What to Expect for the DPP Tanker Demolitions

Aug. 21, 2020

We have done a lot of work utilizing historical data to find a way to determine when a ship has a good probability of exiting the trading fleet based on age and other characteristics. For example, in our analyses in the past, we have shown that 67% of 24-year old VLCCs in a given year exit the trading fleet and so on. Another interesting piece of information that can help paint a picture of the supply side of the tanker market is combining age information with known drydocking schedules. This becomes especially important this year as due to the global lockdowns that affected shipyards and brief frenzy in freight rates, those drydocking responsibilities did not follow their cyclical pattern.

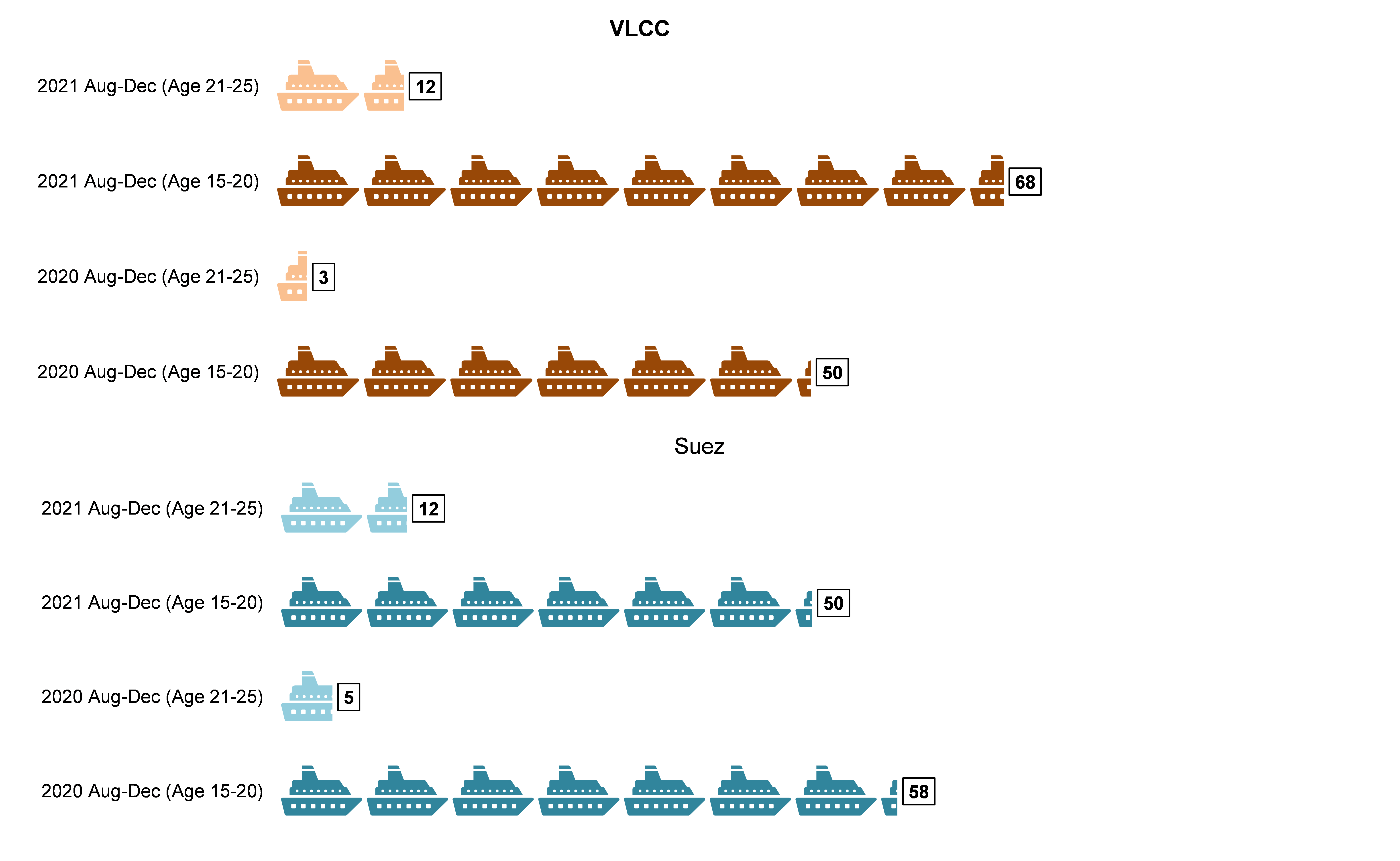

Using the latest data, we project that 2020 will end the year with only 19 DPP deletions, a staggering seventy less than our prediction from January, reflecting the strong desire from owners to capitalize on the short-lived frenzy in the tanker markets due to the OPEC price war, in addition to the lack of availability of shipyards and scrapyards due to the global lockdowns. With the present market uncertainty, owner’s goals and expectations are likely to adjust. Notable is the number of VLCCs and Suezmaxes over 15 years old that are due for drydocking in the short-term (Figure 1).

While we can appreciate owners taking a wait and see approach, we believe that there is danger in waiting too long with the current environment. As the uncertainty continues with COVID-19 presence and crude and products demand still recovering, the impact and effects of a full recovery in global markets will not be seen after 2021 or at least until the race for the vaccine is formally over and it is distributed globally. At the same time, scrap prices are falling amid weak end-user demand, costing VLCC owners about 20% in lost revenue if they would have sold in January versus July 2020. Going back to the expected drydocking schedule for older vessels, it would be very interesting to see how many owners decide that is the “end of the line” for these ships, thus supporting market supply.

Overall, our expectations are that with so many DPP ships over 15 years old with special surveys and other costly maintenance coming up, it is very likely to see a large number of them going for scrapping, thus lending support in the supply side of the market that will become apparent entering 2022, especially amid low orderbook expectations.

Figure 1 – VLCC & Suezmax Drydocking Expectations by Age

Source: McQuilling Services

Source: McQuilling Services