McQuilling’s Forecast Coverage Expands

Jan. 19, 2018

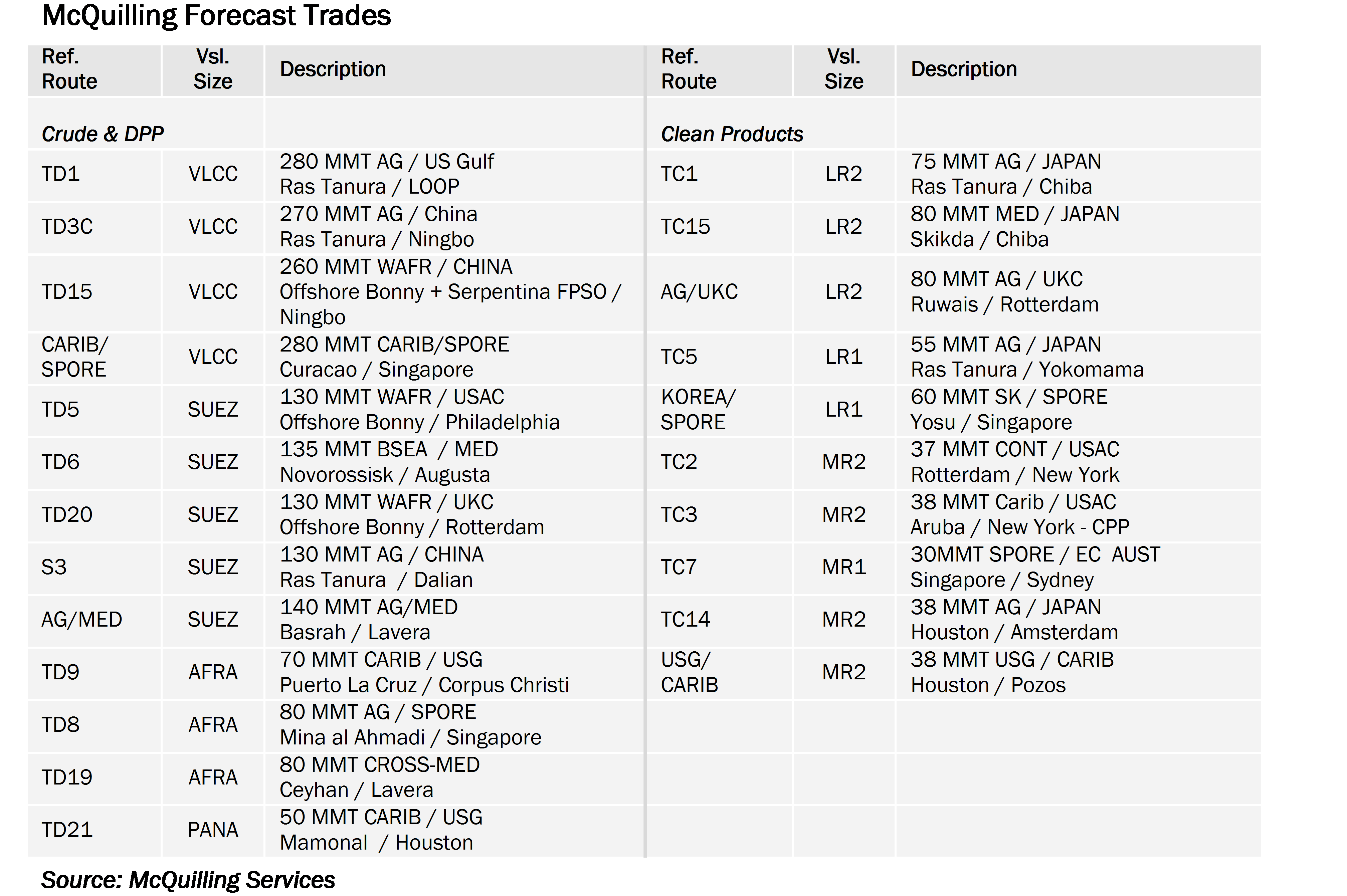

In this year’s Tanker Market Outlook, we have adjusted the benchmark VLCC route to TD3C AG/China (270,000 mt Ras Tanura to Ningbo) to better represent earnings in this sector in conjunction with the industry’s demand to do so. We have expanded our coverage of the Suezmax sector to include the AG/Mediterranean (140,000 mt Basrah to Lavera) trade, giving us a better perspective on Suezmax earnings to the West.

In the clean space, we have created two triangulated routes for the LR2 and LR1 sectors in order to acknowledge that successful owners will heavily rely on triangulated voyages to boost earnings as compared to our round-trip assessments. To complete these triangulations we now forecast the two LR2 trades; AG/UKC (80,000 mt Ruwais to Rotterdam) and TC15 Med/Japan (80,000 mt Skikda to Chiba) as well as the LR1 trade; South Korea/Singapore (60,000 mt Yeosu to Singapore). This brings our earnings forecast table to 23 round trip trades and four triangulated routes. In order to give a well-rounded view on global TCE earnings, we continue to use our regional bunker price forecasts and vessel consumption assumptions geared to specific trade routes.