US Crude Imports Scenarios

June 4, 2021

In addition to this week’s news of OPEC and its allies maintaining their April plan for gradual production return, there was a story regarding the increased volume of oil imports from Russia to the US. Checking the latest Energy Information Administration (EIA) data confirms the trend, with 197,000 b/d of Russian crude imported in March, the highest number reported since 2012. This development supports our call from January this year (in our Tanker Market Outlook report), that a tightening crude balance in the US caused by disciplined shale production and returning refinery throughput would incentivize increasing sour imports by US refiners.

Following a very difficult 2020 from pandemic-related demand destruction coupled with the temporary, but impactful OPEC price war in March 2020, shale producers in the US appear to be very reserved about increasing supply; and in our opinion rightly so. According to EIA data, the average production for the entire 2020 was at around 11.3 million b/d whereas in the first quarter of 2021, the same number stands at approximately 10.7 million b/d. All that while crude prices have been increasing shows a changed mindset, one that is focused more on yield than growth as companies focus their objectives to capital return.

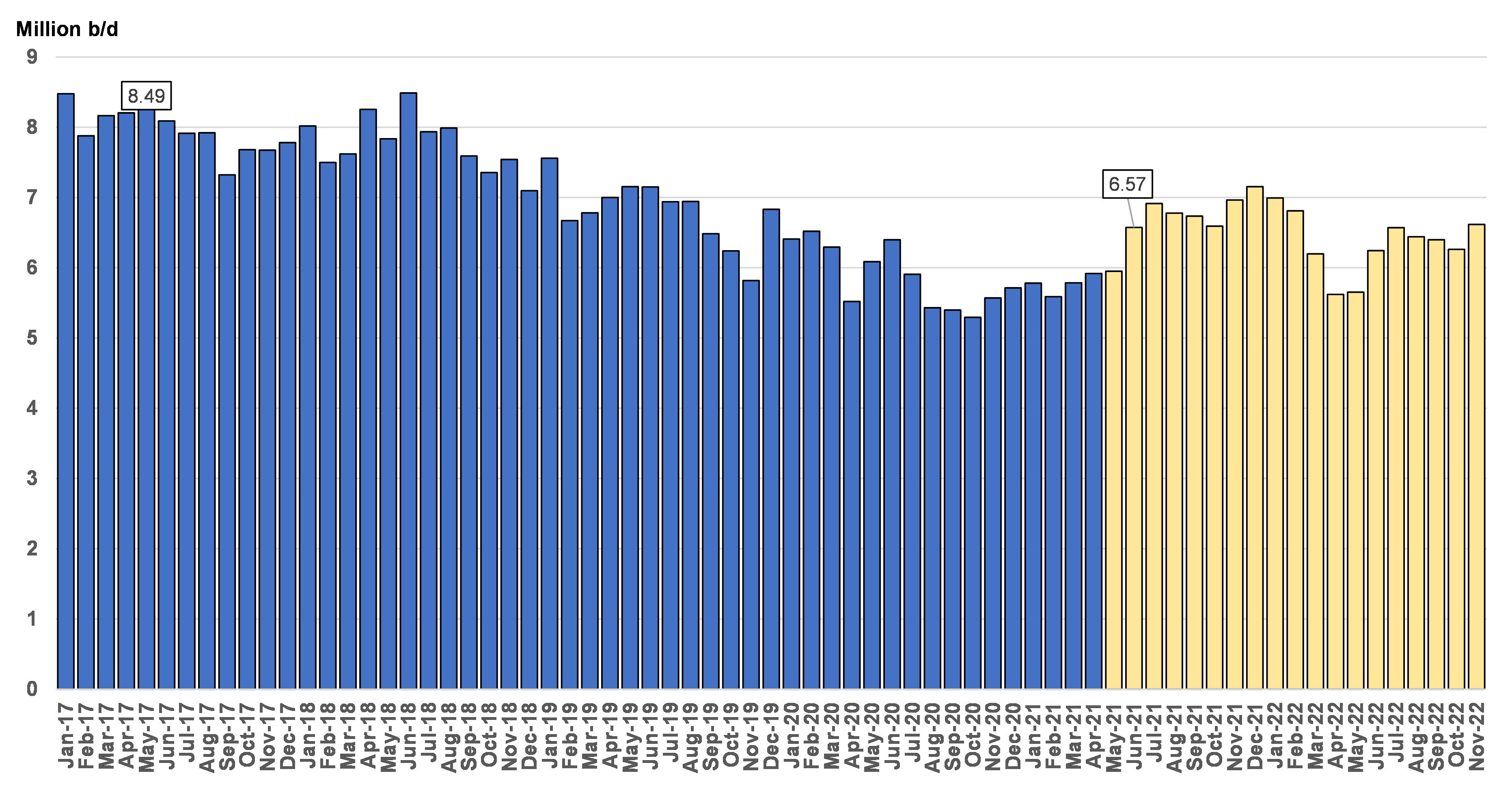

With US crude producers keeping a lid on supply, it is reasonable to believe that the WTI price may find relative support versus international benchmarks as the imbalance between East and West of Suez narrows amid increasing OPEC production and weaker demand in Asian markets impacted more recently by COVID. This effect could be well amplified by the start of the summer driving season, when refiners typically ramp up production to meet increased demand. With the WTI balance remaining tight, a rise in crude imports by US refiners is anticipated (Figure 1).

As for the source of these imports, we hold the view that it can be adequately diversified. The heavy, sour crude from the Middle East is well suited for Gulf Coast refineries. However, we cannot discount increased voyages from Europe, both from the North Sea, Baltic, Med and Black Sea regions – something that is already happening. These inflows could benefit ton-mile demand, but perhaps more importantly enhance the deployment optionality that tanker owners can employ on their assets. Despite our view that the balance of power will continue to point to a weak freight environment, increasing triangulation may be one bright spot for crude tanker owners in the short term.

Figure 1 – Historical US Crude Imports and Forecast

Source: McQuilling Services, JBC Energy, EIA