European Aframaxes

Feb. 15, 2018

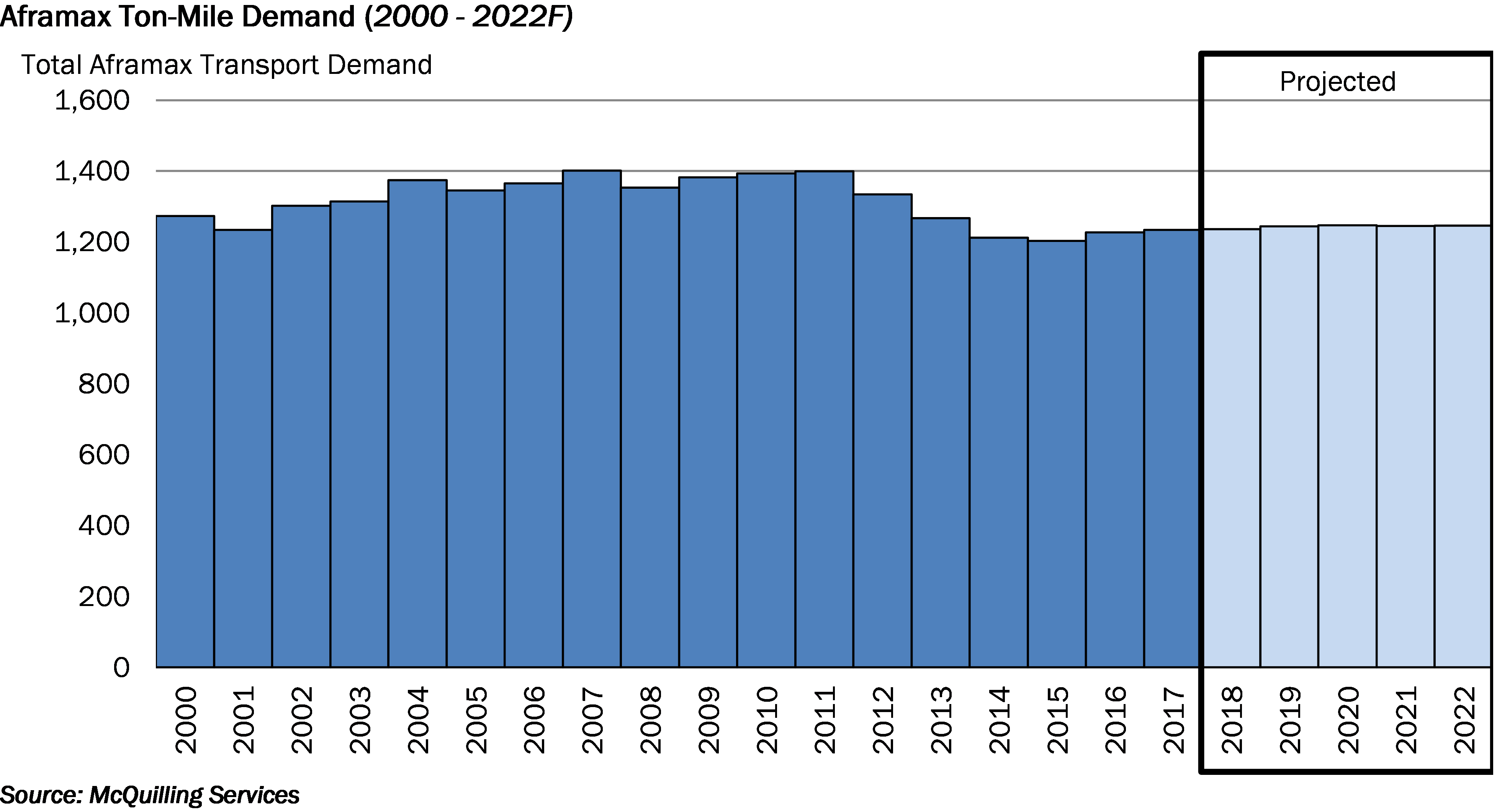

In 2017, Aframax demand rose 0.6%, largely in-line with our January 2017 forecasts. Growth was observed in European regional trading, with the Southern Europe > Northern Europe route climbing 10.3%, while the intra-regional Southern European trade grew by a similar 10.1% as higher crude supply from Libya and Ceyhan (1H) provided regional refiners with advantaged feedstock pricing and supporting both margins and product output.

With just under 15% of market share, the intra-Northern European trade underpins this tanker segment. Despite a 161,000 b/d rise in refinery demand for crude oil in Northern Europe, we observed a higher level of crude exports out of the region, primarily to the Asian markets aboard larger tankers. This created some pressure on the intra-regional Aframax trade, which declined 2.8% year-on-year. Demand from Northern European refineries is projected to face pressure towards the end of the forecast period amid product demand pressures from fuel switching and vehicle efficiencies, which are likely to prevent this trade from regaining any lost growth. However, the end of OPEC cuts may shift some Asian crude imports back to Middle East suppliers, mitigating any sharp downturn. We project this trade to grow by only 0.3% per annum through 2022, similar to the growth we expect for the sector as a whole.