The Time for VLCC Drydocking

Sept. 11, 2020

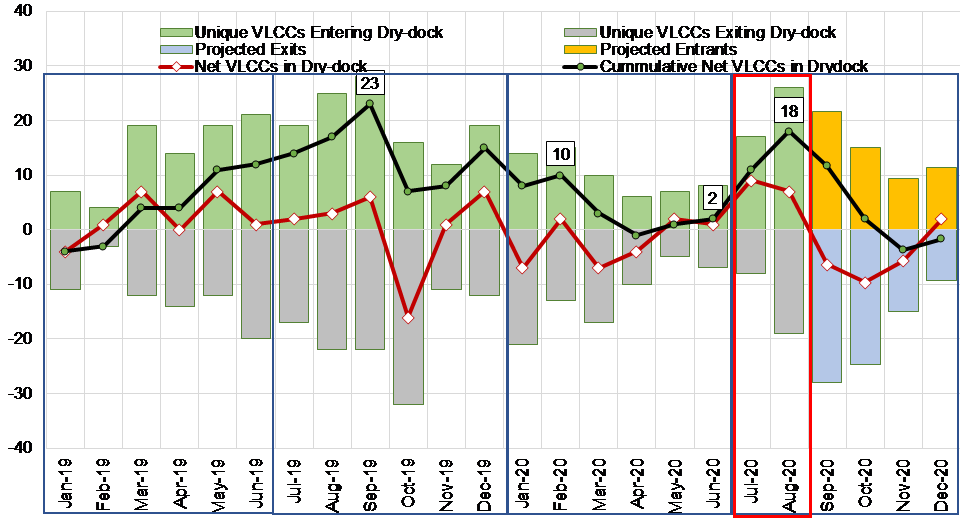

We have touched on the subject of drydocking and scrubber installations a couple of times this year so far. The number of ships entering drydock to retrofit scrubbers or for regular maintenance has always been an important piece of the tonnage supply puzzle. Especially in the VLCC sector, the market has historically shown a tendency to find some support when a large number of ships comes off the trading fleet. A good example of that was the period August-September 2019 when we observed a flurry of scrubber retrofits in preparation for the IMO 2020 regulations.

This year, the discussion on scrubbers became somewhat “irrelevant” in the context of a global pandemic and lack of demand that closed the gap between HSFO and VLSFO amid a very volatile market. In the same context, we observed somewhat of a reversal in the cyclical trends that want owners to take advantage of the typically slow early months in a year to perform maintenance. In 2020 those months saw increased freight rates at the same time that shipyards were closed and unavailable for business as a result of the global lockdowns.

At that time, we had predicted that VLCC drydocking activity will start to pick up during the summer months and we now have the data to support it. A significant pickup in activity in July was followed by the highest number of VLCCs in drydock since September 2019 -at a cumulative total of 18 for the month of August (Figure 1). This does show that owners are trying to take advantage of the current depressed markets and complete scheduled maintenance as well as overdue surveys.

What is important here is perhaps the long-term effects of drydocking on the supply side as it pertains to older tonnage (> 15 years). As it is unlikely for a vessel to be scrapped immediately following a special survey, we remain on guard to update our deletion forecasts for 2021 if we determine more than expected vintage tonnage undergoing dry-docking activities. While only a part of the supply-side variable, lower trading inventory counts from vessels in yards acted as a preventative for VLCC rates to fall even further from recent lows. At the same time, the high level of vessels undergoing maintenance may have augmented the recent rally in freight, caused by short-term floating storage interest.

Figure 1 – VLCC Drydocking Activity With Forecast - Jan 2019 to Dec 2020

Source: McQuilling Services