Tight Shipyard Capacity to Slow Delivery

Oct. 21, 2022

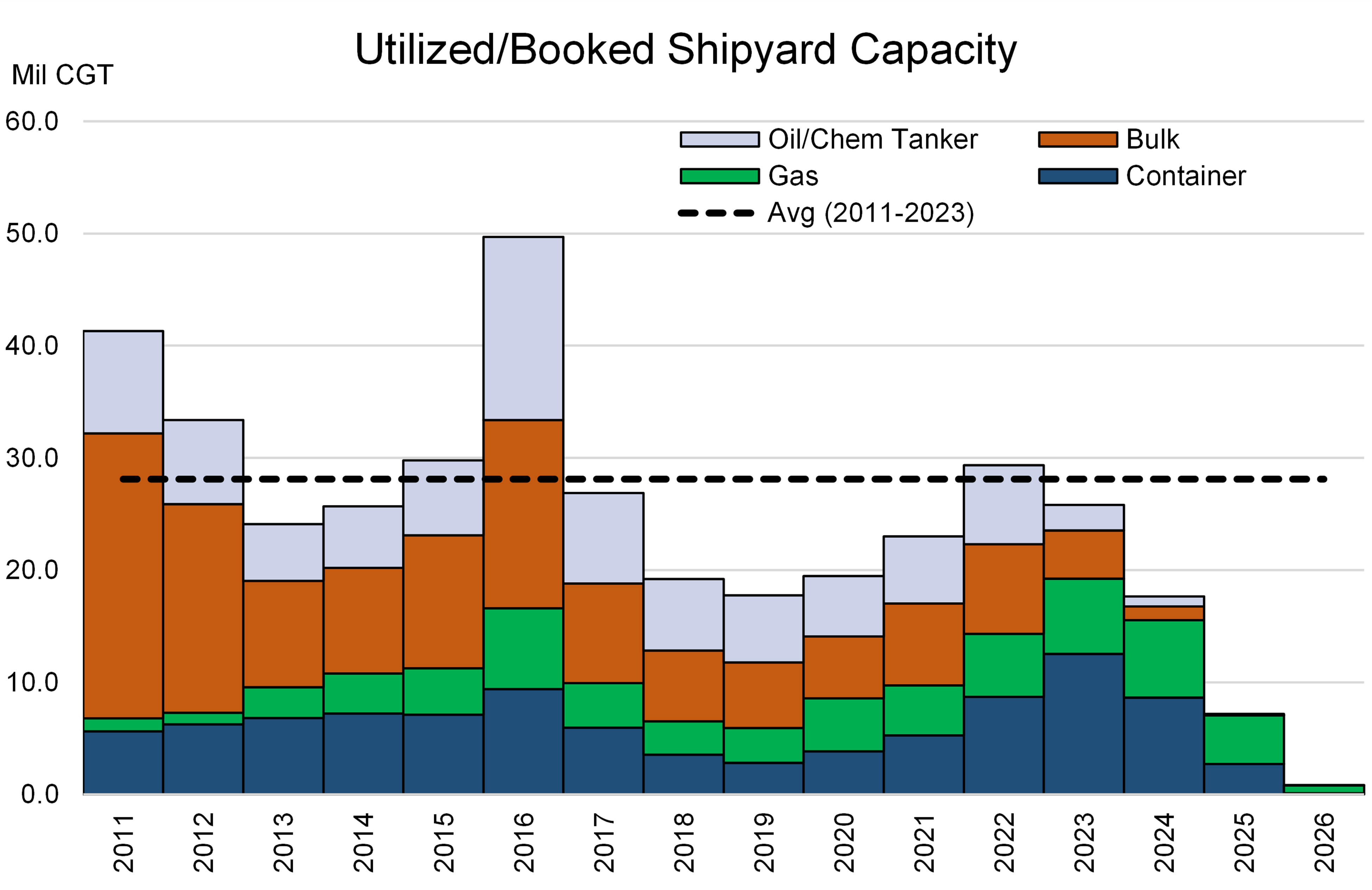

Compensated Gross Tonnage (CGT) is a measure established by OECD to compare the labor required to build a ship across different shipyards and countries. The latest available data confirms that 2022 has been a year of historically high capacity utilization, spread across almost all types of vessels, with 2023 following closely before we begin seeing a drop due to lack of complete future order data.

Chinese shipyards have the top CGT figure for 2022 with a little over 12 million CGT or about 41% of the total, followed closely by South Korea at 11.13 million CGT. According to a Global Times report, in the first eight months of the year China’s shipbuilding completion volume reached 23.94 million tons or about 45.4% of the world market. Japanese shipyards are trailing behind both countries with only about 4.7 million CGT - or 16% of the total.

The measured CGT is currently higher than the historical average of 28.1 million tons, reaching 29.3 million for 2022. For 2023, our data shows 25.8 million CGT. In theory, this figure does not leave much room for expansion although new slots are known to appear when demand is high. In the last year, there has been strong growth in orders for gas carriers given the high import demand after tensions began with Russia, with recent freight rates for these types of ships breaking records. In addition to that, there has been high capacity utilization with the construction of containerships, again due to the strong market during the first two years of the pandemic.

Putting it all together, we note that given the high yard capacity utilization, orders skewed towards gas carriers and box ships, and high prices have helped shrink tanker orders. This translates into low expected deliveries for 2023 and 2024 (e.g., 21 VLCCs for the former and only 6 forecasted for the latter) that is in turn conducive to our view of a sustained market recovery beginning the second half of 2023 – especially for the DPP sector. Finally, due to the now rapidly falling containership freight rates, it wouldn’t be unheard of to see some of these keels converted into tankers although we are skeptical that any such change could sway the market significantly in a different direction.

Figure 1 – Utilized Shipyard Capacity Measured in Compensated Gross Tonnage (CGT)

Source: McQuilling Services