The Tanker Orderbook

June 7, 2016

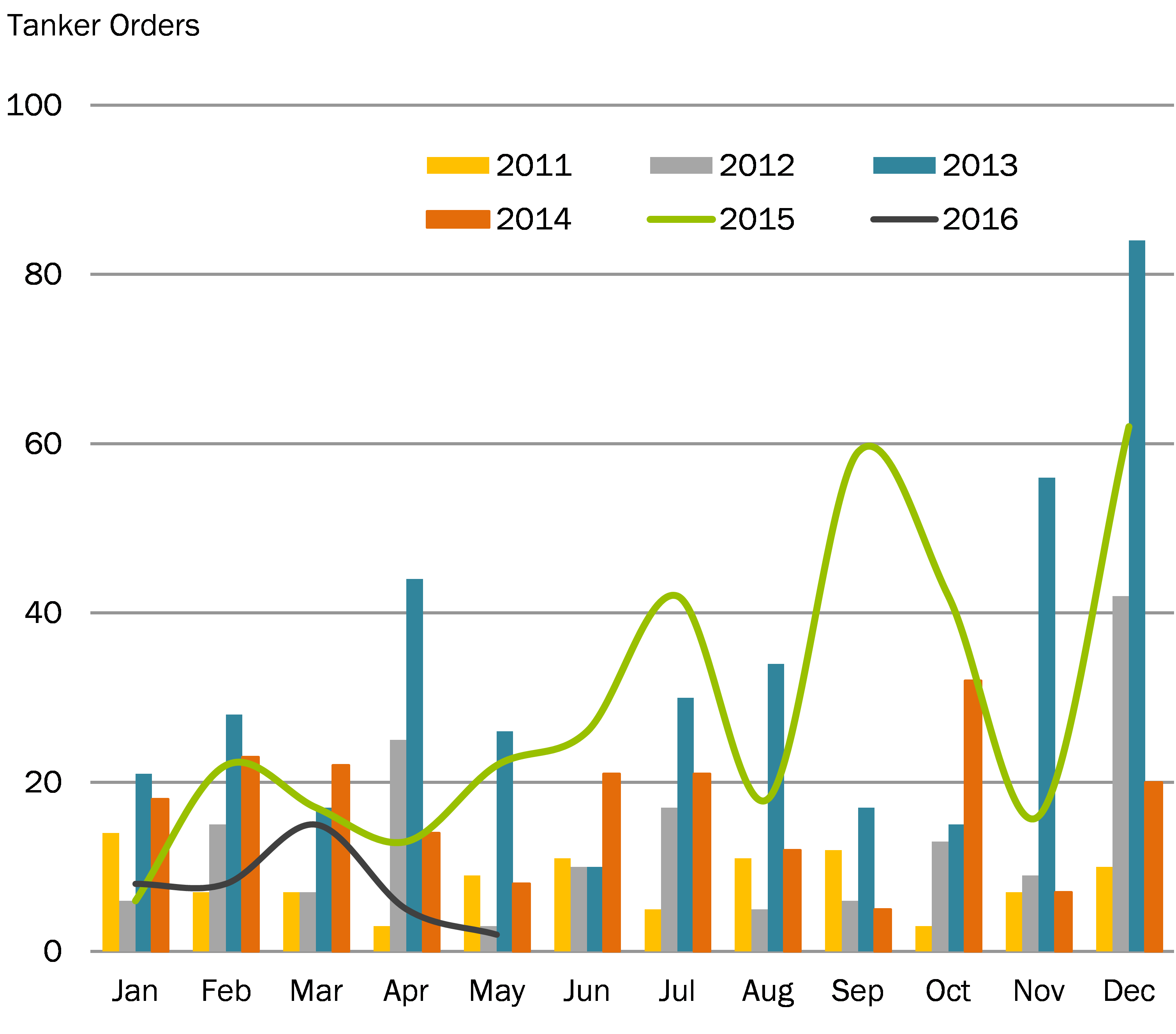

Nearly half of the year is behind us and one thing that continues to stand out is the lack of a tanker newbuilding orderbook. We have recorded just 38 orders placed through May. The last time we saw activity this low was in 2011, when 40 newbuilding orders were recorded during this same period.

Leading the year’s orders so far is the Suezmax class, with 10 in the books, followed by the MR2 class with nine orders. Third in line is the Aframax class, accounting for 19% of the total 2016 orderbook. Absent from the l ist so far this year are orders for Panamax and LR1 newbuildings (figure to the right). Shipyards in Japan have secured 47% of the total orderbook, followed by Korea at 28% and China at 17%.

ist so far this year are orders for Panamax and LR1 newbuildings (figure to the right). Shipyards in Japan have secured 47% of the total orderbook, followed by Korea at 28% and China at 17%.

Newbuilding prices for the large dirty tanker classes have depreciated over the past year, which could be expected as struggling yards continue to lower pricing to fill slots. In a year-on-year comparison, our VLCC newbuilding assessment stood at US $97.3 million in May 2015 and has since fallen to US $94 million this year.

Similarly, Suezmax values have declined US $5 million from this month last year. Aframax and Panamax newbuilding assessments both increased slightly from the start of 2016 to roughly US $52 million for the Aframaxes in May and US $40 million for the Panamaxes. In the clean segment, LR2 newbuilding values have remained steady at around US $55 million this year, while LR1 prices have slightly to US $44 million. MR values have also found steady ground, averaging US $35.3 million in the first five months of the year.

This dearth of ordering will likely influence shipyards going forward, causing them to become even more competitive with their pricing models to secure orders in the second half of the year.