Unrest in the Middle East

Jan. 12, 2018

Tensions in the Middle East rose significantly in the second half of 2017 amid increased internal conflict within Iraq. The Iraqi conflict between the central government and the Kurdish Regional Government (KRG) made headlines at the close of September 2017 as the KRG conducted a referendum to become an independent nation from the central government. Included within the referendum was the city of Kirkuk, which the central government of Iraq viewed as a method to consolidate Kurdish control over oil infrastructure. As a result the Iraqi military conducted an operation to regain control of the Kirkuk area, its oil assets and the KRG pipeline, which has been used to export Kurdish crude and occasionally Iraqi State Oil Marketing Organization (SOMO) crude to Turkey for shipment out of Ceyhan.

The operation caused a halt in production at the Bai Hassan and Avana fields, which have a combined capacity of 280,000 b/d and in turn, reduced exports out of Northern Iraq (280,000 b/d in November). This represents the fifth consecutive month of no SOMO exports through the KRG pipeline as an export agreement between the two governments has yet to be reached. Crude shipments out of Southern Iraq increased to the highest level on record (3.5 million b/d November 2017) to make up the shortfall and a 900,000 b/d single point mooring facility was added to bring export capacity up to 4.6 million b/d.

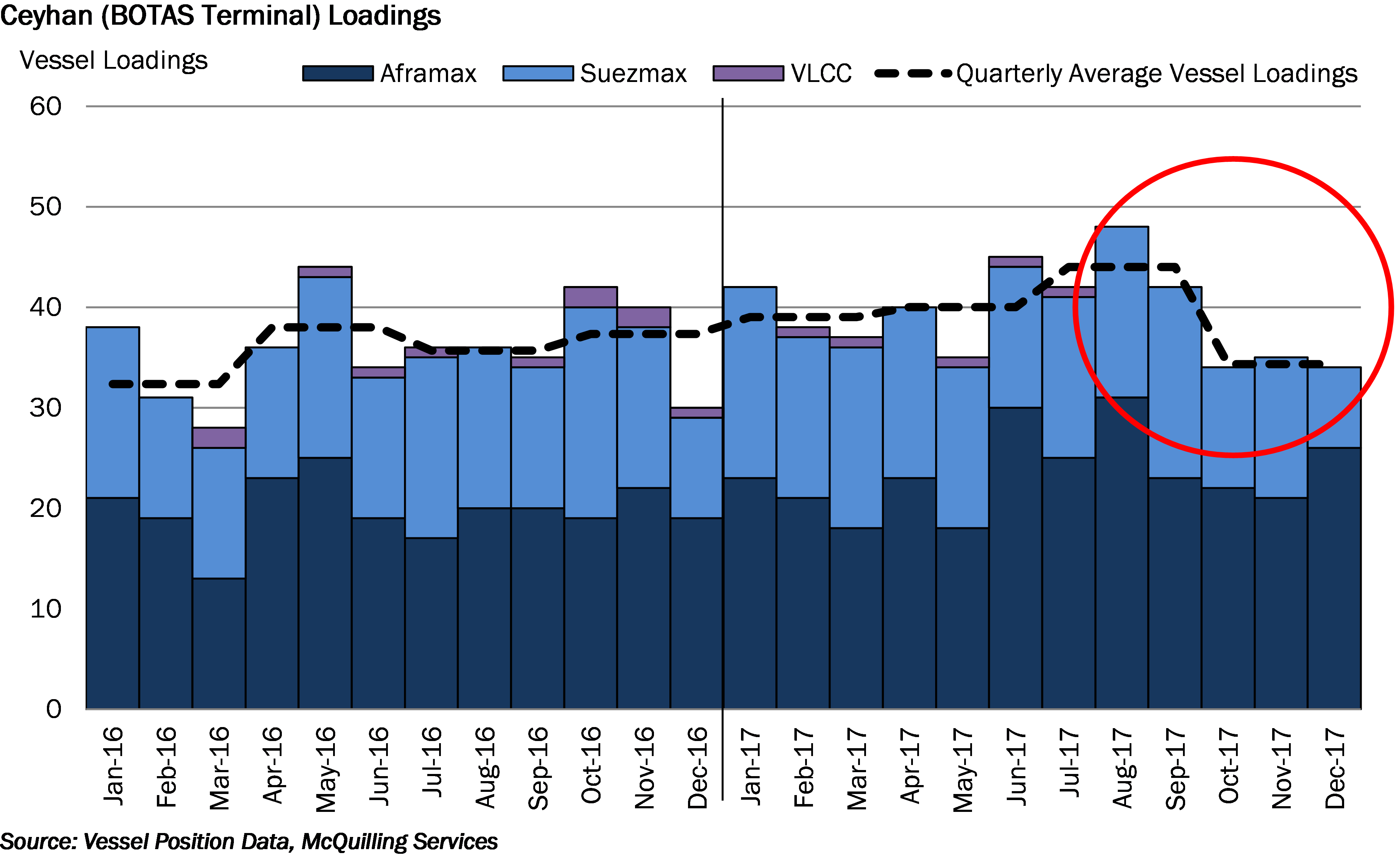

Analysis of remotely-sensed vessel position data tells us that the quarterly average of dirty tankers loaded out of Ceyhan fell 22% in the fourth quarter, the only three-month period, since 2016, where no VLCC activity was observed. Demand pressures were also felt in the Aframax and Suezmax sectors, which traditionally ship this crude into the European refining system. In 2018, the dynamics of geopolitical tensions will have significant impacts on tanker demand in the Mediterranean, the question is how? We expand further on this topic in our 2018-2022 Tanker Market Outlook.