Crude Flows: West to East

Jan. 9, 2018

The Mediterranean/Black Sea has grown as a West to East crude exporter with 23 VLCCs loaded in this region bound for the Far East and South East Asia in 2017 versus 17 in 2016. Considerable growth has also been witnessed in the Suezmax sector with 176 vessels loaded for East discharge in 2017 compared to 109 in 2016. The growth of crude output in Kazakhstan coupled with redirected Russian barrels from the Baltic Sea to the Black Sea has supported this market, which we expect to continue in 2018; however, we note that increased production cut compliance in Kazakhstan has the potential to weigh on this trend.

For West Africa, we forecast a 300,000 b/d expansion of crude supply to support flows to the East on VLCCs and Suezmaxes, especially considering the weaker outlook for European refining next year. VLCC demand is on track to increase by 4.9% to the Far East and by 3.2% to South East Asia in 2018.

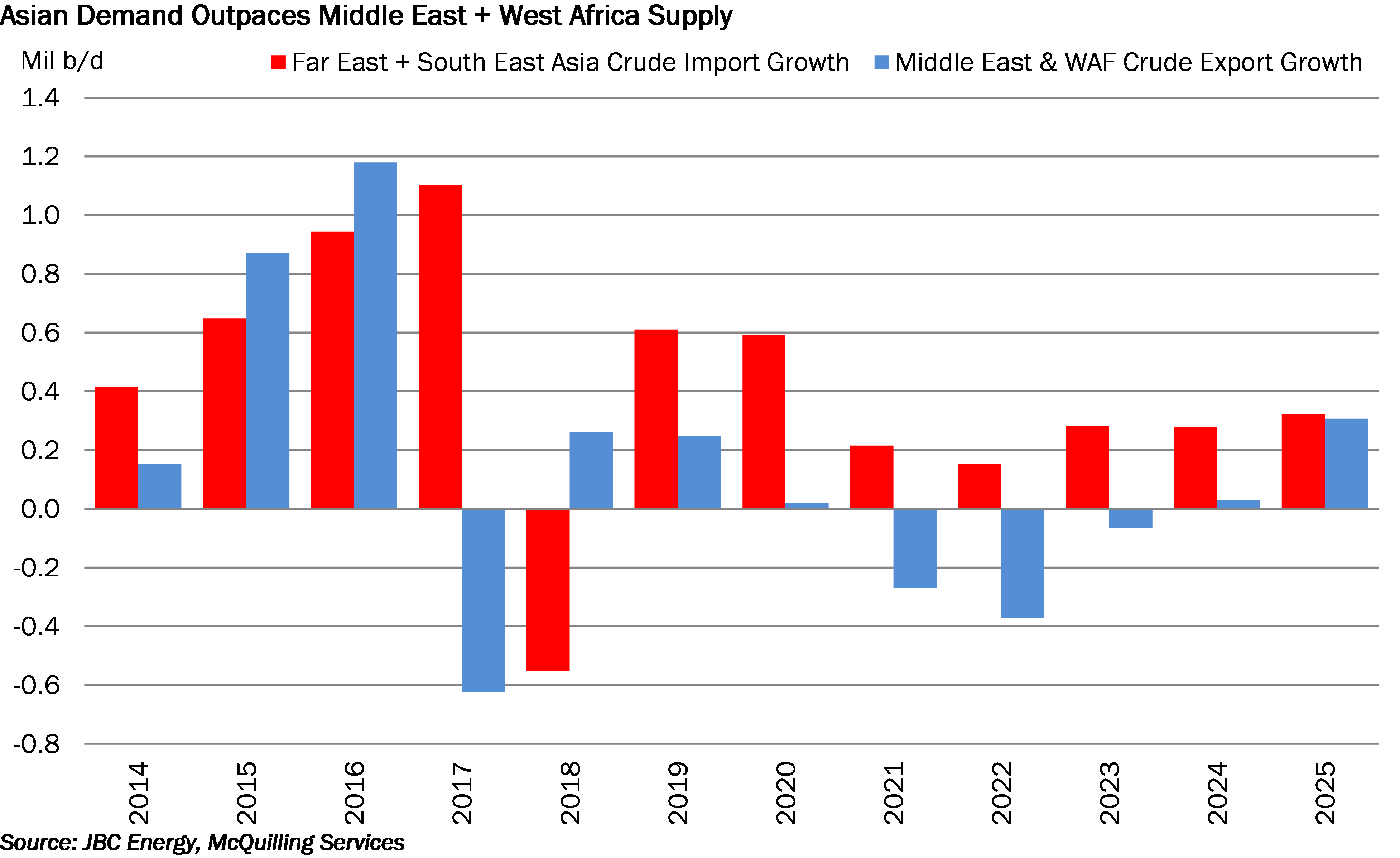

While West Africa is poised to fill feedstock demand of refiners in the East next year, over the longer term, we see that growth in West African and Middle East crude exports is projected to be outpaced by rising import requirements to the East, creating a demand gap of about 2.0 million b/d through 2022. This solidifies our expectation that increased flows from crude export regions in the West are required to meet the ever-growing demand of expanding Eastern refining capacity.