Mid-Year CPP Earnings Review

Aug. 14, 2020

Following on the mid-year review we did last week for the DPP sector, this week we are looking at how earnings evolved for the clean product tankers in a year that so far has proven to be extraordinary.

The global demand crisis brought in by the coronavirus pandemic and subsequent lockdowns affected CPP tankers the same way it did with the DPP sector. Almost overnight, product prices took a big hit and the markets switched into a steep contango structure. The combination of cheap products and an opportunity to sell in the future for a potential profit led to a sharp increase in demand for product tankers, both for transportation of clean products to markets and onshore storage, as well as for floating storage. Despite the limitations regarding long-term floating storage of products, there was a surge that expanded even to MR tankers.

In the LR2 sector, we saw earnings spike from March to the end of April, given this tanker size is probably the most ideal to provide economies of scale in the transportation of clean products. However, a sizeable portion of demand for LR2s came from floating storage requirements, especially for products like jet fuel, which were the first to show a surplus given the widespread lockdowns and cancelations of flights worldwide. The low prices and “upset” global product balances created some opportunities for LR2 tankers. The most sustained one has been the emerging naphtha trade from the West to the East due to refineries in the latter using it as a feedstock after its price became attractive.

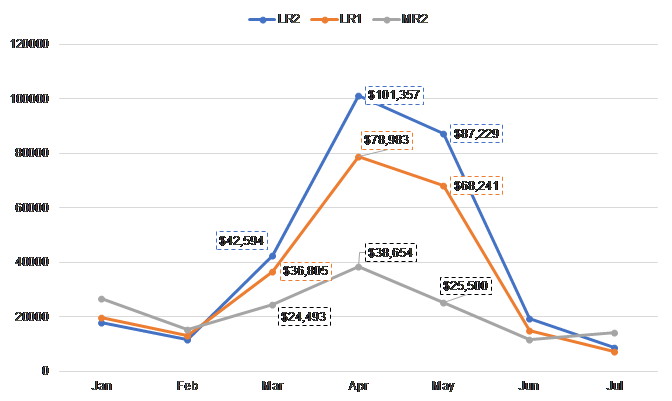

The LR1 sector did not fall far behind the LR2s in terms of demand both for transportation and floating storage. The low February TCE earnings were doubled by March and then those were doubled again reaching an average of almost US $79,000/day in April (Figure 1). The flip side started becoming apparent once we entered May. The sustained lockdown measures were not able to support demand and with inventories worldwide filled, demand for CPP tankers started diminishing.

Taking a look at the MR sector, we saw that not many of those vessels were used to pursue floating storage opportunities to support a very high spike in earnings as in the LR sectors. Despite that, these tankers remained active in spot trading, feeding off the global demand for product transportation in March and April. Lastly, it is worth noting that earnings for the MR2 sector were the only ones that showed a slight increase from June to July.

Figure 1 – TCE Development per Sector – Jan to Jul 2020