OPEC Efforts are Counteracted

Aug. 15, 2017

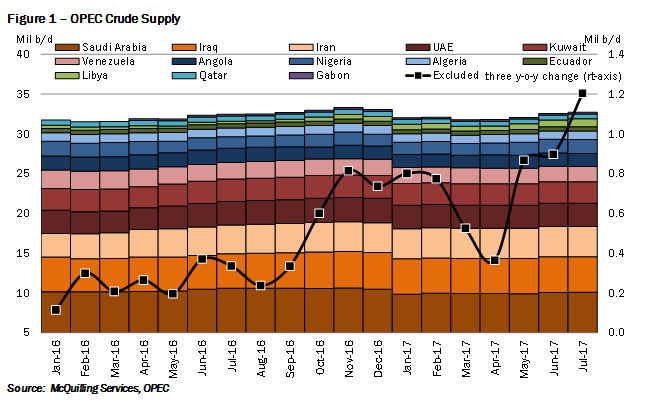

In 2016, OPEC members established a concerted effort to rebalance the global oil market through production cuts, which would be implemented by all members excluding Iran, Libya and Nigeria. After implementing the agreement on January 1, 2017, total crude output from the group over the first half of 2017 has fallen by 400,000 b/d year-on-year; however, when compared to 2016’s full year average, we see a greater decline of over 800,000 b/d (Figure 1).

What this has done is placed significant pressure on Middle Eastern crude supply, forcing refiners in the East to source barrels from supply centers in the Atlantic Basin. We note that despite concerted efforts, production gains in the three exempt nations have proven to offset much of the declines across the group, which has led to discussions for a potential inclusion of these nations.

Regarding the future of OPEC, we forecast compliance within the group to decline this year, especially if Nigeria, Libya and potential Iran do not join the efforts as we expect the remaining nations to consider their own interests and seek to regain lost market share in the East. Over the next few months, we would expect global crude pricing to remain generally flat, with upward potential from lower OPEC compliance.

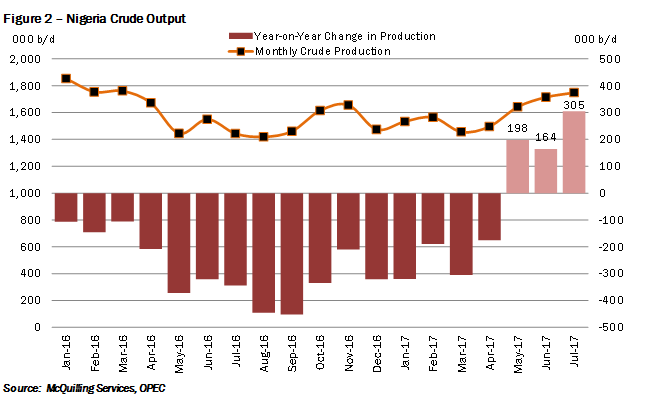

Some of these supply centers include West Africa, which has seen a recent resurgence in Nigerian crude production as militant conflicts within the nation have cooled. Nigerian crude supply has averaged at 1.5 million b/d since the beginning of the year, relatively flat compared to 2016’s full year average; however, recent months have improved the outlook for the West African region as a whole. Through May/July, we have seen the first year-on-year rises in crude output witnessed since before 2016, averaging around 222,000 b/d of additional output (Figure 2).

While Angolan crude production has been slowly declining from the 1.7 million b/d witnessed in 2016, we expect Nigeria to more than offset these losses. This market is on track to grow significantly this year, with West Africa as a region marking 106,000 b/d of additional output this year and 483,000 b/d over the forecast period; however, as we move into the outer years we see a stagnation in production growth which will likely stem from a lack of necessary infrastructure investment. While we remain bullish on this region as a source of tanker demand for the dirty sector, specifically the larger tonnage, we note that OPEC is considering the inclusion of Nigeria in its production cut efforts, which would likely cap output at current levels and potentially impact export flows. We still expect tanker demand to remain strong, however, if output is capped at current levels we will likely see significant negative short-term demand shocks as militant tension break out in the region and upstream operations are pressured.

To the North, Libyan production has also made a resurgence on the back of easing conflicts within the nation. Recently, battling factions within Libya have come to an agreement of ceasefire and to also hold elections in the first quarter of 2018, indicating that the long-term political outlook for Libya is improving. Total crude and condensate output first began improving in the final quarter of 2016 and rose to over 850,000 b/d in June of 2017 with plans to push levels higher going forward. Although the nation likely has a production capacity limitation within the range of 1.0-1.5 million b/d, as significant infrastructure investment is required, we remain bullish on this market in terms of Aframax tanker demand as the supply of Mediterranean crude continues to expand. Over the forecast period (2017-2021), this region is on track to boost crude production by about 786,000 b/d most of which is currently entering the European refining system; however, increasing volumes have been sent to the Far East in recent months.

Additional support for the Mediterranean market has stemmed from rising output in Kazakhstan as the massive Kashagan oilfield began operations at the close of 2016, bringing total national production of crude and condensate to over 1.7 million b/d. With Russian crude production also stable just below 11 million b/d, we have seen significant pricing pressure on Urals and Caspian Pipeline Consortium (CPC) crude, which has increased incentives for Eastern refiners to source these grades over the Middle Eastern exports. As such we have witnessed increased tanker demand out of the Black Sea/Mediterranean region for Suezmaxes, a trend we expect to continue over the forecast period; however, growth will likely stabilize as compliance to OPEC production cuts falls and Middle Eastern crudes begin to price more competitively.

Order a copy of McQuilling Services 2017 Mid-Year Tanker Market Update

The Mid-Year Tanker Market Outlook Update provides an outlook for spot market freight rates and TCE revenues for 19 major tanker trades, including two triangulated trades, across eight vessel classes for the second half of 2017 and the remaining four years of the forecast period to 2021. We revisit our forecasting process at the mid-year point, distilling data from the first half of the year to better understand recent market developments and expectations for the future. In our view, this process allows us to accurately adjust our forecasts and provide additional value to our clients.