LR2 Demand to Find Support from Physical Balance Developments

Dec. 17, 2021

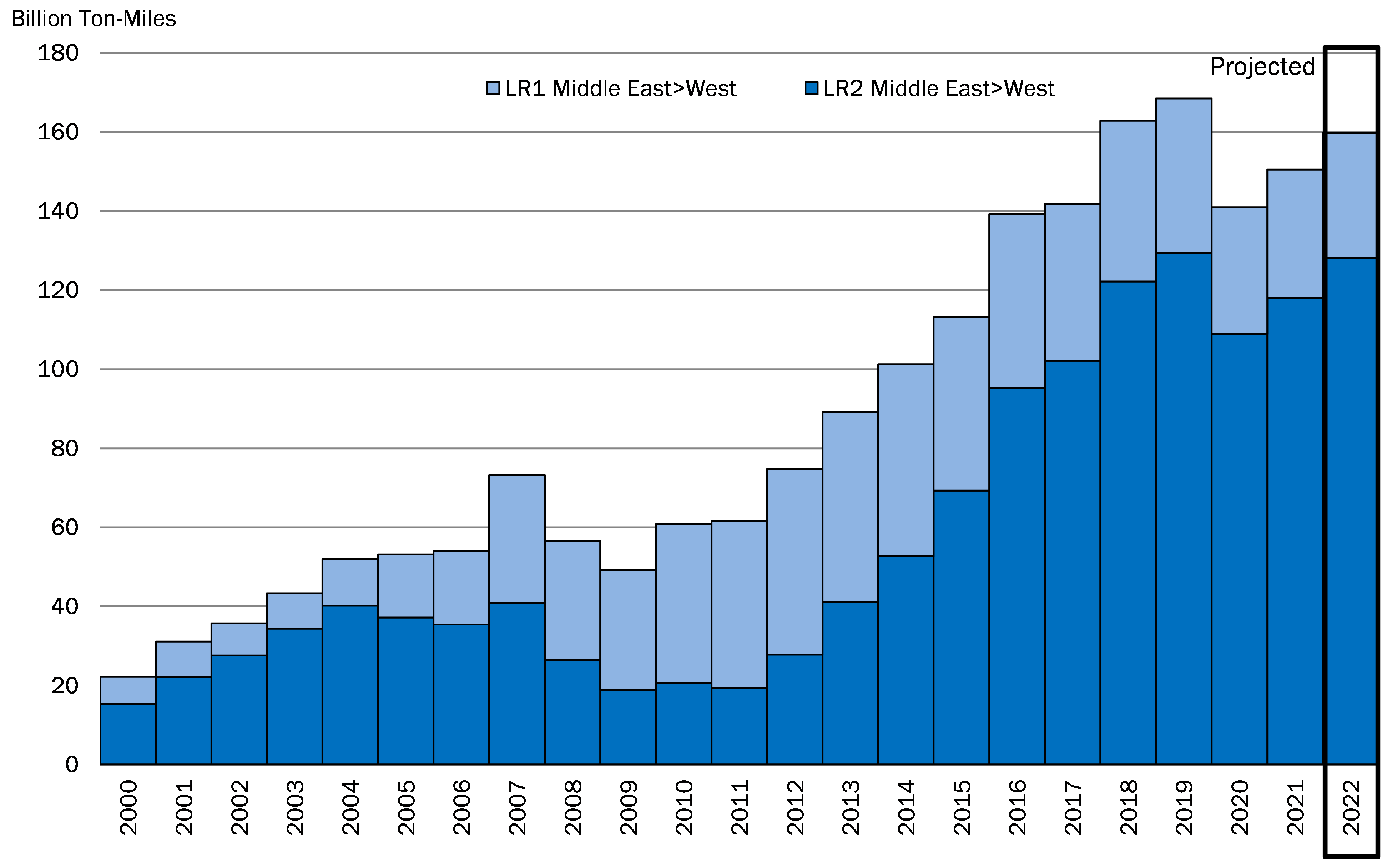

Staying on the theme of preliminary findings from our upcoming 2022-2026 Tanker Market Outlook, we focus this week’s highlight on LR2 ton-mile demand from the Middle East to the West, particularly to Europe. For 2022, we project a 6.0% increase in ton-mile demand on this trade, with growth stabilizing at about 5.0% year-on-year throughout our forecast period (Figure 1).

Recent data from JBC Energy reveals Northern Europe distillate demand to outpace parallel supply additions from the Continent’s refining complex. The impact from gas-to-oil power generation requirements is likely to remain in place for the short-term and is coupled with a slightly more constructive view on mobility restrictions, particularly if the OMICRON variant continues to present “milder” effects than previous strains. Plugging the physical balance changes into our tanker demand models, we show an accelerating Middle East>Northern Europe LR2 demand profile in 2022, which is likely to offset flows from the US Gulf and intra-regional flows (Russia).

Beyond 2022, we envision the world will be transitioning to a pre-pandemic environment, with resulting increases in underlying oil demand. At the same time, we note the Continent’s refining complex is consolidating, with 529,000 b/d expected to be lost during 2021 from plant closures or conversion projects. With Europe at the forefront of the decarbonization push, capacity additions are highly unlikely in the future thus creating a constructive environment for increasing imports from the Middle East. We do note, however, that despite reduced top-line capacity, the leaner refining complex will likely exceed 82% utilization in 2022/23, amid a more conductive margin environment.

As the Continent’s fundamental backdrop supports increasing imports, our projection for rising LR2 demand from the Middle East is further supported by the strong growth in regional refining capacity, primarily from additions in Kuwait and Saudi Arabia. In 2021, the Middle East added 290,000 b/d of processing, with 2022 estimated to bring another 740,000 b/d online in the region. We anticipate this increase to be geared towards middle distillate production, lengthening product balances by around 160,000 b/d in 2022 (JBC Energy data) and supporting LR demand, with a bias towards Western destinations, including the aforementioned Northern European region.

Figure 1 – Middle East > West LR Ton-Mile Demand with Forecast

Source: McQuilling Services