Filling the Gap: Part 2

Nov. 16, 2017

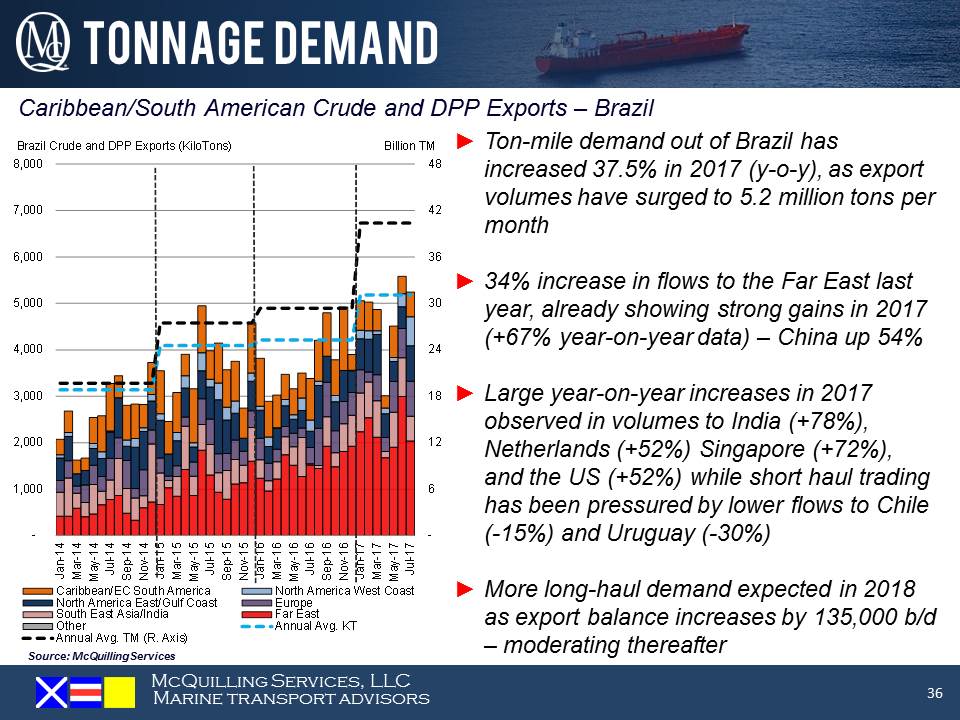

One major oil producing nation that we expect to fill the demand gap in the East is Brazil, which has increased crude production by 155,000 b/d year-on-year to 2.6 million b/d over the first 10 months of 2017. Levels are expected to rise further to upwards of 2.8 million b/d next year and with demand on track to rise to 1.78 million b/d, we foresee the crude balance available for export expanding by about 135,000 b/d on average next year. Export volumes into China continue to follow their upward trend observed since at least 2014, gaining a 58% boost through the first half of this year as OPEC production cuts increase the pricing of Middle East crude and force Eastern refiners to find alternative feedstock at better pricing. Higher volumes have also been observed to India, Singapore and the US.

In terms of tanker demand, Brazil is on track to add considerable support to the VLCC and Suezmax sectors with total export DPP ton-mile demand already up 37.5% year-on-year. We expect VLCC ton-mile demand out of East Coast South America to the Far East to rise by 8.4% per annum from 2017 through 2021. Regarding VLCC demand to South East Asia, we expect levels to fall 3.9% this year; however, 2018 is likely to bring a recovery with growth expected at 4.4% per annum over the 2017-2021 period.