Sanctions Removal Scenarios

April 1, 2022

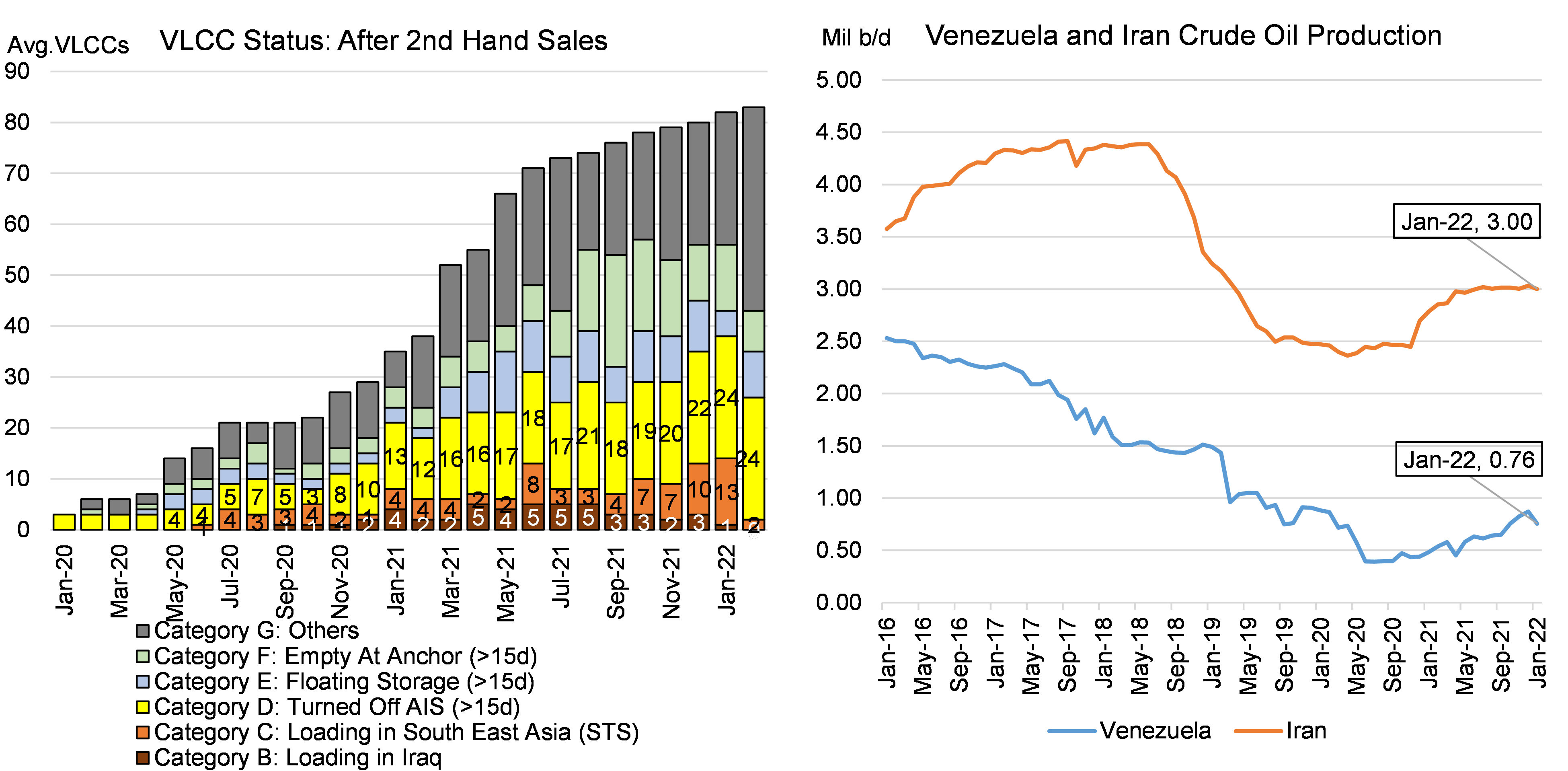

We have counted over 80 VLCCs of over 15 years of age changing hands since January 2020, the majority of them going to previously unknown entities, mainly in Asia (Figure 1). Out of those “ghost ships”, about 40% has been observed to load in Iraq, perform STS operations near Malaysia or turn off their AIS transponders. All of these actions point to those tankers participating in illicit trading activities most likely with Iranian or Venezuelan barrels. As we have discussed in previous reports, these tankers are part of the oversupply problem given they are taking potential cargos away from conventional tonnage even though they are disadvantaged.

On their part, Iran and Venezuela have been steadily increasing supply since last year, with the latest data showing about 3 million b/d of production for the former and a little over 750,000 b/d for the latter (Figure 1). As long as sanctions are in place there are utilization opportunities for these ghost ships so the question becomes what will happen if sanctions are indeed suddenly lifted.

In terms of production, Iran has already been public with its plans to boost production to over 4 million b/d as soon as sanctions are removed and according to reports, Venezuela has the capacity to increase its own supply by at least 20% in a relatively short time during a similar scenario.

Lifting sanctions on Iran will not become a super bullish scenario for crude tankers given the typical geographical spread of Iranian crude (based on historical data). About 20-25% historically has gone to India, which represents less miles than the typical AG/East voyage, with another 30% going to Southern Europe, most likely on Suezmaxes during the current ballast leg from a Med/East voyage. In terms of tanker supply, we estimate that about 13-15 VLCCs will likely become obsolete and head to the scrapyards after considering the impact from a return of NITC tonnage.

Removing sanctions from Venezuela on the other hand is likely to have a major impact on tanker earnings. The Venezuela trade involves several inefficiencies, requiring a larger number of VLCCs than traditional load regions. We have estimated that for every 100,000 b/d of crude exports to the Far East, about 10 VLCCs worth of supply are needed. With that in mind, a sanctions relief scenario could be a game changer, with possibly over 50 “ghost ships” coming under utilization pressure and thus becoming obsolete – replaced by conventional tonnage and bringing forth a major supply side relief to the balance.

Figure 1 – VLCC “Ghost Ship” Activity (Left) and Venezuela & Iran Crude Oil Production (Right)

Source: McQuilling Services, JBC Energy, JODI