VLCC Liftings and End-User Demand

Oct. 22, 2021

The current energy crunch, mainly in Europe and Asia has pushed refining margins up to their pre-pandemic levels in almost all global regions. A surge in demand mainly in the northern hemisphere during the summer months has brought product inventory levels down, effectively clearing the buildup observed during the first nine months of 2020. According to JBC Energy, core product average inventories for Q3 2021 were about 1.3 million b/d lower than the 5-year average levels.

Robust end-user demand appears to be continuing through Q4, although as we have noted before, oil demand does not always translate in direct crude demand at the refinery level. In fact, regional pressures such as higher energy costs in Europe and a policy shift in China prevented a similarly positive picture for crude oil intake at the refinery level in Q3. In fact, China remains in question as they released what is probably their last batch of import quotas for the year, coming at 4% lower compared to the same period in 2020, at 14.89 million tons (Reuters). In other regions such as the US, previous outages and maintenance work also affected intake, with utilization falling to 84% in September from 90% the previous month (JBC energy).

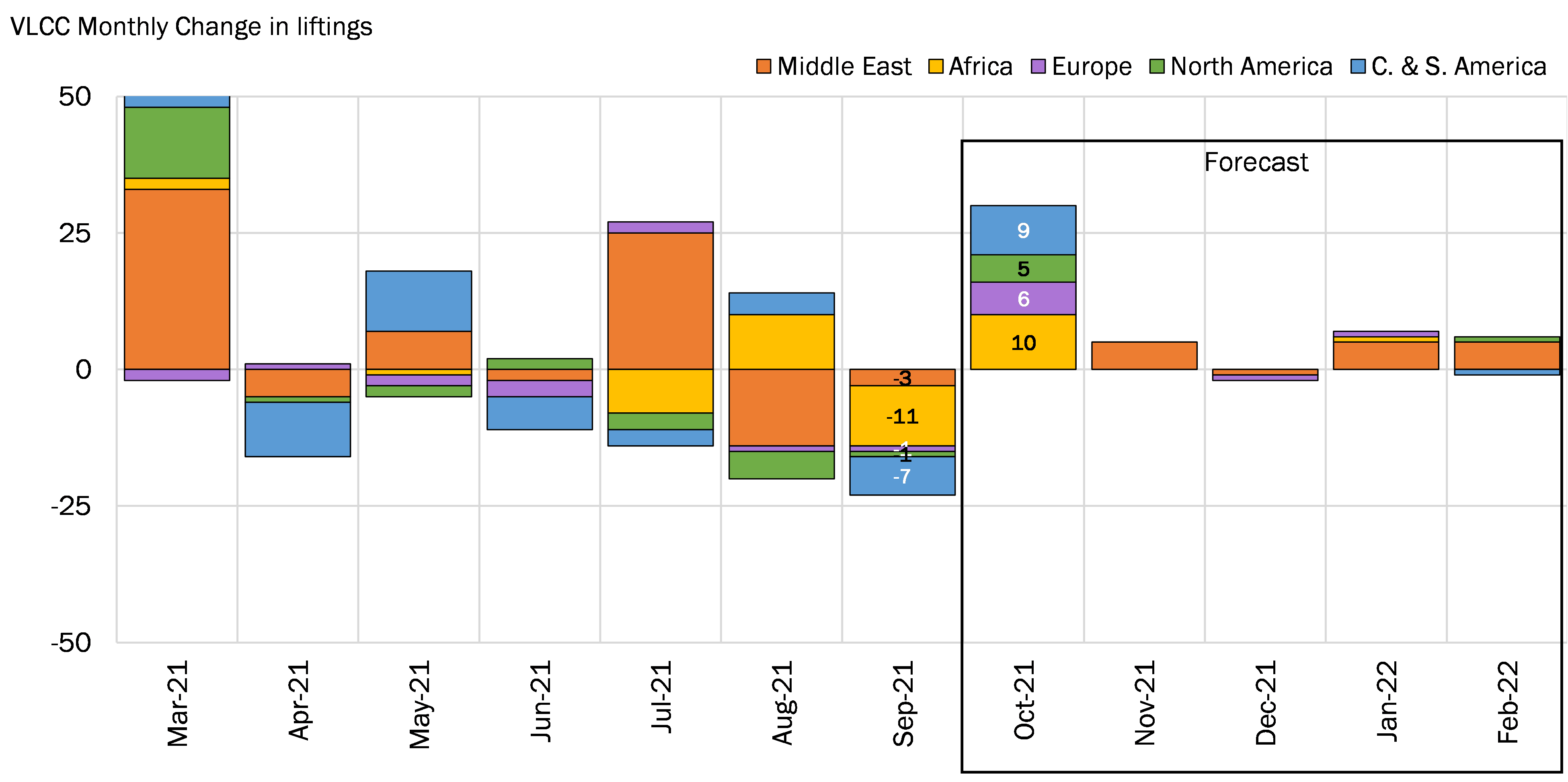

These indicators were reflected in VLCC tanker liftings in September, which trended in negative territory compared to the previous month in all major loading regions (Figure 1). As we noted in our recent Short Term Outlook, regional refineries opted for more local crudes in September, while OPEC and allies did not announce any additional increases in production on top of the previously agreed 400,000 b/d per month, therefore keeping large tanker liftings in the region subdued.

Moving forward, VLCC liftings from the Middle East are expected to remain flat in October, with upward momentum building into 2022 as more OPEC barrels are added to the market. On the other hand, Atlantic basin liftings are expected to trend higher in the current month and overall in Q4, with most barrels likely destined for Asian markets where crude intake is anticipated to increase for the current quarter (JBC Energy data) as mobility restrictions continue to ease.

Figure 1 – VLCC Monthly Liftings by Region

Source: McQuilling Services