DPP Tanker Demand Drivers

Jan. 17, 2018

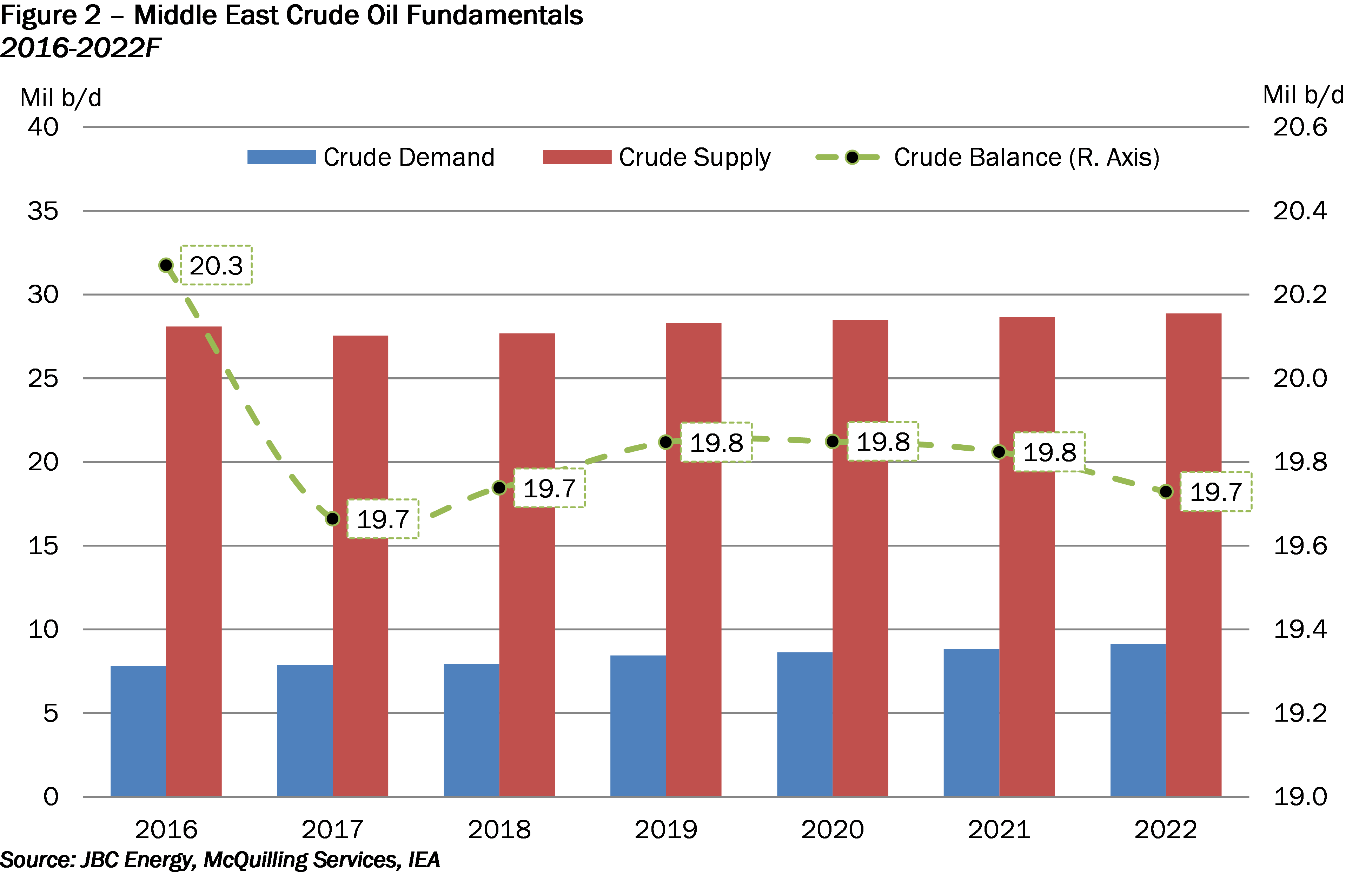

In 2017, we recorded the average mileage for DPP maritime volumes to be 4,564, a 2.3% rise from 2016 levels and 6.8% higher than the beginning of the decade. The most impressive gains were present in the Suezmax sector, whereby average voyage-mileage increased 3.6% in 2017 due to increasing Southern European flows to Asian refining centers amid crude pricing arbitrages. VLCC mileage increased 1.2% to 6,689 miles in 2017 as a decline in Middle East flows to the West were offset by market gains in Atlantic Basin exports to the Asian refining complex (Figure 1).

