Voluntary Carbon Offsets and Shipping

June 25, 2021

In mid-June, the Marine Environment Protection Committee (MEPC) formally adopted amendments to the MARPOL Annex VI that requires ships to reduce greenhouse gas (GHG) emissions by combining technical and operational methods. The merchant fleet will be required to calculate their Energy Efficiency Ship Index (EEXI) and establish each vessel’s annual operational carbon intensity indicator (CII). The CII is an attempt to link GHG emissions to the transport work of ships.

This has been another step taken by the IMO towards the goal of halving shipping emissions by 2050. In reality though, there have been market participants and regulators who are assessing that the pace is not quick enough to reach those goals and they are either proposing stricter measures (e.g. the case of carbon taxes on marine fuels) or look for alternatives to begin offsetting their carbon footprint before the technology for cleaner ships and fuels become mainstream. One such effective and efficient way is voluntary carbon offset.

The voluntary carbon offset market allows a ship operator to voluntarily purchase carbon credits that can be applied in offsetting a vessel’s carbon emissions over the course of a single voyage. The funds collected from the transaction are transferred to projects that are actively reducing greenhouse gas emissions such as a forest expansion, energy generation from renewable sources and many others on a global scale. These projects must be independently verified and the number of credits assigned to each are listed on international carbon registries such as the American Carbon Registry, Verra, the Gold Standard and others.

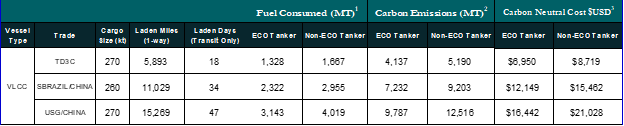

By utilizing a trusted advisor that has the knowledge and resources to facilitate a voluntary carbon offset, a ship operator can engage in the process in a straightforward way, during chartering negotiations. The advisor typically collects voyage information such as speed, distance, fuel type and estimated consumption that are then forwarded to the carbon trading company. The latter submits a proposal to the charterer, who at the end of the voyage can confirm the actual voyage emissions data and accept the proposal. After the transaction takes place, the used carbon credits are retired from the market and the operator has achieved a net-zero emissions voyage. To illustrate this, a few VLCC voyage scenarios are included in table 1.

Recognizing the need and opportunity, McQuilling Partners has formed a partnership with Vertis Environmental Finance, a pioneer in carbon trading with over 20 years of experience in the field, to offer Carbon Offsetting & Advisory (CO&A) services in the maritime industry. The partnership aims to provide direct access to carbon offsetting as well as environmental sustainability and zero-emission shipping advisory services to market participants ranging from ship owners, charters to oil companies and refiners. We encourage you to learn more by contacting McQuilling at services.us@mcquilling.com

Table 1 – Carbon Offsetting on Typical VLCC Voyages (see notes)

1 Fuel Consumptions based on 13.5 knots transit speed during laden voyage & reference speed/consumptions for non-eco and eco engine designs

2 Assuming HFO usage, as per the IMO ‘Resolution MEPC 245 (66) 2014 = emission factor of 3.114 tCO2/t fuel

3 Voluntary Emission Reduction price used is an indication based on current market price of any avoidance or removal carbon credit offset, from ICROA-approved Standards and compliant with ICROA Code of Best Practice, for an approximate volume of 10,000 tonnes of carbon dioxide-equivalent

Source: McQuilling Services, Vertis Environmental Finance