The Effect of the Dangote Refinery

July 2, 2021

The Dangote refinery is currently being built in Nigeria, with the government of the country recently making the news with an additional stake purchase in the project. Since its inception it has been a project criticized by many regarding its progress, with many analysts believing that it will never be completed. What we know so far though is that construction continues, even if at a slower pace due to covid and other factors, and that it is likely for the huge plant to partially come online sometime in 2022. At least close to 380,000 b/d of refining capacity are expected next year, with an additional 270,000 b/d coming on stream in 2023, reaching a substantial total of 650,000 b/d of total added refining capacity in the region.

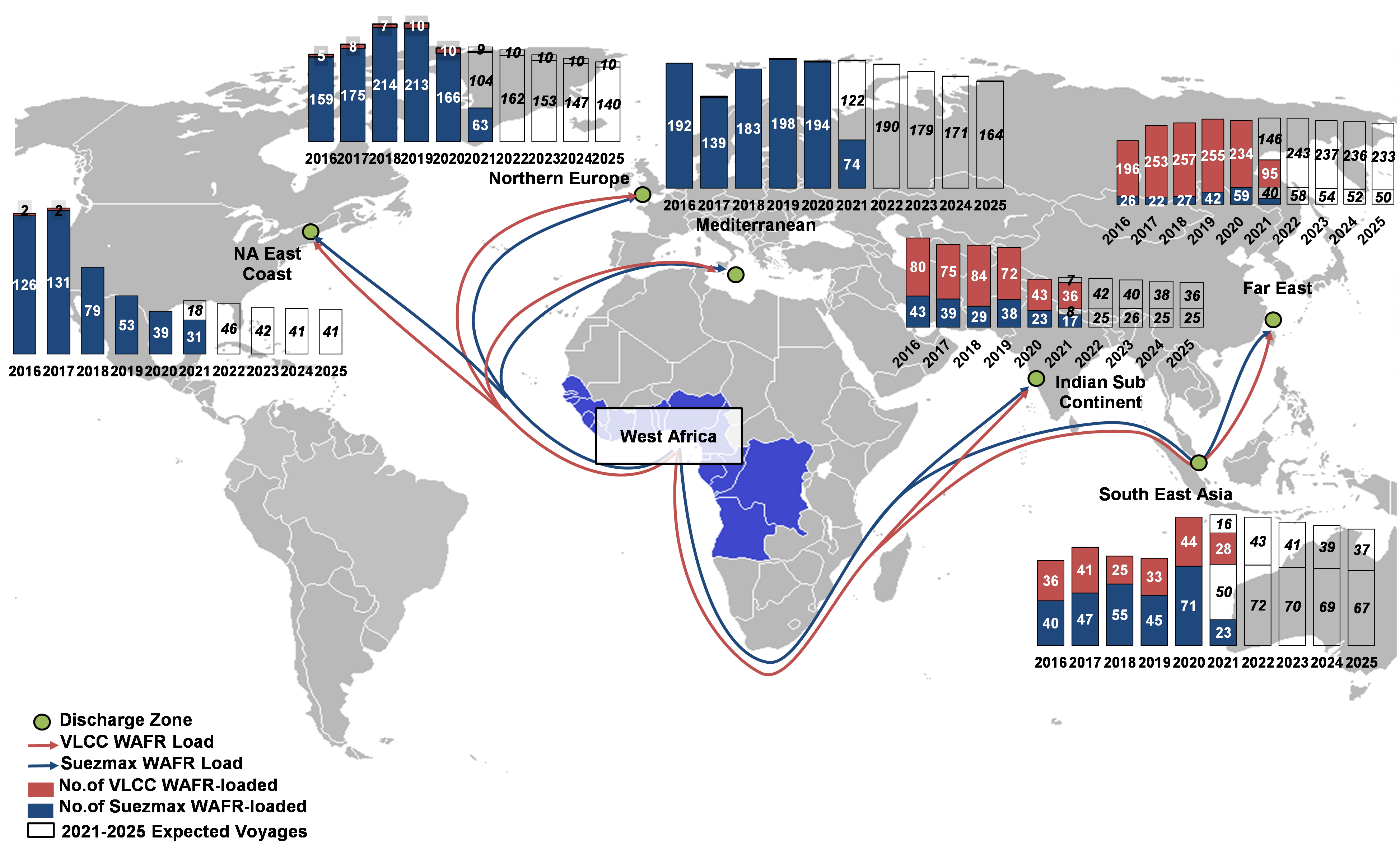

We are interested in the effects such a big project will have in tanker demand to and from the region and we start with the impact in the Suezmax market. Our expectation is that with the refinery absorbing significantly more domestic crude, there will be less available for exports on Suezmaxes (and VLCCs). As we project the remaining barrels to be placed in the East of Suez markets, Suezmax voyages to the MED and UKC are likely to be significantly reduced for the current, relatively steady numbers (Figure 1). Instead, refineries in the MED and UKC market are projected to increase their demand for US crude, after the Dangote Refinery comes online. Strengthening our call is the fact that the current West African crude oil supply is faced with underinvestment (especially in Angola) and heightened domestic political risks (e.g. militant groups attacking oil facilities in Nigeria).

Given we regularly use AIS and market information to forecast demand from a region, we currently have a picture of a little more than 10 Suezmax voyages disappearing from West Africa in 2023 and a little less than 10 in 2024 (Figure 1). We also forecast less voyages in other regions such as North America and Australia although the impact will likely be less severe.

The launch of the Dangote Refinery will significantly impact the CPP trade flow in the Atlantic Basin market as well. Such a boost in refining capacity is bound to increase the availability of refined products in the domestic market. The loosening gasoline balance in the region could result less product import from the UKC and the East. We expect LR demand from UKC to WAFR to suffer the most, as well as less newbuilding VLCCs/Suezmaxes carrying clean products from the East to this region for their maiden voyage.

Table 1 – Suezmax Voyages from West Africa, with Forecast

Source: McQuilling Services