McQuilling Partners Named in Lloyd's List Top 100 List

Dec. 21, 2015

We are pleased to announce we've been selected again this year as one of the Top Ten Brokers in Lloyd's List 100 Most Influential People in the Shipping Industry. Write up below:

We are pleased to announce we've been selected again this year as one of the Top Ten Brokers in Lloyd's List 100 Most Influential People in the Shipping Industry. Write up below:

On November 19, 2015, Commercial Director of McQuilling Services, David Saginaw, presented a SWOT analysis of the crude tankers markets at the 2015 Tanker Shipping and Trade Conference in London.

Download a complimentary copy of the presentation here

McQUILLING PARTNERS, INC. ANNOUNCES COMMENCEMENT OF NEXT PHASE OF IMPLEMENTATION FOR THE BRASIL BASIN DRYDOCK COMPANY IN BRAZIL

(New York – 12 November 2015) – Dave Saginaw, Commercial Director of McQuilling Services, LLC in New York and the project Director of the Brasil Basin Drydock Company (BBDC) project announced today that the project has progressed into the next phase of implementation with the receipt of additional early stage investment funds and application for environmental licenses to the authorities in Brazil.

“We are extremely excited about the advancement of activities in the development of the new ship repair facility in the northeast of ...

Marine transportation demand for crude tankers usually finds support in the final three months of the year as refiners complete maintenance in-time for winter grade fuel requirements. In turn, the supply/demand balance tilts in the owners’ favor, creating a seasonal opportunity to push rates higher until the tide reverses once again at the end of Q1. In this year’s fourth quarter, there is an additional element that is working in the owners’ corner – low bunker costs. The combination of seasonally higher freight revenues and fundamentally pressured fuel costs is creating a perfect storm, of the beneficial kind, in ...

The Managing Director of McQuilling Brasil Serviços Maritimos, Ltda., Nelson Almeida, was recently interviewd by Interfax regarding the LNG market in Brazil. His interview is below:

As a supplement to this year's 2015 Mid-Year Tanker Market Outlook, we've developed a "Mid-Year Outlook Scorecard," which provides a snapshot of previous market behavior as well an updated forecast for 2015. The one-page format makes it a perfect desk reference that can be used throughout the rest of the year.

Download the Mid-Year Tanker Market Outlook Scorecard

New York – August 7, 2015 – McQuilling Services is pleased to announce the release of the Mid-Year Tanker Market Outlook Update.

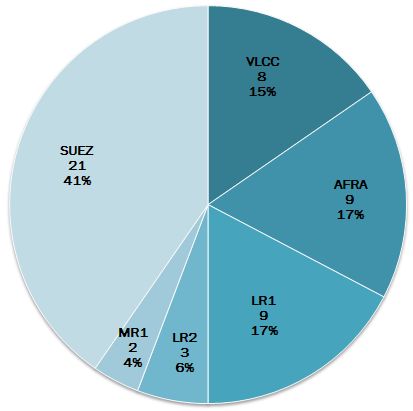

The Mid-Year Tanker Market Outlook Update provides an outlook for monthly spot market freight rates and TCE revenues for 15 major tanker trades across eight vessel segments for the second half of 2015 and the remaining four years of the forecast period. This year we expanded our global trade flow coverage to 95% through additional data sourcing arrangements, enabling a more comprehensive view of global oil demand fundamentals and tanker trading patterns.

2015 Mid-Year Tanker Market Outlook Update

Tanker demand ...

There are a few complimentary calculators available to mcquilling.com registrants including Voyage Economics, Loadable Quantity, Pre-Construction Interest and Acquisition Economics. The following “How To” blog series will show you how to use each calculator.

The Voyage Economics Calculator is designed to calculate tanker revenues, costs and time charter equivalents for pre-loaded and user-defined voyages. For this example, we will use the pre-loaded voyage, TD3.

1. From the pulldown menu – select TD3. The green cells are input cells and can be changed as needed. [The WS 100 rate reflects the flat rate for each particular voyage for 2015].

