Crude Oil Supply Outlook

Jan. 11, 2018

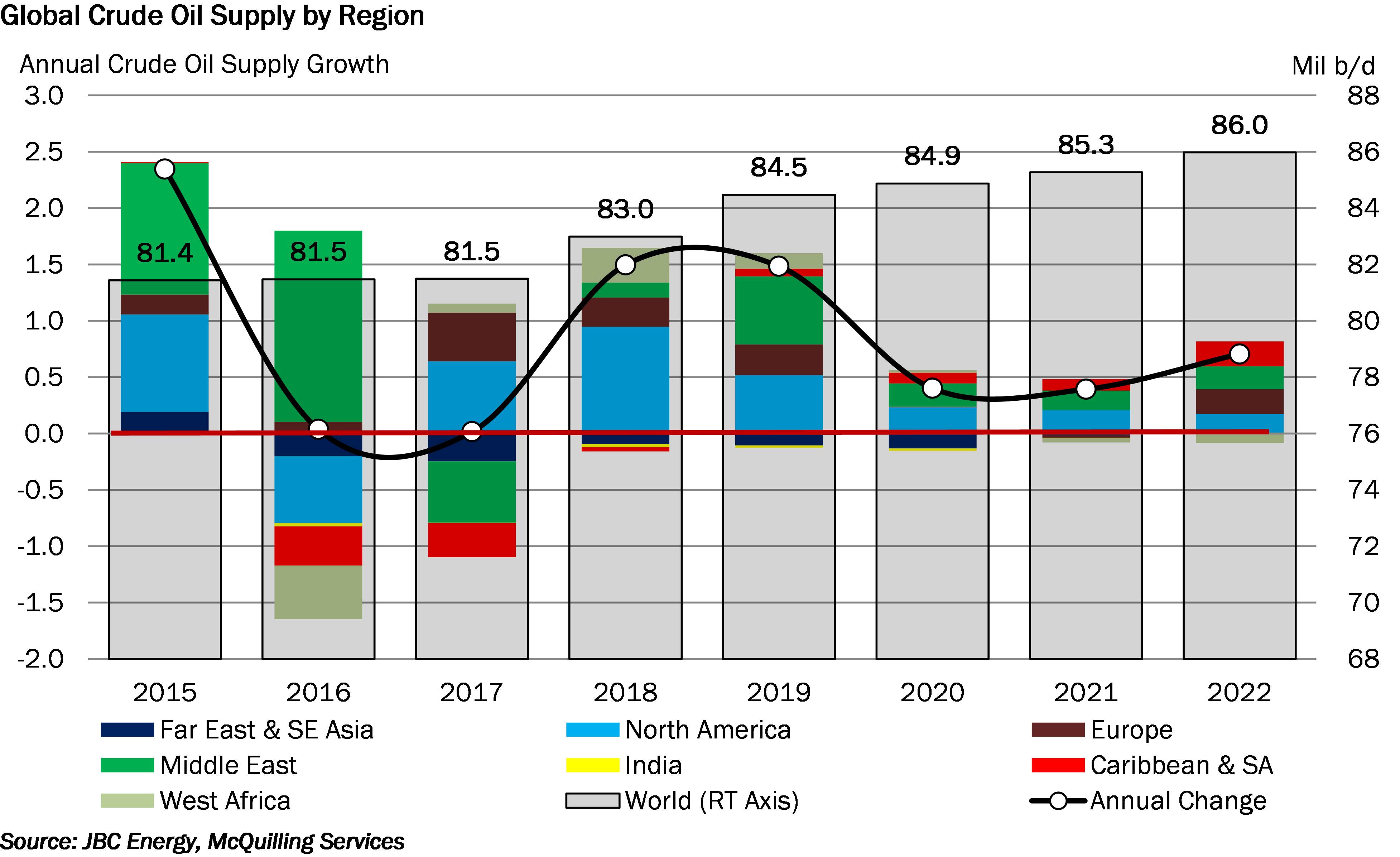

Global crude supply growth is projected to rise by 1.5 million b/d, despite continued efforts from OPEC and non-OPEC countries to reduce output levels, according to data from JBC Energy. After feeling declines of about 545,000 b/d year-on-year in 2017 the Middle East is expected to make modest gains of 135,000 b/d this year. This figure could change considerably if we see a reduction of compliance or a failure of the extended accord; however, both are unlikely through 2018.

Crude supply in West Africa is on track to rise by 310,000 b/d in 2018, one of the largest years of growth since 2014. Continued growth is projected through 2020, albeit at a slower pace, although as we move into 2021/2020 fundamentals point to declines in crude supply of 30,000-80,000 b/d, which when coupled with the start-up of the Nigerian mega refinery, is likely to pressure exports volumes.

Europe experienced a large rise in crude supply (430,000 b/d year-on-year) in 2017, mainly supported by the Mediterranean region as Libya and Kazakhstan produced more crude, while Russia redirected export barrels from the Baltic Sea to the Black Sea. This trend was also a major contributor to the recent health of the European refining system as refiners could source cheaper feedstock from more proximate sources. Crude supply growth is expected to continue this year; however, at a slower pace of 260,000 b/d, again mainly supported by the Mediterranean.

North America is the main driver behind rising global crude supply next year as higher production is expected out of the US and Canada. The US EIA forecasts US production to reach 10 million b/d in February 2018, while the IEA expects Canadian production to rise to an average of just below 5.0 million b/d. As a result, JBC Energy projects the North American supply of crude to increase by 950,000 b/d year-on-year to 15.1 million b/d in 2018. This trend will further support the growing crude export market out of the US Gulf and pressure pricing of WTI-linked grades to incentivize purchasing from refiners in the East……we discuss global crude supply further in the 2018-2022 Tanker Market Outlook.