Crude Balance Revisions: More Headwinds

May 6, 2022

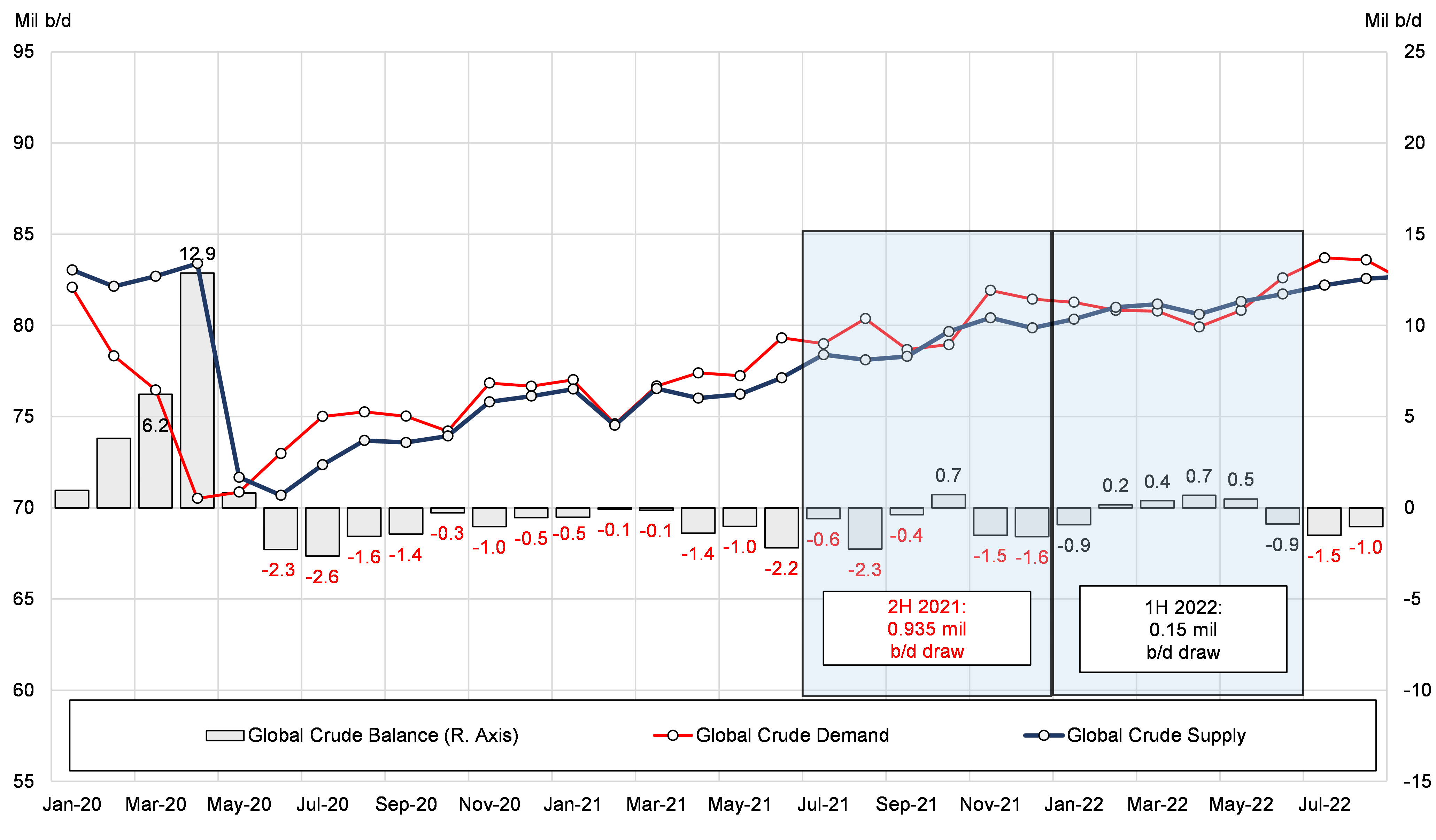

Revised global crude data is beginning to verify the tightness observed in the physical markets after the Russia-Ukraine war began. For April, we saw the projected balance length increase to 691,000 b/d, likely the highest surplus for the entire year, but still far from adequate to produce any meaningful results for the tanker markets. In fact, despite the length, we project an estimated 0.15 million b/d of draws for the first half of the year.

With demand on refineries expected to increase going into the summer months in the northern hemisphere and structural challenges from Russian sanctions, the balance tightness is more than likely to linger. As a result, we anticipate freight rates for DPP tankers to face some pressure leading to the summer months, with no incentives to store crude as well mediocre production increases from OPEC+, with the organization likely sticking to their plan going forward and even struggling to meet its current quota.

Market players expect some respite from an increase in US shale oil production, which is projected to increase by close to 1 million b/d throughout 2022 according to the latest data from JBC energy. The increase combined with the recently decided SPR releases are likely to provide a boost for crude exports in the near term, benefiting mid-size DPP tankers.

Combined with overall strong Atlantic Basin production (Brazil, Guyana) and exports under a Russian sanctions context, it is possible to see more VLCC owners deciding to ballast back to the West after discharging in Asia. This has recently started to occur, and we hold the position that it is very likely to increase in the near future, with the immediate result of increased competition and potentially lower utilization for Suezmax and Aframax tankers.

Figure 1 – Global Crude Demand, Supply and Balance

Source: McQuilling Services, JBC Energy