2. Input ...

Managing Director of McQuilling de Mexico, Mr. Diego Aguilar, will participate at the 2015 OSV & Subsea Vessels Conference in Mexico City on Thursday June 25 at the Sheraton Mexico City Maria Isabel Hotel. Mr. Aguilar will discuss evaluation chartering contracts in Mexico and internationally, with a specific focus on the following topics:

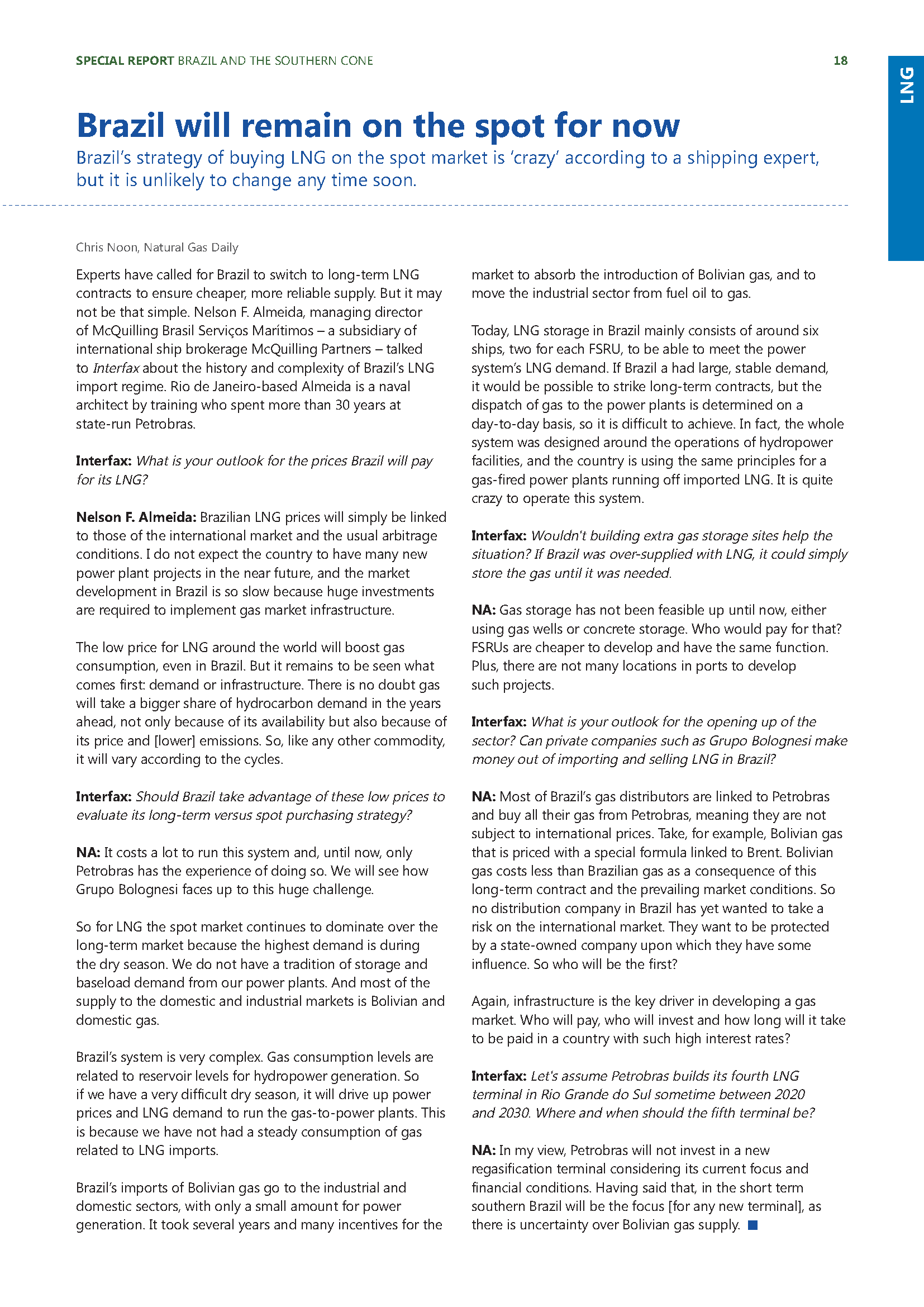

Among the many questions facing the tanker markets today, none stands out more than whether this recent rally in rates is a long-term cyclical shift or little more than a head fake? While not all sectors of the tanker market will trend in the same direction, we note a recent development that may provide some clues about the direction of the crude tanker markets. For the first time in 55 months, the 1-year time charter rate for the VLCC and Suezmax sectors has risen to a level greater than that of the 3-year time charter rate (Figure below).

In May ...

In the 2015-2019 Tanker Market Outlook published in January, McQuilling Services projected that 67 crude newbuildings would deliver to the trading fleet, while 31 dirty ships would exit the fleet via demolition or conversion in 2015. Based on this forecast, we would have expected that through May, 28 ships would have delivered to the trading fleet and 13 would have been sold for demolition or conversion.

Actual figures show that deliveries are lagging behind our initial forecast as 20 ships have been delivered, compared to our year-to-date expectation of 28. Exit activity is also slightly behind our year-to-date expectation of ...

