McQuilling Services’ Forecast Performance

Aug. 24, 2017

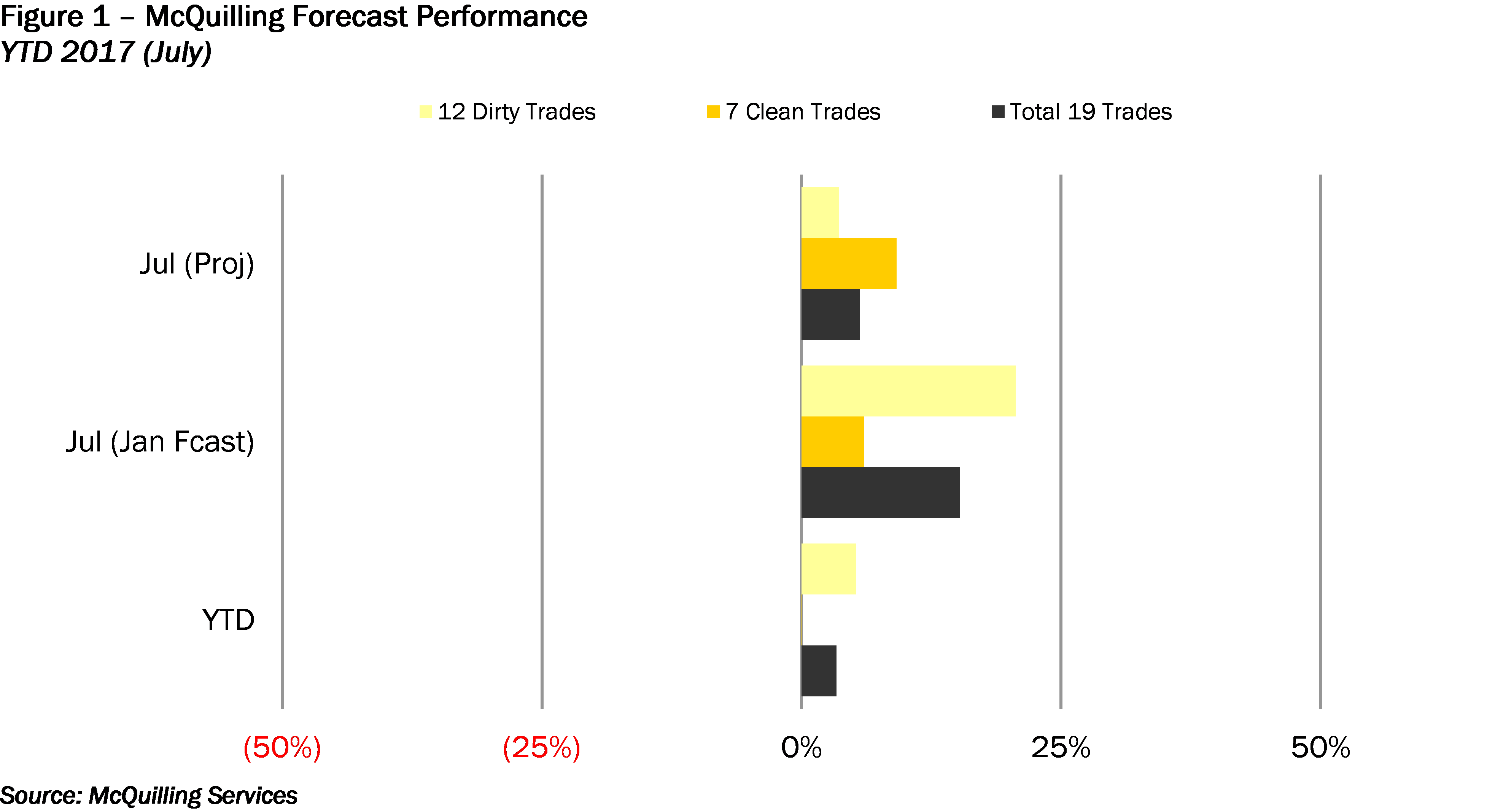

As part of our forecasting process, we like to evaluate our forecast performance throughout the year and provide our clients with the results (Figure 1). At the beginning of the year, we noted in our Tanker Market Outlook that the year 2017 is likely to be a down year for owners of all tanker classes on the basis of supply side risks. Similar to what we expected, over 180 tankers (DWT>27.5k) joined the trading fleet and our original forecasts for the 19 trades included in the 2017-2021 Tanker Market Outlook are only 3% above actual market levels for the first seven months of 2017.

In the VLCC segment, our year-to-date estimates for TD3 and TD15 have been only one worldscale point lower than the actual monthly rates. Our January forecasts for VLCC Carib/Spore were also close to the actual market levels, slightly underestimated by 0.8%. However, our AG/West (TD1) forecasts were overcast by 13.1% as the actual market spot rates traded at 15-years record-low in June and July.

The Suezmax sector has experienced an overall weak market in the first seven months with 40 Suezmax tankers delivered to the trading fleet so far this year. The ample Suezmax tonnage has prevented the freight rates to trade higher even when we see a large amount of inquiry. The forecast we projected at the beginning of the year for TD20 was 7.3% above actual market levels, and TD5 rates was overestimated by 6.8%. The AG > China Suezmax trade has performed 6.0% below our original expectations as the large amount of disadvantaged tankers combined with the overall weaker demand in the Middle East have pressured the rates in the first half of 2017. The Mediterranean market has stemmed from rising output and, as we expected, supported Suezmax BSea/Med (TD6) freight rates. Therefore, our TD6 monthly freight forecasts have stayed within 10% of the actual market performance for each month from January to July 2017.

Similar to the larger tanker class, Aframax and Panamax rates were traded close to slightly lower than our original forecast. We overcast Aframax Caribs/US Gulf (TD9) by 7.8% through July and Panamaxes on the same route (TD21) by 8.1% than our January forecast. The AG/Singapore trade (TD8) has been 9.5% weaker than our original expectations.

The variances between our original expectations and the actual market performances are slightly larger for the clean trades than the dirty trades. We overcast the LR2s and LR1s in our January forecast by 11.5% and 7.8%, respectively for the weaker-than-expected benchmark AG/Japan due to lower cargo levels and longer tonnage list week-over-week in the first half of the year. In the MR segment, the smallest difference was recorded for the US Gulf/Continent (TC14) as our year-to-date forecast of WS 106 has matched with the actual monthly average spot rate. The NWE/USAC (TC2) route and the Carib/USAC (TC3) outperformed our forecast by 3.2% and 4.4% respectively, amid a 6.4% increase in this year’s MR2 global fixture activity compared to the same period of 2016.

Order a copy of McQuilling Services 2017 Mid-Year Tanker Market Update

The Mid-Year Tanker Market Outlook Update provides an outlook for spot market freight rates and TCE revenues for 19 major tanker trades, including two triangulated trades, across eight vessel classes for the second half of 2017 and the remaining four years of the forecast period to 2021. We revisit our forecasting process at the mid-year point, distilling data from the first half of the year to better understand recent market developments and expectations for the future. In our view, this process allows us to accurately adjust our forecasts and provide additional value to our clients.