Floating Storage Shifts

Aug. 29, 2017

As we noted in the 2017-2021 Tanker Market Outlook, an increasing amount of spot fixture activity has been carried out by disadvantaged tankers in 2017 as older tonnage tends to fix below market levels. Meanwhile, a notable amount of older tankers have been fixed for operational floating storage in the time charter market or optioned for short-term FSO duty in the spot market.

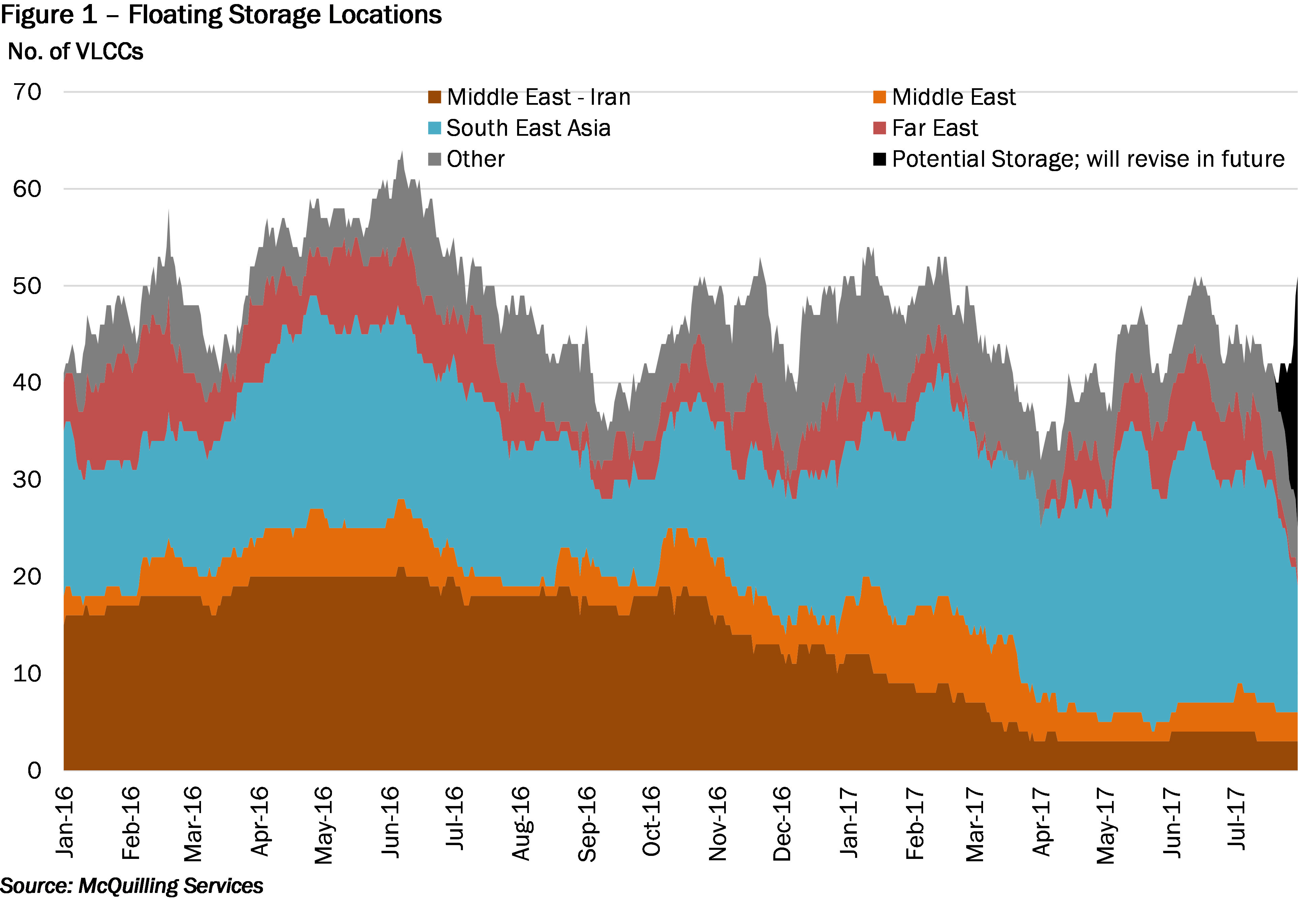

Distilling large sets of remotely sensed position data we are able to analyze a variety of parameters and determine the operations of each tanker on a daily basis. Through this process we determined that floating storage peaked in April and June of 2016 when about 87-89 vessels were anchored with cargo on board, and about 69% of this activity stemmed from the VLCC sector. However, the storage activity began to drop after the peak and the total number of floating storage units has remained at around 55-65 vessels in the first seven months of 2017 (Figure 1).

We also noticed the change in the major anchorage regions of the floating storage activity. Throughout 2016, majority of floating storage operations occurred in the Middle East, accounting for approximately 45% of activity. Within the Middle East, Iran remains the top anchorage zone peaking at 20-21 vessels from April to June 2016. As a list of Iranian vessels have returned to the active trading fleet since the fourth quarter of 2016, the number of Iranian VLCC floating storage tankers has decreased dramatically to three tankers at the end of July 2017. These additional VLCCs have further increased the tonnage supply, and thus could continue putting downward pressure on VLCC freight rates.

While less floating storage has been operated in the Middle East, increasing VLCC storage activity has been observed in the South East Asia. The number of VLCC tankers anchored in this region has risen by 72% from 18 tankers at the end of 1H 2016 to 29 at the end of July 2017. South East Asia has now become the top anchorage zone with 55-60% of the global VLCC floating storage operated there.

Order a copy of McQuilling Services 2017 Mid-Year Tanker Market Update

The Mid-Year Tanker Market Outlook Update provides an outlook for spot market freight rates and TCE revenues for 19 major tanker trades, including two triangulated trades, across eight vessel classes for the second half of 2017 and the remaining four years of the forecast period to 2021. We revisit our forecasting process at the mid-year point, distilling data from the first half of the year to better understand recent market developments and expectations for the future. In our view, this process allows us to accurately adjust our forecasts and provide additional value to our clients.