Global Refinery Capacity and Utilization Expectations

Feb. 5, 2021

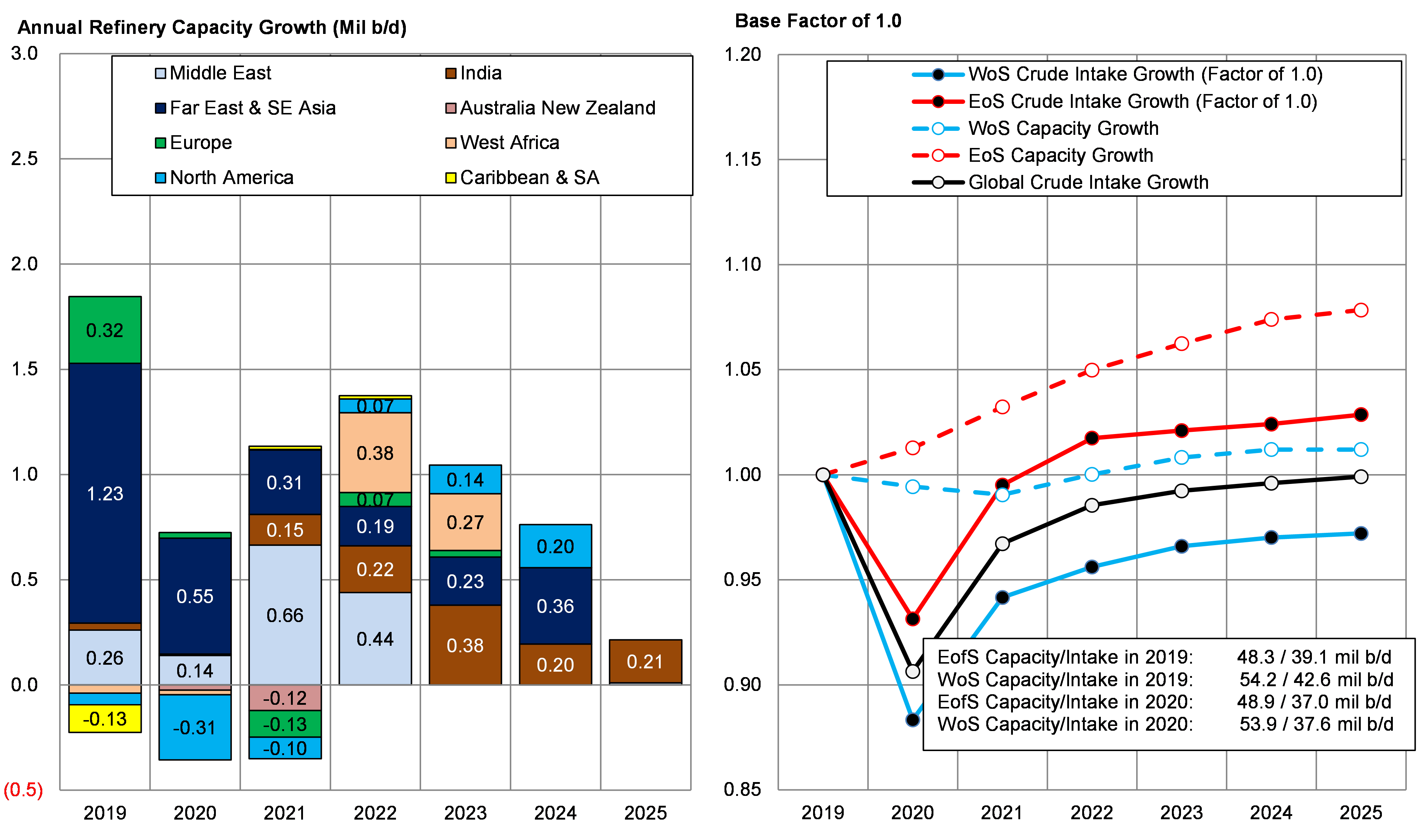

In 2019, we saw some significant refining capacity additions, especially in the Far East and Southeast Asia. In 2020, despite the absence of oil demand, a large amount of projects were completed, again most of them in Asia. In terms of the relationship between capacity and utilization we have noted many times that refinery capacity does not mean that all of it is utilized and indeed 2020 was a year of very low utilization rates amid low demand and a low margin environment.

As we move beyond 2020, we expect refinery intake to rebound, although it is unlikely to see levels reach 2019’s over our forecast period. When comparing to the 2019 baseline, we note that that main cause for this projection is West of Suez refinery intake, which is projected to reach 97% of 2019 levels by 2025, while a more optimistic scenario is envisioned in the East of Suez centers (Figure 1).

As it relates to refinery capacity additions, we expect the bulk of them in 2021 to take place in the Middle East, where we project close to 660,000 b/d of additional processing capacity, and 440,000 b/d in 2022. Less talked about, but very important to tanker demand is the startup of the Dangote refinery in Nigeria sometime in 2022, which will add more than 600,000 b/d of crude processing in the region, significantly lowering the Suezmax and VLCC demand from the region. Finally, India is expected to continue adding refining capacity throughout our forecasting period, in line with a growing demand from the region.

The results of this analysis point to several developments around ton-mile demand. The increased crude demand from the Middle East will likely temper crude export growth from the region, despite supply side increases. It also adds significant support for CPP tanker demand as product surplus expands. Furthermore, we expect notable declines in Suezmax demand from West Africa to Europe, but also declines in CPP demand from Europe to West Africa, while India’s increased demand will be largely met by Middle Eastern supply, particularly as the pace of new additions in the Far East temporizes.

Read more about refining development and other topics at our just published 2021-2025 Tanker Market Outlook.

Figure 1 – Annual Refinery Capacity and Intake Growth

Source: JBC Energy, McQuilling Services