Clean East | LRs in the AG are slowly beginning to see higher rates - hearing TC1 was fixed at WS 104 and TC5 on subs for WS 125. The tonnage list is still tight for the first decade of June; however, the MRs in that region are still soft. The south is tight and rates are firming with WS 185 seen for a Spore/Oz voyage. The North is slowing down and rates are falling.

Suezmax cargoes originating in the Caribbean (Colombia, Venezuela) with discharge in the Far East are examples of candidates for transiting the Panama Canal; however, key considerations including loadable quantity restrictions and Panama Canal costs will likely offset the benefit from the shortening of distances using current East-bound routing options for these trades.

In McQuilling Services most recent industry note, we evaluate the voyage economics pertaining to these trades for the year 2016. The basis of our analysis will be the calculation of the cost per barrel for loadings transiting through the canal compared to those routing through the open-seas.

Clean East | The AG market is starting to pick up a bit on the LR1s as more activity is being seen. We are seeing the same sentiment for the LR2s. No change in the Southeast region; however, MRs in the North look to be more active although the tonnage list is balanced.

At the start of 2015, the tanker trading fleet* totaled 3,645 vessels. This represents an approximate 1% net fleet growth year-on-year. We expect that throughout 2015, there will be a total of 161 additions and 43 deletions, a net fleet growth of 118. The largest growth is anticipated to be seen in the MR2 sector, while the uncoated Panamax sector will experience negative net fleet growth.

So where does vessel supply stand at the end of the first quarter?

VLCC

Four newbuildings have delivered to the trading fleet, while two vessels were sold for demolition and and two for ...

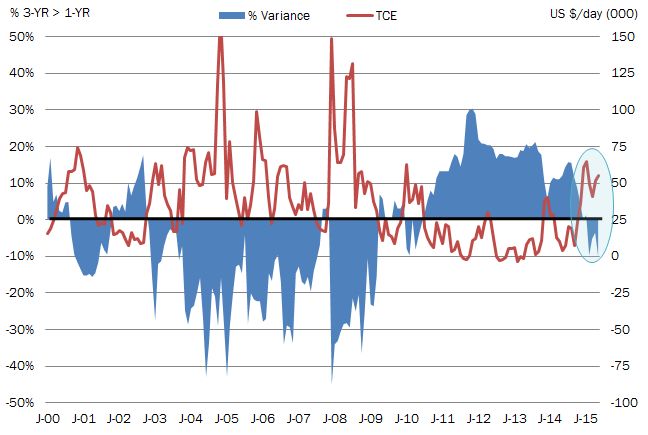

Newbuilding contracting has slowed in the first quarter of the year to the lowest levels recorded since 2 012. Through March, our proprietary data showed that 52 orders have been placed, the bulk of which were Suezmax tankers. Following this were the Aframax and LR1 tanker classes.

012. Through March, our proprietary data showed that 52 orders have been placed, the bulk of which were Suezmax tankers. Following this were the Aframax and LR1 tanker classes.

Owners have strayed away from ordering newbuilding MR2 and MR1 tankers. In fact, no MR2 orders have been recorded to date and just two MR1s were ordered. When compared to the first quarter of 2014, there were two MR2s ordered through March and nine MR1s.

Suezmaxes have had a strong start to the ...

In support of the 2015-2019 Tanker Market Outlook, McQuilling Services has held complimentary seminars around the globe to share the findings from the report. Discussions include a review of tanker tonnage demand and supply as well as McQuilling Services five-year forecast. Upcoming seminars will be held in New York City and the Far East. For more information, send a message to services.us@mcquilling.com

A selection of slides from the Tanker Market Outlook presentation is now available to all registered users for download on our products and services page. Want to download the presentation, but aren't registered? Fill ...

We are pleased to announce McQuilling Partners' President and CEO, John Schmidt, was featured in Tanker Shipping and Trade Industry Leaders 2015. Read the full article

Clean East | The AG market continues to firm up on the LR1s and the LR2s are holding steady. MRs are also firming in the Southeast and the North as lists are tight and some prompt cargoes are still uncovered.

Clean East | The AG market is beginning to pick up on the LR1s as it's becoming more attractive to fix on an LR1 rather than an LR2. The South is still and the North is starting to tighten up as multiple ships are seen on subjects.

Market Realist: 5-year and 10-year VLCCs’ prices are rising

"McQuilling Services noted that VLCCs and Suezmax tankers may offer investors a more attractive risk-adjusted return in the long term. It also added that the ten-year tankers of these two vessel classes will outperform their younger counterparts. Asset prices for these vessels recorded a growth of 21.2% and 44.9%, respectively, in the past 12 months.

McQuilling believes that the upward momentum initiated during 2015 will continue forward as the current firm earnings environment persists at a stable rate during the current year. It will retreat slightly in 2016 before ...

