Scrubber Investments, Another Virus Victim

April 24, 2020

The conversation on scrubbers in the tanker sector has been somewhat suspended lately and for good reasons. First, global quarantine measures have left shipyards either closed or with little personnel, resulting in backlogs and delays. Second, tanker freight rates are soaring, making any gains from bunker fuel price differentials assume a secondary role in the voyage economics. Third, with the collapse of crude oil prices, bunker prices have followed suit and we have been observing the price difference between VLSFO and HSFO shrink daily. This week, we look at this price spread and how it affects an investment in a scrubber in the VLCC sector (non-Eco design).

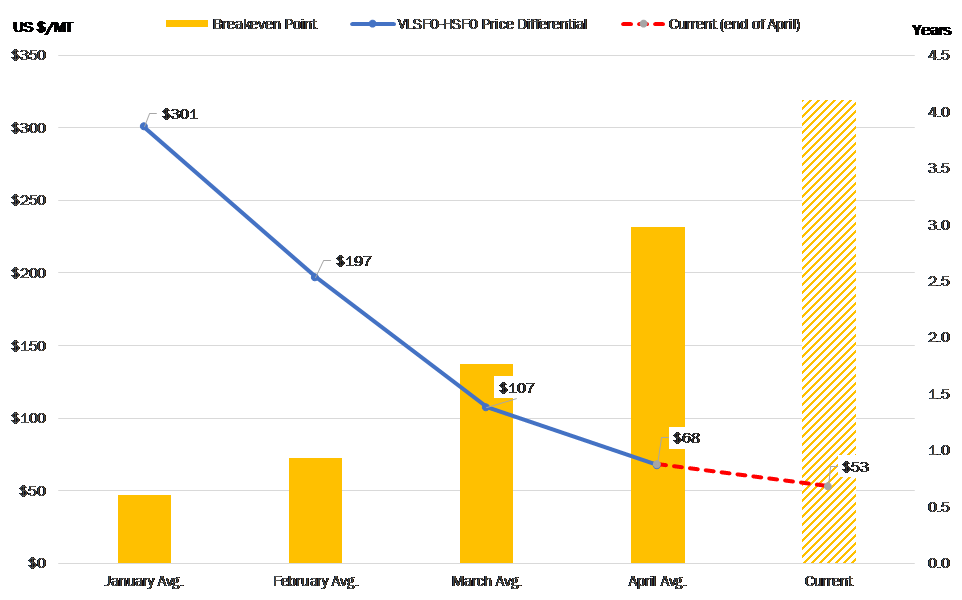

The biggest unknown with the IMO 2020 regulations in the months prior to implementation was how the VLSFO prices are going to evolve and what would be the difference between them and the price of high sulfur fuel, as well as MGO. As we were moving closer to January 2020 analysts and owners had a decent understanding, with the latter increasingly investing in retrofitting their ships with scrubbers in anticipation of a high spread. Indeed, at the beginning of the year in the Singapore hub, we saw the difference starting as high as US $350/MT, quickly settling at an average between US $200 - $250/MT for January and for the largest part of February. Assuming a cost of US $5 million for a Non-Eco VLCC retrofit (on the high side), those levels would give a breakeven span of about a year.

As soon as the coronavirus restrictions started to hit oil demand hard by the end of February and OPEC decided to incite a price war, we have seen the spread between high and low sulfur fuels shrink in tandem with the collapse of oil prices. Again, in Singapore, the beginning of March saw the difference at around US $140/mt while the end of the same month at US $80/MT. As of the latest available data this week, the price differential has retreated to a little over US $50/MT. Assuming the same constants, the gains from using a scrubber and burning high sulfur fuel will pay off in about 3.5 years. If we add to that maintenance costs of about US $50,000/year we see the breakeven number slightly over 4 years (Figure 1). We must also note that in the current strong market, the opportunity cost for a ship going to drydock to install a scrubber may very well surpass the actual cost of installation itself, thus pushing the breakeven point further in the future.

We have been projecting scrubber installations to slow down significantly after 2021 under normal circumstances, assuming that VLSFO will dominate and price differentials will permanently drop closer to US $60/MT. However, in the current environment, we will not be surprised if investment in the technology dwindles faster than expected.

Figure 1 – VLSFO & HSFO Price Spread and Scrubber Breakeven (Monthly Avg. - Years)

Source: McQuilling Services