The combination of rising crude demand in the East and longer mileage between suppliers and customers is due to several factors, and are projected to remain in place for at least 2018: 1) OPEC/non-OPEC crude production agreement; 2) rising Atlantic Basin crude supply (except Caribbean); and 3) incremental crude demand growth from primarily East of Suez markets. However, we remain cautious about the longer-term viability of growing West to East crude flows as Middle East supply gains in 2019 are likely to narrow crude pricing differentials and pressure arbitrage flows to an extent.

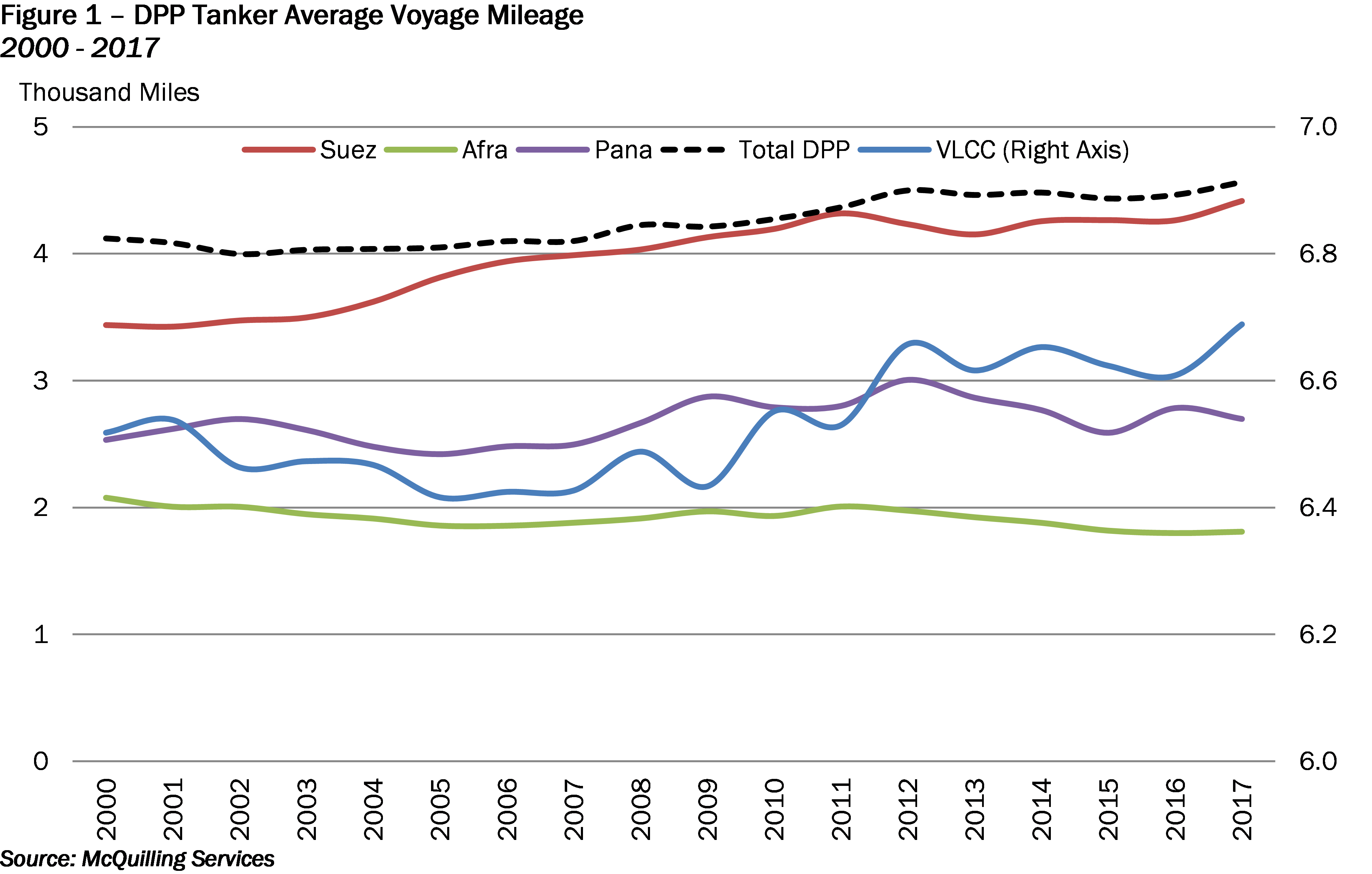

In our base case projections, OPEC cuts are likely to remain in effect through December 2018. In 2019, we expect Middle East crude oil supply to grow 600,000 b/d or 2.2%, following a net decline of 411,000 b/d in 2017 and 2018. However, crude oil supply must be viewed in the context of regional demand as well. The Middle East has made significant progress in developing downstream capabilities, accounting for 9.7 million b/d of the world’s refining capacity and by 2019, we anticipate regional crude demand will grow by 652,000 b/d, limiting the amount of excess crude oil available for export markets, particularly the West (Figure 2).