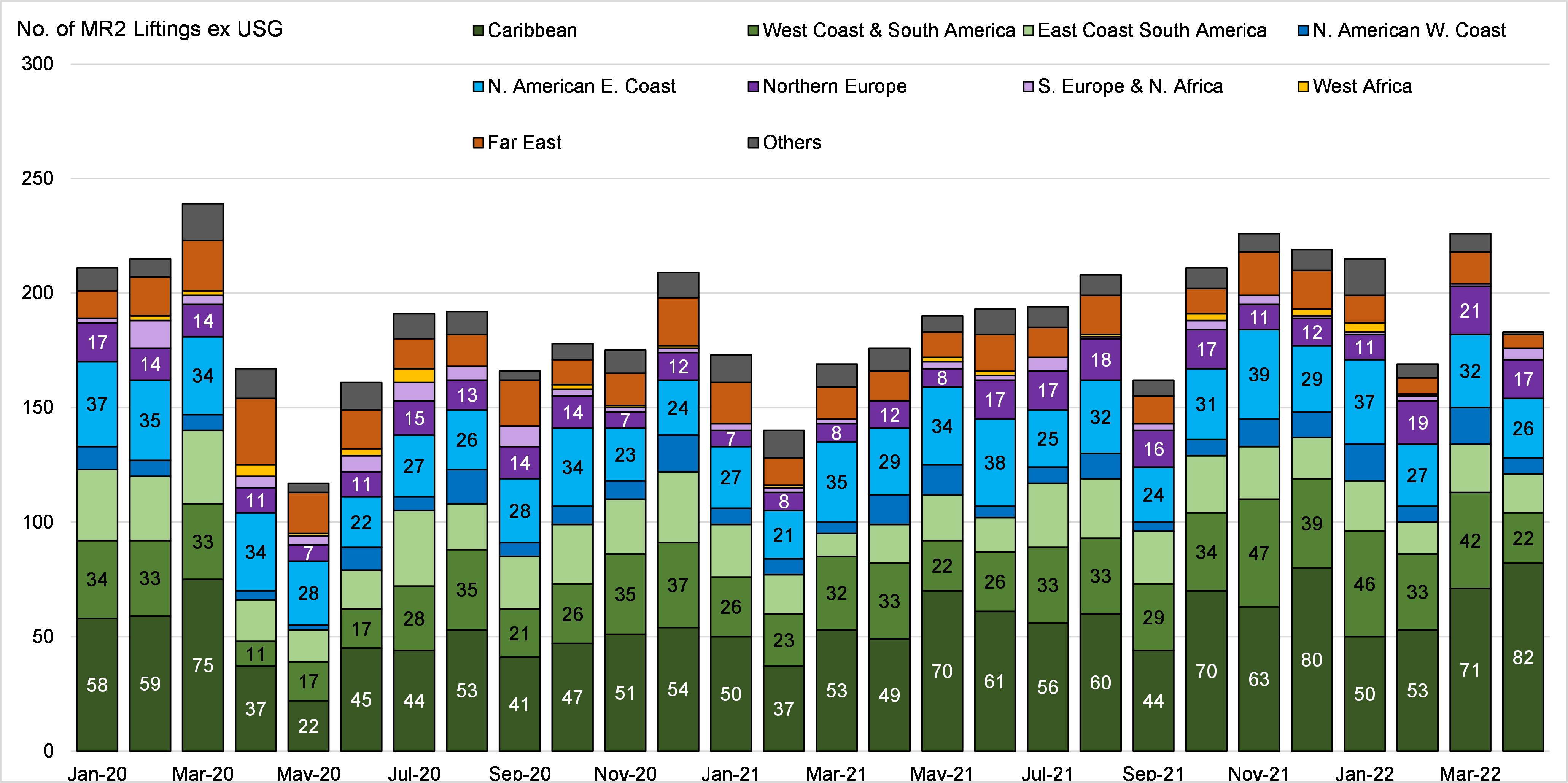

Shifting our focus to the MR markets in the Atlantic Basin, loading activity exploded in March from the US Gulf region, with rates breaking records. To unpack this development, we understand that it has been a combination of European buyers trying to offset the loss of Russian barrels in a rising demand environment, in addition to strong demand from Latin America and the Caribbean. For the latter, we note that loadings from the US Gulf reached the highest in over two years (Figure 1) as European product supply became suddenly unavailable for this region. Furthermore, sustained droughts in Brazil necessitated the use of fossil fuels instead of hydro for power generation, increasing refined product pull.

Overall, we assess the situation in the US Gulf as likely to remain robust for owners, albeit more tempered, as an expected influx of ballasters in the US Gulf region from both MRs, but growing LR1s could offset some of the demand strength.

Figure 1 – MR2 Liftings Ex US Gulf by Discharge Region

Source: McQuilling Services