US Crude Exports May Find Support in 2021

June 5, 2020

2019 was by all accounts a record year regarding US crude oil exports. The upward trajectory that began after the shale oil boom in 2017 pushed crude exports to historically high numbers with a peak seen in February 2020 at almost 3.7 million b/d of American crude exported to international markets. These numbers kept lending optimism to market players, with a good example being the various projects we saw announced in the US Gulf regarding building offshore crude loading terminals.

In February though, we were not anticipating the magnitude of the coronavirus spread or the extensive lockdown measures. We were also not expecting the, arguably, ill-timed move by Saudi Arabia and Russia to dissolve the OPEC+ agreement and flood the market with crude -until introducing the largest cuts ever about four weeks after that. As a result, oil prices dived to historically low levels and with them the capacity of US Crude producers to remain competitive.

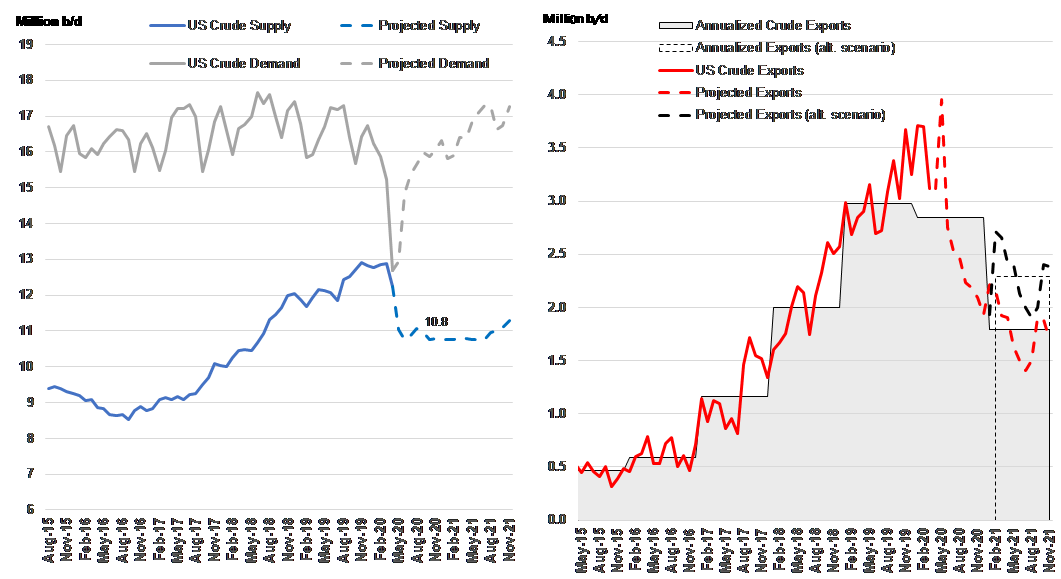

Even before the volatility we were predicting that US crude exports would likely stabilize in 2020 given the decelerating pace of shale production amid rising costs and the healthy appetite of US refineries for domestic crude. The bankruptcies and production cuts that were forced upon producers resulted in export numbers trending lower, dropping about 600,000 b/d between February and March according to the latest EIA data. However, the drop may even be seen as relatively mild given production cuts happened in parallel to refinery run cuts, all because of a global drop in end-user demand. Overall, we expect US crude exports in 2020 to average about 200,000 b/d lower than 2019 at 2.8 million b/d (Figure 1).

Looking forward, we may have an interesting scenario developing. If we follow the pattern of US crude loadings in the US Gulf and production numbers, we are likely to see a sizeable drop in 2021. However, we feel that crude oil prices will not find too much support, even after we begin seeing a global crude balance deficit. For that reason, it may be economically advantageous for US refiners to bring in more Saudi crude, thus releasing domestic quantities for exports, despite potentially lower production. If that scenario becomes a reality, we would expect about 500,000 b/d of added exports to our current projections (Figure 1). It will also revitalize VLCC loadings in the US Gulf, which for the past year have been trending below historical averages.

Figure 1 – US Crude Supply, Demand and Exports, including projections

Source: McQuilling Services