Europe Pulls US Crude

April 25, 2018

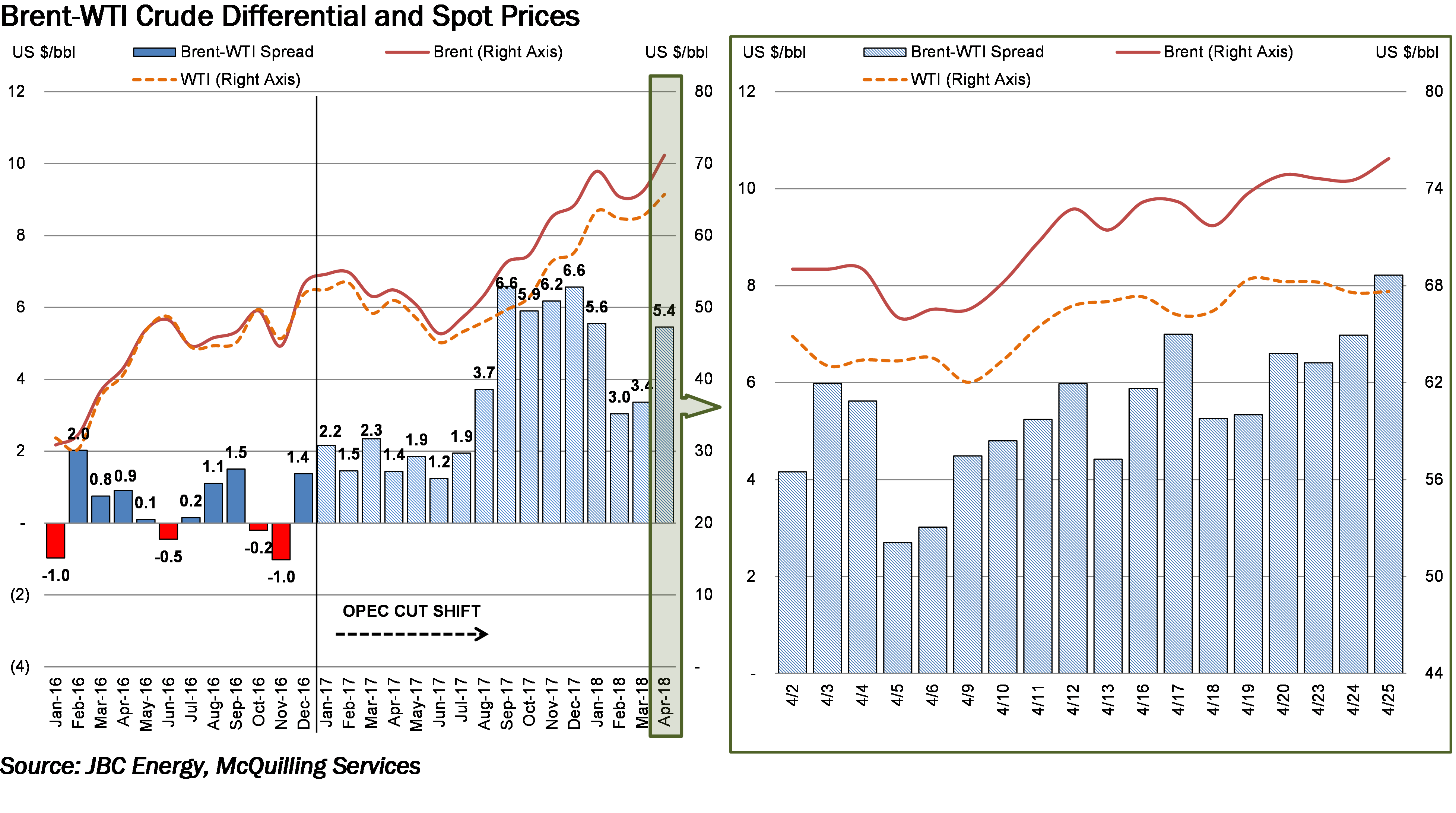

Interest to ship US crude into the European market has been rising in recent weeks, driven by a combination of increased demand in the latter and favorable crude pricing. Suezmax and Aframax spot activity to load end April/early May has increased in the US Gulf with a strong preference to travel trans-Atlantic. European refinery runs are beginning to ramp again as maintenance season comes to an end with JBC Energy projecting just around 120,000 b/d of offline capacity for June, coming off 900,000 b/d in May. A recent uptick in refinery runs is providing upward support for Brent crude pricing, consequently expanding the differential to WTI crude. This pricing spread has averaged roughly US $7/bbl this week from opening the month around US $4/bbl, prompting European refiners to source crude from across the Atlantic. The preference for sweeter US crude is likely influenced by the expected rise in demand for gasoline and middle distillates due to the upcoming driving season as we note that the increasing sulphur content in Urals grades is deterring interest from European refiners.

Traders are likely taking advantage of competitively priced US crude sales from the strategic petroleum reserve, which will total 7 million barrels this year. US crude production was estimated just below 10.6 million b/d for the week ending April 20, while refinery runs fell 330,000 b/d week-on-week, according to the US Energy Information Administration (EIA). Looking forward, fundamentals point to lower availability of North America crude for export through June as US refiners ramp up for the summer season; however, we envision a more significant tightening in the European market to keep Brent crude pricing at a significant premium to WTI. In our view, this pricing incentive will keep US exports elevated with additional support stemming from crude output gains in the US and Canada after June. For tankers, we expect increasing demand for Aframaxes and Suezmaxes on trans-Atlantic voyages to reduce the Caribbean-US Gulf position list and provide upward support for TD9 freight rates. To view our five-month freight rate forecast for 23 DPP and CPP tanker trades, please check out our upcoming Interim Update report, published on May 5th, by clicking here.