A “Mild” Winter for the Tanker Market

Oct. 16, 2020

If there is one thing in the tanker markets that all analysts can agree on, that is its seasonal nature. Despite various events that may be affecting the market one way or another, there is a certain cyclicality to be observed every year, one that culminates in a typically firmer winter market.

That, of course, along with myriad other things we used to take for granted has come to be upended by a global pandemic that began in the Far East in the last months of 2019 and has since expanded the globe, bringing unprecedented economic pressures in almost all sectors and altering anything that was considered “normal”.

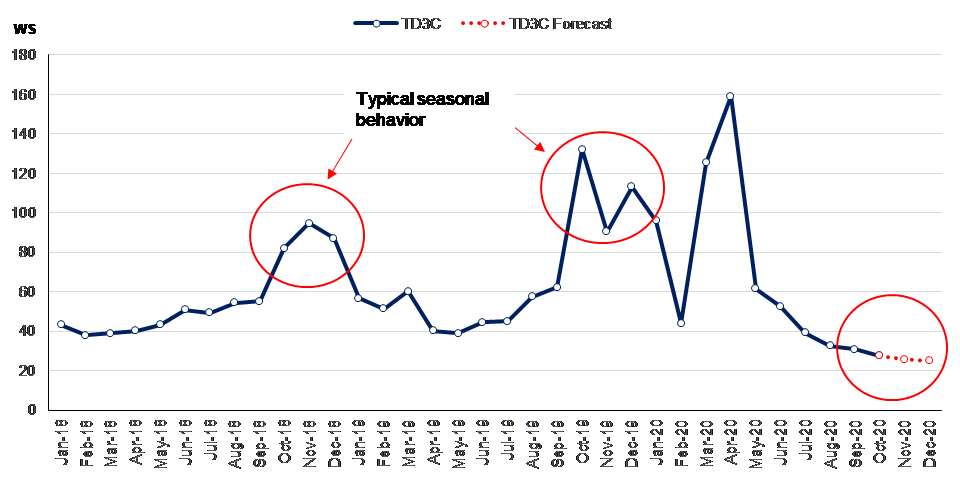

If we look at the benchmark TD3C voyage in the VLCC sector, we can observe that both in 2018 and 2019 there was a “bump” in freight rates, starting in September and progressing through the end of the year. This is the typical market support from the winter months. The same trend in 2019 was more volatile due to the sanctioning of the COSCO tanker fleet by the US, something that gave tanker rates a temporary boost (Figure 1). Despite that though, we can see from the graph the peaks and valleys correspond to more or less the same period each year.

That is until we come to 2020. The combination of events transpired in the beginning of the year sent tanker rates to dizzying heights, mostly due to demand for ships to be used in floating storage. The same events brought the same market to serious lows almost as quickly as it did the opposite, with no transportation demand and an ample fleet waiting to be utilized. The continued weakness, slow recovery along with ships returning to trading from floating storage as demand picks up (increasing supply), are showing us a picture that not only precludes the typical winter “bump” but, according to our forecasts, will continue pushing rates downward until the end of the year (Figure 1).

Perhaps a very important question right now is whether we will experience a full second wave of COVID-19 infections. We hope not, but if it becomes a reality and affects demand as it did in the beginning of last year, we are bound to see longer crude balances and with that perhaps a renewed demand for floating storage.

Figure 1 – TD3C (AG/CHINA) Historical Freight Rates and Forecast

Source: McQuilling Services