More Surprises on Floating Storage

April 3, 2020

In the past two weeks we examined the economics of floating storage, looking at VLCCs and crude storage as well as LR2 tankers and gasoline storage. This week we are going to take a final look at what led to this surge in floating storage as well as the signs of a possible reversal. We are referring of course to yesterday’s tweet by US President Donald Trump, who claimed that an agreement for production cuts between Saudi Arabia and Russia may be close. This would not be of much importance if it wasn’t followed by a truly unprecedented rally in the crude oil markets. The rally in crude produced gains of up to 25% in a single day, which may have been “good news” for the struggling oil & gas industry, but also created another surprise reversal in the tanker markets.

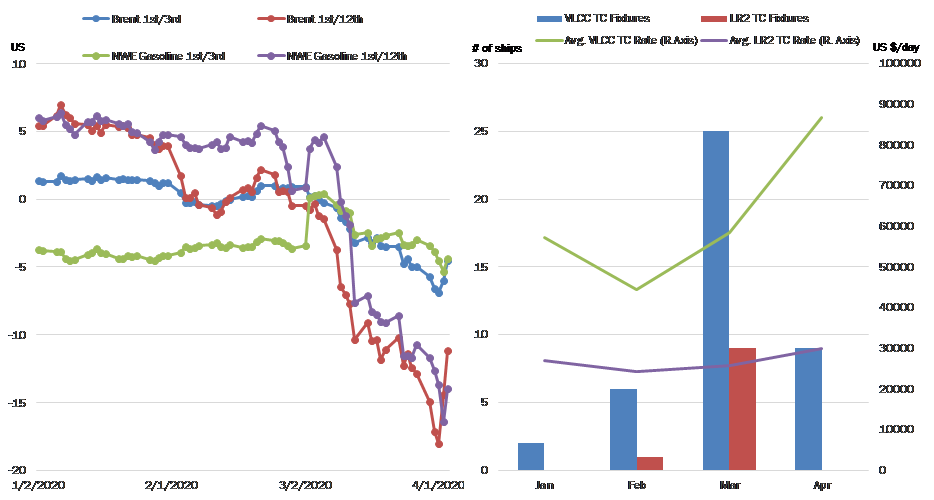

Since the beginning of March, with the steepening of the contango structure in the oil futures markets, we started seeing significant inquiries for time charters. The inquiries were for the most part including options for floating storage and indeed, we saw a lot of them materialize (figure 1). Since mid-March, the economics had definitely been favorable and by the end of March the cash breakeven point for short-term (3-month) floating storage on a VLCC was at US $143,778/day, with TC rates at $90,000/day. While today we have confirmed more than 35 VLCCs on time charters, we expect the actual number to be much higher. Meanwhile, the clean floating storage on LR2s has not been equally active given that the contango started making economic sense only the last couple of days in March.

Enter April 2 and the tweet. The vague and unconfirmed promise of supply cuts threw a wrench in the climbing tanker markets and immediately rates started retreating on fears that lack of demand will eventually catch up with tankers, without the support from very low oil prices. At the same time, the commodity spreads were squeezed by $2.37/bbl (Brent, 1st/3) and $0.94/bbl (NWE Gasoline 1st/3) within just two days (figure 1). With these numbers the breakeven TC rate for a 3-month VLCC storage is now at US $79,333/day, although for gasoline, the spreads are still profitable.

It is very hard to make a prediction on whether the cuts will become a reality and if or not the market will continue the reversal. The only thing clear is that in these volatile times, opportunities and pitfalls can emerge within hours.

Figure 1 – Brent and NEW Gasoline Forward Spreads & Observed VLCC and LR2 TC Fixtures with TC Rates

Source: McQuilling Services