Crude and Product Tanker Orderbook

Oct. 16, 2014

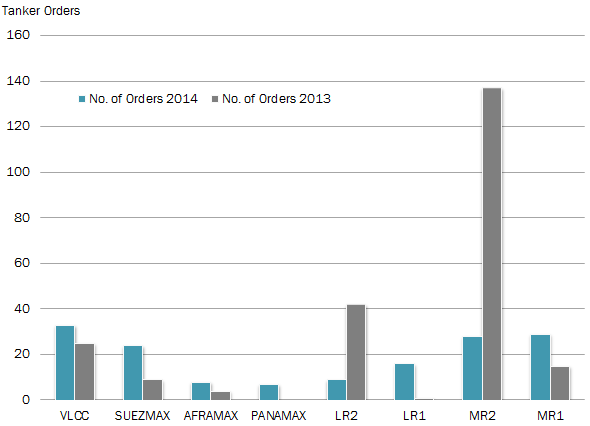

Our proprietary data shows that tanker newbuilding orders through the third quarter of 2014 are down 32% when compared to the same period last year. We can attribute this slowdown to the lack of orders placed in the LR2 and MR2 segments. As displayed in the figure below, roughly 137 orders were placed for MR2 (IMO III) tankers and 42 LR2 product tankers through September 2013. The continuation of the weak earnings environment for clean tankers this year has likely dampened the enthusiasm exhibited in 2013 when LR2 and MR2 tankers dominated newbuilding orders.

It’s interesting to note the reversal of the ordering trend we’ve seen this year as the focus has shifted to the crude tanker segment. Renewed confidence in the dirty classes was ignited early on as earnings seemed to be on the road to recovery. VLCCs have led the way with 33 newbuilding orders to date, followed by Suezmax (24) and Aframax (8). Navig8 and DHT have ordered the bulk of the VLCCs, while Quantum Pacific, Polembros and Arcadia have been active in the Suezmax segment.

The pace of ordering did ease at the tail end of the third quarter, but with the winter season and historical spot rate spike approaching, it will be interesting to see if there’s another end-year surge in newbuilding orders.