Iran Deal Implications

Feb. 11, 2022

The discussion about Iran and the potential sanctions removal has two main questions. When will the Iranian barrels return (assuming talks progress further), and what will be the impact in the tanker markets.

To answer the first question, we looked back at the timeline of the Joint Comprehensive Plan of Action (JCPOA) in 2015. The deal was concluded on July 14, 2015, and the UN Security Council endorsed it on July 20. Exactly 90 days later, “adoption day” triggered Iran and the other members of the deal to take action to meet their commitments. It was not until January 16, 2016, that Iran was certified to have taken all steps necessary to restrict its nuclear program and that was when the US, EU and the UN proceeded to lift sanctions on the country and Iran could now trade its crude oil barrels in the international market. This could easily mean that even if a deal was signed today, it may take well up to six months for barrels to start trading.

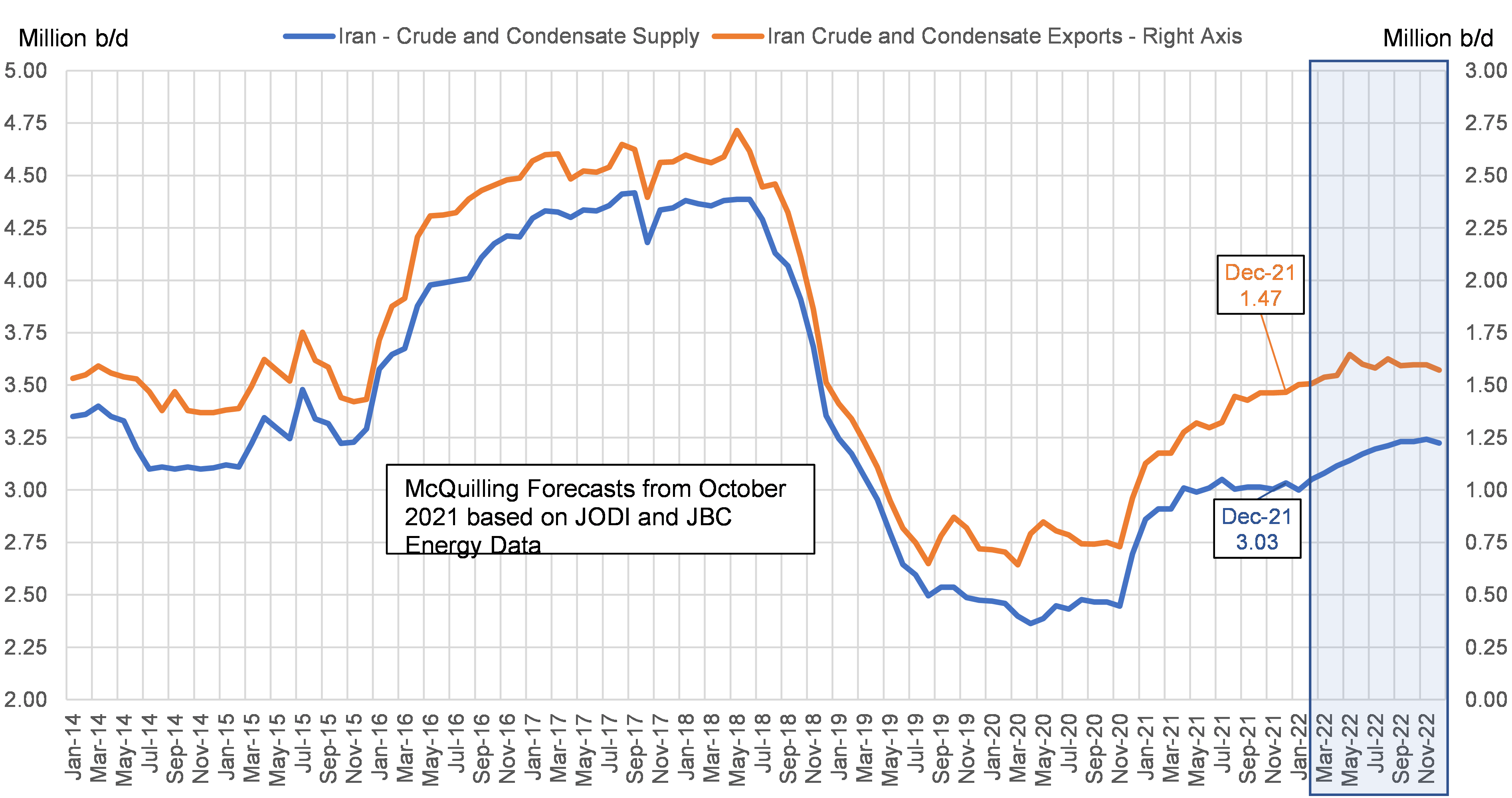

As of the end of 2021, we are estimating about 1.47 million b/d of Iranian crude being exported (Figure 1) despite the sanctions, going almost exclusively to China on VLCC tankers we have dubbed “ghost ships”, as it is typically vintage tonnage that has been sold in the secondhand market at a premium and to unknown entities. Our analysis shows about 13 of these VLCCs becoming obsolete if sanctions are lifted although we note that about 15 of these tankers are already removed from our supply numbers since they operate with their AIS transmitter off. Finally, the return of Iranian crude will also mean the return of the NITC VLCC fleet, although we see utilization of these tankers trending down as they will be constraint by age and vetting restrictions.

Putting it all together, the net ton-mile impact of sanctions removal is likely to be minimal and even negative if we consider that Iranian crude may replace some US Gulf barrels heading East (50% shorter mileages). Outside of a potential supply side relief, we note the expected increased utilization of Suezmaxes, especially for flows to Europe. However, we caution that the incremental demand of those trades would be the additional time required for these tankers to load on an AG>MED trade instead of ballasting back to Europe after a MED > Far East run. The silver lining in this scenario though is that with more Iran crude in European refiners, additional barrels could be freed in the region for exports.

Global themes and the effect on tanker markets are covered in depth in our recently published 2022 – 2026 Tanker Market Outlook.

Figure 1 – Iran Crude Supply & Estimated Exports

Source: McQuilling Services, JBC Energy, JODI