The New Asset Price Forecasting Model

Aug. 20, 2021

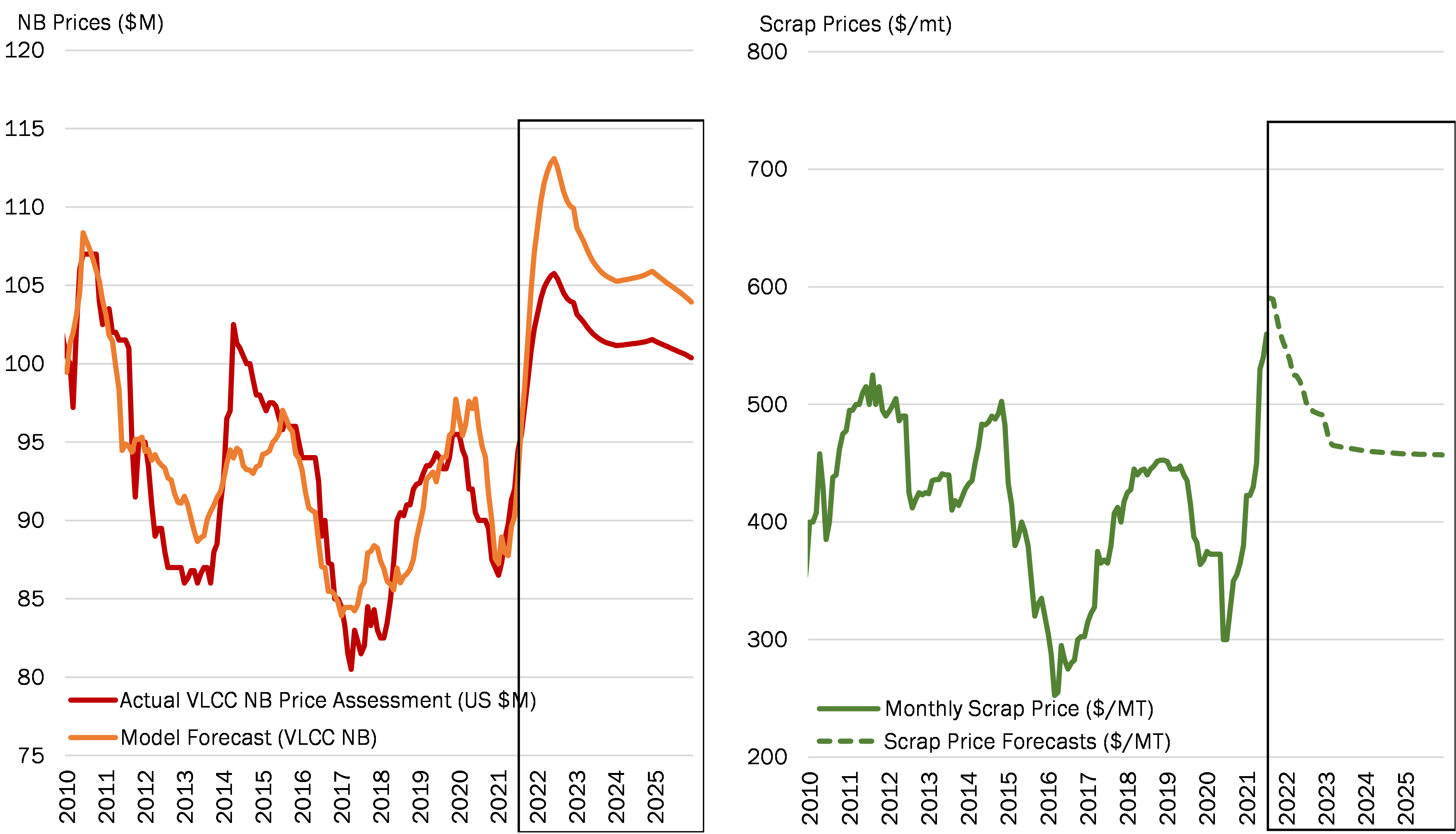

Asset values are traditionally correlated with the corresponding earnings environment, with more statistically significant relationships attributed to the period rates. However, the recent climbing inflation rates, extremely tight yard capacity, surging steel prices have introduced significant bias to the correlation between asset values and tanker earnings. Despite the persistent weak tanker earnings in the 2nd quarter, newbuilding prices have reversely firmed and reached the highest record since 2016. Scrap prices, on the other hand, jumped from US $300/mt in mid-2020 to US $585/mt in August 2021, as these values are highly correlated with steel prices.

To measure the impact from these new variables, a new asset price forecasting model has been built, which takes earnings but also inflation factor, shipyard capacity utilization and steal prices into account.

Among three new variables, the biggest challenge would be to develop the steel price index and its forecasts. Due to the lack of steel future contract that can be used as the industry standard, we have conducted steel price regression analysis (with 86% R-square) based on iron ore, coking coal, and hot-rolled coil steel prices. Based on CME future quotes for iron ore, coking coal and hot rolled coil steel, we foresee the steel price index (1982 price=100) to cool off in the 2H of 2021 and 2022 from a peak of 408 in August 2021, and eventually back to just below 300 in outer years.

Combining the steel price index, shipyard capacity (described in the post from June 11th) and US CPI as the inflation factor, with McQuilling’s monthly spot TCE assessments and forecasts, we have captured a close correlation (72%) for the regression model result. The strong steel price outlook and tight shipyard capacity are likely to continue pushing tanker newbuilding asset prices for the rest of 2021 and reaching the peak level in mid-2022. A downward correction is projected in the outer years, as steel prices ease from the current levels. A byproduct of this analysis provides us a statistical approach to forecast scrap prices. As mentioned earlier, the strong steel market has pushed scrap values to a record level as these lines are written. Indeed, these two data sets have shown a very strong correlation (79%) based on monthly statistics from 2010. The scrap price forecasts, derived from the model results, indicated a downward trend in scrap prices moving forward.

Figure 1 – VLCC Newbuilding Price Forecasts (left) and Scrap Price Forecasts (right)

Source: McQuilling Services, FRED, CME, Yahoo Finance, OECD