The Saudi Pledge

Jan. 8, 2021

Perhaps the most interesting, in terms of the oil and tanker markets, piece of news this week has been the result of the latest OPEC+ meeting in which Saudi Arabia pledged to reduce its own crude oil output by 1 million b/d for the months of February and March. At the same time, the organization and its allies decided to allow a 75,000 b/d production increase for Russia and Kazakhstan (cumulative) for the same time period. This was a surprise move by the Kingdom that signaled that it is more concerned with maintaining the current rally in crude price amid a resurgence of covid-19 cases worldwide, something that in turn may lead to more restrictions at least in the short-term.

While the effect on the oil markets was immediate, we still believe there are deeper implications, especially around the US and its crude production. Many analysts could jump to the conclusion that with oil prices supported, shale oil production in the US will inevitably ramp up, something that is logical given historical elasticity; however, we believe that past behavior is not indicative of future performance in this regard.

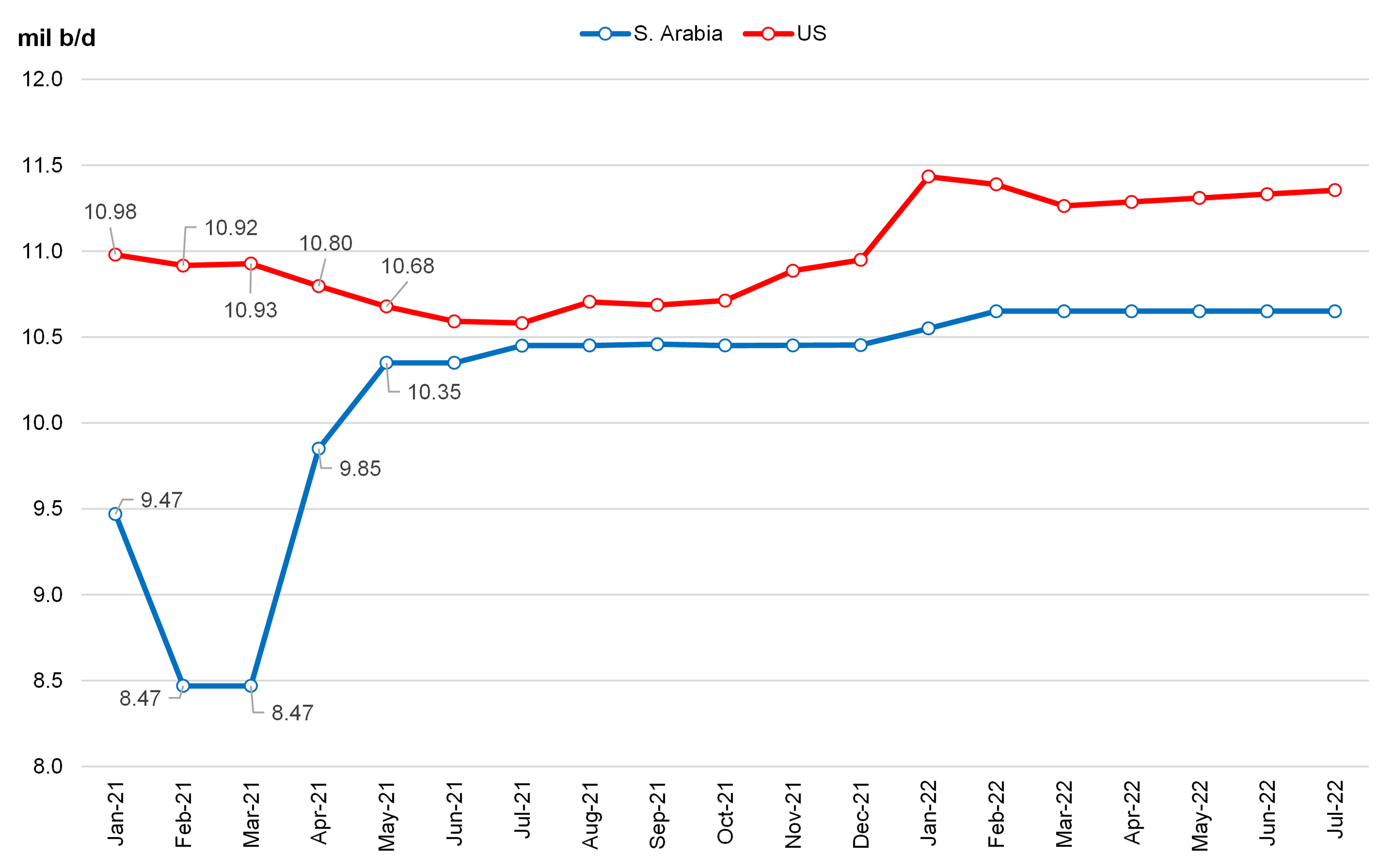

Using the latest data available, we project that Saudi Arabia will not keep the voluntary cuts beyond March 2021, especially if the price of oil does remain supported as intended. For April 2021, we project supply from the country to increase to 9.85 million b/d and continue growing as demand returns and the initial OPEC+ agreed cuts are rolled back (Figure 1). At the same time, we believe that US producers have already found themselves in a similar situation, once in 2016 and a second time last year during the short-lived “price war” between Saudi Arabia and Russia. Based on our projections, the US is likely to keep tempering its output to account for a very sluggish return of oil demand, independent of the barrel spot price. With such a strategy, US producers essentially protect themselves from a very rapid return of production and another fall in prices, something that Saudi Arabia (and OPEC+ in extension) can arguably do without too much cost on their end as they will be gaining market share.

Lastly, concerning tanker freight rates, we note that increasing oil prices may pressure earnings given the higher voyage costs. It is unclear if owners will have the leverage to negotiate higher rates to offset this increase. Historically, the bunker price and freight rate relationship has been inconsistent, although the impact of higher bunkers on freight is has been more statistically signficant when earnings approach Opex levels, something we predict will be the case for the crude tanker segments in 2021.

Figure 1 – Crude Oil Production Comparison Saudi Arabia/United States

Source: JBC Energy, McQuilling Services