Pressure on Refineries

May 15, 2020

In the recent inventory report from the Energy Information Administration (EIA), we saw for the first time in many weeks, the total commercial crude inventories (excluding SPR) decrease by 0.7 million bbl. According to the same report, total motor gasoline inventories also decreased by 3.5 million bbl. These two numbers alone show how some partial reopening of some US and European economies has led to an immediate increase in implied demand, albeit very slightly given that no country in the Western world is expected to immediately rebound to pre-coronavirus levels.

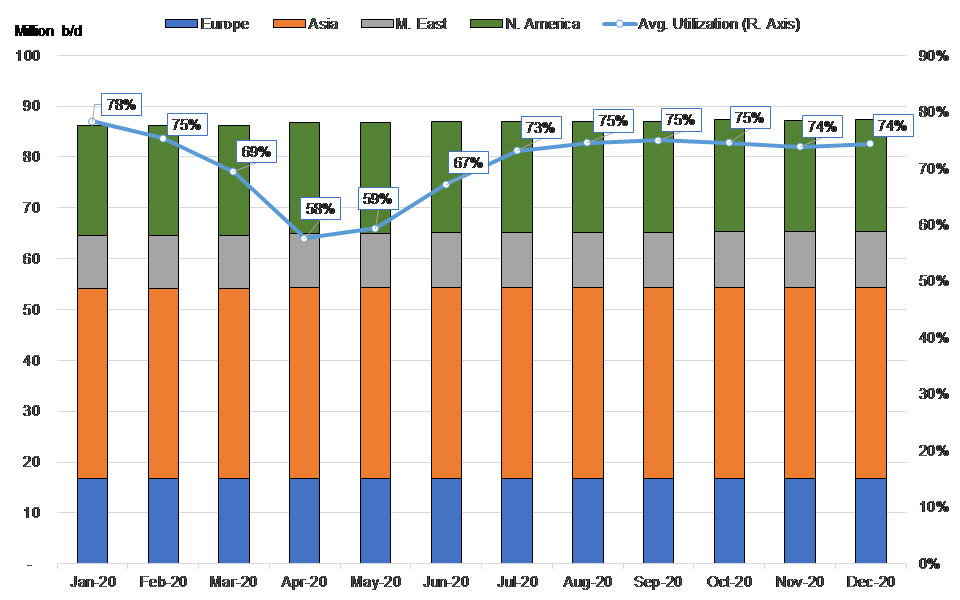

The positive sentiment created by the US inventory data as well as hopes on the OPEC+ cuts starting to work their way into global crude balances has helped front month crude futures realize some gains this past week, followed by gains in the physical markets as well. This development, however, appears to have a somewhat adverse effect in the refining world, pushing margins lower, thus making it not economical to increase refinery runs -something we can see in the most recent and projected utilization rates for key global regions, that remain low while capacity is relatively unchanged (figure 1). It can be seen as an effect of sentiment versus real demand growth, with the latter still absent on a consistent scale that can lead to a large inventory reduction and re-balancing of the markets.

For the time being, continuing low refinery utilization rates with relative support in crude prices can mean a couple of things. First, crude has to go somewhere in the short term and by definition, if not in refineries, that place would be storage. As we discussed last week, with the markets remaining in contango, storage plays are not over although we expect them to continue at a much slower pace. Second, a continuing increase in front month crude prices may lead to refiners tapping into inventories, which in turn can lead to a newfound length in the market, thus pushing prices lower once again and perhaps even initiating another contango and storage cycle.

Overall, we expect the next six weeks to remain very volatile in terms of crude pricing and inventories, regardless of the progress of reopening Western economies. Having said that, it is very likely to see the production cuts really taking hold in Q3 2020, thus lending true relief from the supply side and potentially setting the pace for the markets to become stable again.

Figure 1 – Refinery Capacity and Average Utilization in key Regions (Jan – Dec 2020)

Source: McQuilling Services