Clean East | The market is off to a slow start with China still celebrating Lunar New Year. The LR1 market remains weak due to a long position list and the spread between the LR1s and LR2s is almost nothing. The MRs are also slow at the moment. The North looks to be picking up a little as there are quite a number of ships on subjects.

McQuilling Brokerage Partners Asia and McQuilling Anglo Asian (Dry) have moved. The new office is located at 8 Temasek Blvd #21-02 Suntec Tower 3, Singapore.

For additional information, please visit our locations page

Clean East | The AG market remains flat on soft sentiment. The southeast is also quiet with owners looking for longer hauls to tide over the coming Chinese holidays. The North is still soft on the MRs, but firm on the LR1 backhauls.

Clean East | The AG market is still soft on the LRs and lower numbers are being seen; the MRs are starting to soften as well. The South is still weak on a long tonnage list. North is slightly active, the LR positions are tight, but the MRs are still soft.

The McQuilling Services 2015-2019 Tanker Market Outlook is a five-year rate projection for eight vessel classes across 15 benchmark trades and represents the company’s 18th forecasting cycle. After over ten years of tanker rate forecasting, McQuilling Services is a leader in the industry and continues to support a variety of stakeholders in the energy and maritime industries with its annual Tanker Market Outlook.

Methodology

The McQuilling Services rate forecast is based on the evaluation of historical and projected tonnage supply and demand fundamentals in the tanker market within the current and projected global economic environment, including oil supply ...

Clean East | The AG market is on a firm run, with more fixtures seen on the LRs and the MRs. The south is also starting to hold steady with the activity seen in the Gulf. However the North is getting quiet again after the flurry of LR cargoes being covered and not many MR cargoes are seen coming out in middle of February.

Clean East | The AG market has begun this week on a stable note. LR2s are still tight and rates are expected to increase. It's the exact opposite situation for the LR1s. The South is still holding stable as well and LR backhauls are still busy as the list is getting tight and ships are being put on subjects.

In 2014, the dirty and larger clean tanker segments straddled the line of recovery, while the smaller clean tankers remained under pressure despite positive expectations from the majority of market participants. Global spot market activity continued to rise from 2013 and the dirty tankers posted an increase of 6%, while the clean ships saw roughly 892 more fixtures year-on-year.

VLCC Although this segment was still faced with oversupply, fleet consolidation reduced the number of entities controlling those ships. This helped inject some volatility into the rates throughout the year. There was also a shift in general market sentiment after the ...

Clean East | Depsite the activity seen on the LR2s in the AG - sentiment is still soft. The list is getting longer which is preventing rates from making any headway. LR1s are losing their piece of market share to the LR1s, while MRs are holding stable. The Southeast is becoming more active and ships have been put on subjects for shorthaul voyages. In spite of this activity though, the list is still plentiful. MRs are seeing some activity in the Far East, but still no upward pressure on rates.

Clean East | The AG market continues to remain weak due to a lack of activity and a long tonnage list. Even the MRs are coming off as well. The South is also soft, but some activity seen. MRs in the North are becoming more active and ships are being reported on subjects. The LRs, on the other hand, are still active as some LR cargoes are seen for the first decade of February.

Clean East | The AG market continues to slide on the LR2s. Hearing WS 85 was done on TC1 and the list is still long. The LR1s will probably follow suit as well. The South is still weak and the North is holding stable on the LR backhauls.

Clean East | The LR2s are softening due to weak sentiment. The LR1 list is also getting longer and rates are expected to fall, which will narrow the LR1/LR2 spread. The South and North remain flat and the LRs are seen firm on the backhauls.

Clean East | The LR2s in the AG are starting to soften and hearing 75,000 x WS 87.5 was put on subjects. The LR1s are also softening as more cargoes are being moved on LR2s. MRs are still soft in the Southeast and Far East, but the LRs on the backhauls are active.

Clean East | Although there's been activity on the LR2 tankers, there wasn't enough to push rates up and the market remains soft. LR1 tankers are lacking in activity with no fresh cargoes being seen. The Southeast and Far East markets are getting weaker, especially on the MRs.

Clean East | The AG market is softening despite LR2s being active. The Southeast and Far East are also softening against a longer tonnage list.

Clean East | The East of Suez market continues to be soft and although the LR2s are getting tight - rates are not rising. The LR1s are starting to ease off, but promptish positions are still tight. The Southeats and Far East are both quiet and the list is getting longer, so expect worldscale rates to come down.

Clean East | As the New Year kicks off, not much change has been recorded East of the Suez as quite a number of traders are still away. We expect activity will begin to pick up in the coming week. The North is getting softer and we are hearing a mid-January cargo (Ulsan/Singapore) was done on a Korean tanker below US $450,000.