Demand Revisions: Will there be another hard Winter?

Aug. 13, 2021

The resurgence of the COVID infection rates due to variants in both East and West of Suez markets have again put significant uncertainty on the pace of global crude demand recovery, including forecasts made by oil industry players.

The IEA made the news this week as the organization cuts its year-on-year oil demand increase in 2021 to 5.3 million b/d but raise the figure for 2022 to 3.2 million b/d. In its monthly report, the growth projection for the 2H of 2021 has been downgraded more sharply by 500,000 b/d, as new COVID19 restrictions imposed in several major oil consuming countries, particularly in Asia, look set to reduce mobility and oil use. OPEC, on the other hand, has sticked to its previous prediction of a strong demand recovery in 2021 with further growth in 2022, but noted that “numerous challenges remain that could easily dampen this momentum”.

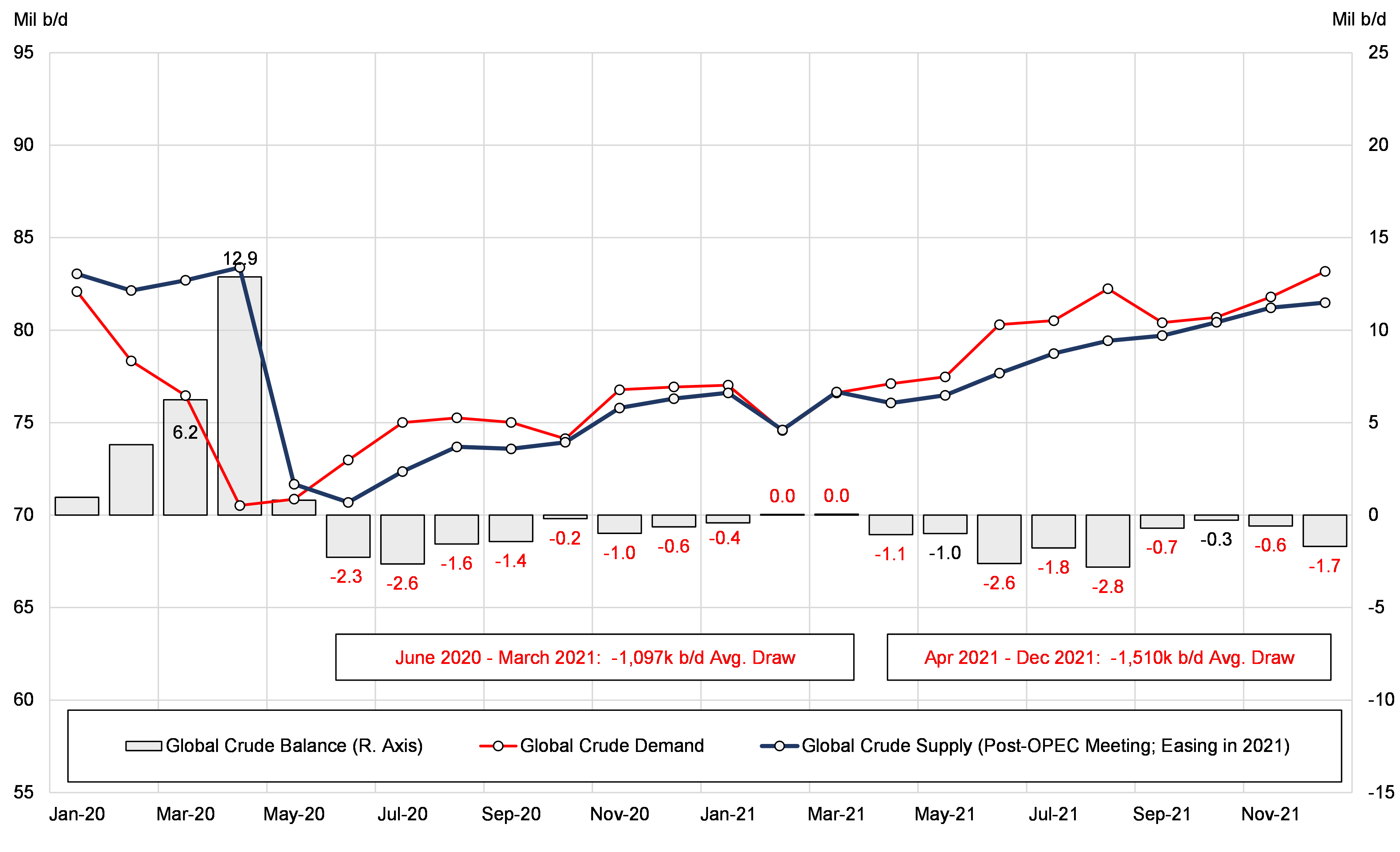

According to JBC Energy’s latest crude oil demand forecasts which was adjusted down by 863,000 b/d on average for the rest of the year, global crude demand is expected to grow by 1.7 million b/d in August and settle at 81.7 million b/d on average for the rest of the year. Taking into consideration the gradual increase of 400,000 b/d by OPEC+ per month, crude balance is projected to remain in deficit by 2.8 million b/d this month and on average at a deficit of 849,000 b/d in Q4 2021. The tighten global crude balance will also result further inventory drawdowns, especially for floating storages. Based on our calculation, we expect nine VLCC floating storages to unwind in the next two months, representing all previous built to return to the trading fleet by the end of September.

While a strong oil and tanker demand is expected in the upcoming months, the substantial vessel supply imbalance including floating storage unwinding and remarkably low tanker deletions will cap the upward momentum in DPP tanker freight rates. For the VLCC sector, we expect the benchmark TD3C to stay weak in August and September, before firming to the WS 40s in the winter.

You can read more in-depth analysis on oil and tanker market fundamentals in our upcoming Mid-Year Update, publishing in August.

Figure 1 – Global Crude Oil Balance

Source: JBC Energy, McQuilling Services